Blackberry 2007 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

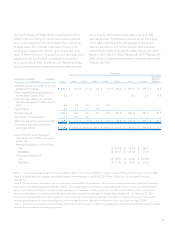

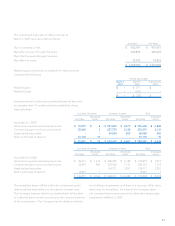

Plan until February 27, 2002, (2) the misapplication of U.S.

GAAP in the accounting for certain share awards granted

prior to the adoption of the Stock Option Plan, and (3) the

misapplication of U.S. GAAP in the determination of an

accounting measurement date for options granted. As a

result of these errors, the Company has recorded additional

adjustments for stock-based compensation expense in

accordance with APB 25. In addition, the Restatement also

records adjustments to certain tax amounts related to the

accounting for stock-based compensation as more fully

described below. The following table sets forth the impact

of the additional charges for stock-based compensation

expense (benefit) on net income (loss) for the fiscal years

ended March 4, 2006, February 26, 2005, February 28, 2004,

March 1, 2003, March 2, 2002, February 28, 2001, February 29,

2000, and the cumulative adjustment to the fiscal year ended

February 28, 1999:

Fiscal Year

(US dollars in millions) Expense/

(recovery) Total 2006 2005 2004 2003 2002 2001 2000

Cumulative

to fiscal

1999 (1)

Variable accounting relating to “net

settlement” feature $ 223.3 $ 0.5 $ 1.1 $ 3.6 $ 11.3 $ (46.5) $ (317.1) $ 551.2 $ 19.2

Share-based awards granted prior

to the Stock Option Plan 9.2 - - - - - 0.2 0.5 8.5

Intrinsic value related to options

issued subsequent to February 27,

2002 5.0 1.9 1.8 1.1 0.2 - - - -

Payroll taxes 5.0 2.1 2.1 0.8 - - - - -

Pre-tax amount 242.5 4.5 5.0 5.5 11.5 (46.5) (316.9) 551.7 27.7

Tax impact of restatement 5.7 2.9 2.8 - - - - - -

After-tax impact on net income (2) $ 248.2 $ 7.4 $ 7.8 $ 5.5 $ 11.5 $ (46.5) $ (316.9) $ 551.7 $ 27.7

Cumulative impact on retained

earnings (deficit) $ 248.2 $ 248.2 $ 240.8 $ 233.0 $ 227.5 $ 216.0 $ 262.5 $ 579.4 $ 27.7

Selected share price data (see

discussion on variable accounting

below (3))

Average share price in fiscal year

TSX $ 19.18 $ 53.85 $ 26.01

NASDAQ $ 12.37 $ 36.30 $ 17.35

Closing share price (4)

TSX $ 18.81 $ 29.50 $ 101.00

NASDAQ $ 11.94 $ 19.34 $ 67.62

Note 1: The annual charge to Net Income is as follows: $0.7 million in Fiscal 1997, $ 9.7 million in Fiscal 1998 and $ 17.3 million in Fiscal 1999.

Note 2: Additionally, the Company has restated the pro forma expense under SFAS 123 in Note 12(b) to the Consolidated Financial

Statements.

Note 3: The application of variable plan accounting causes significant fluctuations in the accounting expense/recovery when the Company’s

share price is experiencing periods of high volatility. The variable plan accounting non-cash expense for options issued during the period

of the “net settlement” feature includes (1) all realized gains on exercise of stock options prior to February 27, 2002, and (2) an allocation

of all unrealized gains for unexercised stock options based on the stock’s trading price at each reporting period. On February 27, 2002,

the unexercised awards became fixed awards and the remaining unamortized compensation cost became fixed and is expensed over the

remaining vesting period of the related options. All share data has been adjusted to reflect the 2-for-1 stock split on May 27, 2004.

Note 4: The closing share price noted for Fiscal 2002 reflects the February 27, 2002 closing share price, being the day that the variable awards

became fixed awards for accounting purposes.