Blackberry 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

For the Years Ended March 3, 2007, March 4, 2006 and February 26, 2005

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

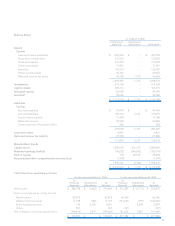

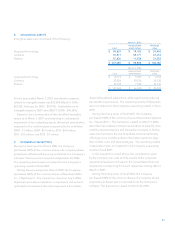

The Company determined that it was more likely than not that

it can realize its deferred income tax assets. Accordingly, no

valuation allowance is required on its deferred income tax

assets (March 4, 2006 - $nil). The Company will continue to

evaluate and examine the valuation allowance on a regular

basis and as future events unfold the valuation allowance may

be adjusted.

The Company has not provided for Canadian deferred

income taxes or foreign withholding taxes that would apply

on the distribution of the earnings of its non-Canadian

subsidiaries, as these earnings are intended to be reinvested

indefinitely.

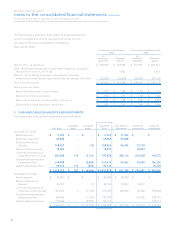

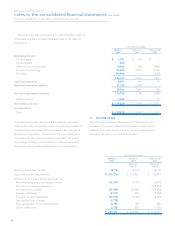

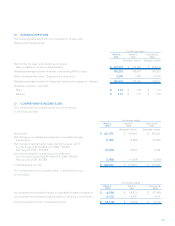

11. LONG-TERM DEBT

At March 3, 2007, long-term debt consisted of mortgages

with interest rates ranging between 6.88% and 7.90%, against

which certain land and building are pledged as collateral. The

carrying value of the collateral at March 3, 2007 is $10,570. All

mortgage loans are denominated in Canadian dollars and

mature on March 1, 2009.

Interest expense on long-term debt for the year was $494

(March 4, 2006 - $483; February 26, 2005 - $460).

The scheduled long-term debt principal payments for the

fiscal years 2008 through to maturity are as follows:

For the years ending

2008 $ 271

2009 291

2010 6,051

$ 6,613

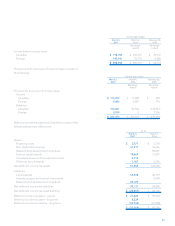

During fiscal 2007, the Company amended an existing credit

facility and now has a $100 million Demand Credit Facility

(“the Facility”). The Company has utilized $15.9 million of

the Facility to secure operating and financing requirements.

As at March 3, 2007, $84.1 million of the Facility was unused.

The Company has pledged specific investments as security

for this Facility. The Company had previously utilized $48

million of the Facility in order to fund a letter of credit to

partially satisfy the Company’s liability and funding obligation

in the NTP, Inc. (“NTP”) litigation matter. As a result of

the settlement of the NTP litigation matter, the Company

cancelled the letter of credit on March 6, 2006.

The Company has an additional demand facility in

the amount of $17.0 million to support and secure other

operating and financing requirements. As at March 3, 2007,

$15.6 million of this facility was unused. A general security

agreement and a general assignment of book debts have

been provided as collateral for this facility.

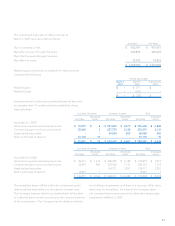

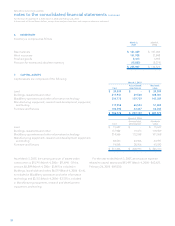

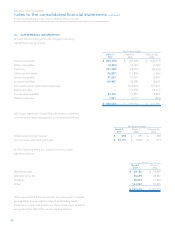

12. CAPITAL STOCK

(a) Share capital

The Company is authorized to issue an unlimited number

of non-voting, redeemable, retractable Class A common

shares, an unlimited number of voting common shares and

an unlimited number of non-voting, cumulative, redeemable,

retractable preferred shares. There are no Class A common

shares or preferred shares outstanding.

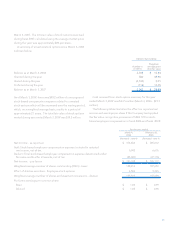

The Company declared an effective two-for-one stock

split in the form of a one-for-one stock dividend payable

on June 4, 2004 for all shareholders of record as at close of

business on May 27, 2004. All common shares, earnings per

share and stock option data for the current, year-to-date and

prior comparative periods have been adjusted to reflect this

stock dividend. In addition, the effect of this stock dividend

doubled the number of stock options outstanding and

reduced the exercise prices of these stock options by half of

the original exercise price.