Blackberry 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 3, 2007

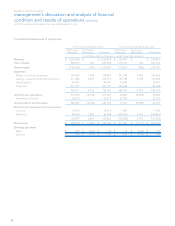

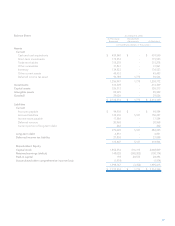

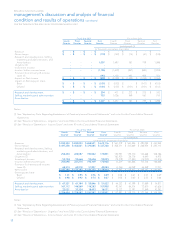

The following table sets forth certain consolidated statement

of operations data expressed as a percentage of revenue for

the periods indicated:

For the Fiscal Year Ended

March 3, 2007

March 4, 2006

(as restated) (1) Change

2007/2006

February 26, 2005

(as restated) (1) Change

2006/2005

Revenue 100.0% 100.0% 0.0% 100.0% 0.0%

Cost of sales 45.4% 44.8% 0.6% 47.1% (2.3%)

Gross margin 54.6% 55.2% (0.6%) 52.9% 2.3%

Expenses

Research and development 7.8% 7.7% 0.1% 7.6% 0.1%

Selling, marketing and administration 17.7% 15.2% 2.5% 14.4% 0.8%

Amortization 2.5% 2.4% 0.1% 2.7% (0.3%)

Sub-total 28.0% 25.3% 2.7% 24.7% 0.6%

Litigation (2) 0.0% 9.8% (9.8%) 26.1% (16.3%)

28.0% 35.1% (7.1%) 50.8% (15.7%)

Income from operations 26.6% 20.1% 6.5% 2.1% 18.0%

Investment income 1.7% 3.2% (1.5%) 2.7% 0.5%

Income before income taxes 28.3% 23.3% 5.0% 4.8% 18.5%

Provision for (recovery of) income taxes (3) 7.5% 5.2% 2.3% (10.3%) 15.5%

Net income 20.8% 18.1% 2.7% 15.1% 3.0%

Notes:

(1) See “Explanatory Note Regarding Restatement of Previously

Issued Financial Statements” and note 4 to the Consolidated

Financial Statements.

(2) See “Results of Operations – Litigation” and note 13(b) to the

Consolidated Financial Statements.

(3) See “Results of Operations – Income Taxes” and note 10 to the

Consolidated Financial Statements.

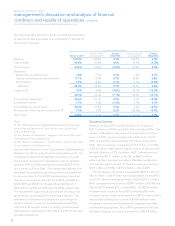

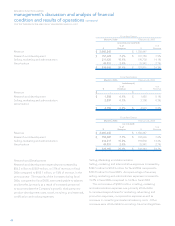

As more fully disclosed under “Explanatory Note Regarding

Restatement of Previously Issued Financial Statements”, the

Company has determined that the cumulative, non-cash

stock-based compensation expense for options granted

between 1999 and 2006 was approximately $248.2 million

up to the end of fiscal 2006. The restatement adjustments

decreased the previously reported preliminary diluted net

income per share for fiscal 2007 and previously reported

diluted net income per share for fiscal 2006 and 2005 by

$0.02, $0.05 and $0.05 for the periods ended March 3,

2007, March 4, 2006, and February 26, 2005, respectively.

The restatement adjustments did not have any impact on

gross margin percentage for the periods indicated. The

restatement adjustments increased the percentage of

revenue impact on research and development by 0.1%,

0.1% and 0.1%, and the impact on selling, marketing and

administration expense by 0.1%, 0.1% and 0.3% for the same

periods noted above.

Executive Summary

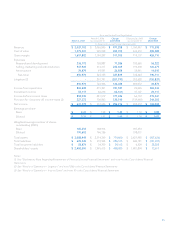

Revenue for fiscal 2007 was $3.04 billion, an increase of

$971.3 million, or 47.0%, from $2.07 billion for fiscal 2006. The

number of BlackBerry devices sold increased by 2.4 million

units, or 58.6%, to approximately 6.4 million units in fiscal

2007, compared to approximately 4.0 million units in fiscal

2006. Device revenue increased by $776.3 million, or 53.9%,

to $2.22 billion, reflecting the higher number of devices sold,

partially offset by a 2.7% decrease in ASP. Service revenue

increased by $177.1 million, or 46.2%, to $560.1 million,

reflecting the Company’s increase in BlackBerry subscriber

accounts during the period. Software revenue increased by

$16.6 million, or 10.6%, to $173.2 million in fiscal 2007.

The Company’s net income increased by $256.9 million to

$631.6 million, or $3.41 basic earnings per share (“basic EPS”)

and $3.31 diluted earnings per share (“diluted EPS”), in fiscal

2007, compared to net income of $374.7 million, or $1.98 basic

EPS and $1.91 diluted EPS, in fiscal 2006. The $256.9 million

increase in net income in fiscal 2007 primarily reflects an

increase in gross margin in the amount of $517.6 million, which

was partially offset by an increase of $300.9 million in the

Company’s research and development expenses and sales

and marketing programs. Fiscal 2006 operating results also

included a litigation accrual in the amount of $201.8 million