Blackberry 2007 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13

May 17, 2007

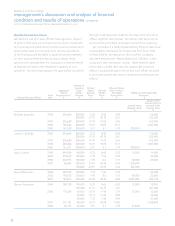

The following Management’s Discussion and Analysis of

Financial Condition and Results of Operations (“MD&A”)

should be read together with the audited consolidated

financial statements and the accompanying notes (the

“Consolidated Financial Statements”) of Research In Motion

Limited (“RIM” or the “Company”) for the fiscal year ended

March 3, 2007. The Consolidated Financial Statements have

been prepared in accordance with United States generally

accepted accounting principles (“U.S. GAAP”).

All financial information herein is presented in United

States dollars, except for certain financial information

contained in tables which is expressed in thousands of United

States dollars, and as otherwise indicated.

RIM has prepared the MD&A with reference to National

Instrument 51-102 “Continuous Disclosure Obligations” of

the Canadian Securities Administrators. This MD&A provides

information for the fiscal year ended March 3, 2007 and up to

and including May 17, 2007.

Additional information about the Company, including the

Company’s Annual Information Form, can be found on SEDAR

at www.sedar.com and on the U.S. Securities and Exchange

Commission’s (“SEC”) website at www.sec.gov.

EXPLANATORY NOTE REGARDING THE RESTATEMENT OF

PREVIOUSLY ISSUED FINANCIAL STATEMENTS

The Company has restated its consolidated balance sheet

as of March 4, 2006, and its consolidated statements of

operations, consolidated statements of cash flows and

consolidated statements of shareholders’ equity for the

fiscal years ended March 4, 2006 and February 26, 2005,

and the related note disclosures (the “Restated Financial

Statements”). The Restated Financial Statements have been

prepared to reflect additional non-cash stock compensation

expense relating to certain stock-based awards granted

prior to the adoption of the Company’s stock option plan on

December 4, 1996 (as amended from time to time, the “Stock

Option Plan”) and certain stock option grants during the 1997

through 2006 fiscal periods, as well as certain adjustments

related to the tax accounting for deductible stock option

expenses. The restatement does not result in a change in the

Company’s previously reported revenues, total cash and cash

equivalents or net cash provided from operating activities

shown in the Restated Financial Statements.

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 3, 2007

Background of the Review

The Company commenced a voluntary internal review

(the “Review”) of its stock option granting practices and

related accounting on August 8, 2006. The Review was

commenced under the direction of the Audit Committee of

the Company’s Board of Directors, at the initiative of Dennis

Kavelman, the Company’s former Chief Financial Officer (now

the Company’s Chief Operating Officer – Administration

and Operations), with the support of Jim Balsillie, the Co-

Chief Executive Officer of the Company, and the executive

management team of the Company. Following the recusal

of two Audit Committee members who also served on the

Compensation Committee, the Review was completed by

the remaining two members of the Audit Committee as a

special committee of independent directors of the Board

of Directors (the “Special Committee”). Any references to

actions by the Special Committee prior to January 16, 2007

are to the Audit Committee. The Special Committee was

assisted in the Review by outside legal counsel and outside

accounting advisors in both Canada and the United States.

Certain of the investigative actions by the Special Committee

described hereafter were carried out by the outside legal

counsel or outside accounting advisors under the direction of

the Special Committee.

On September 28, 2006, the Company publicly announced

that the Audit Committee had made a preliminary

determination that, under U.S. generally accepted accounting

principles (“GAAP”), pursuant to which the Company has

been preparing its financial statements since fiscal 2004 (prior

to which time the Company prepared its primary financial

statements in accordance with Canadian GAAP – together

with a U.S. GAAP reconciliation note following its U.S. listing

in 1999), accounting errors were made in connection with

the accounting for certain stock options granted since the

Company’s initial public offering in 1997 (the “IPO”) and

that a restatement (the “Restatement”) of the Company’s

historical financial statements would therefore be required.

At that time, the Company also announced that it had

voluntarily informed the SEC and the Ontario Securities

Commission (the “OSC”) about the Review.

Each of the SEC, the OSC and the office of the United

States Attorney for the Southern District of New York (the

“USAO”) has commenced investigations in connection

with the Company’s stock option granting practices. The

Company intends to continue to cooperate with each of these

agencies.