Blackberry 2007 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

17

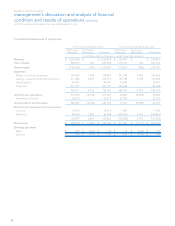

Fiscal Year

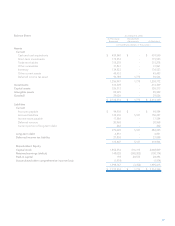

(US dollars in millions) Expense/(recovery) Total 2006 2005 2004 2003 2002 2001 2000

Cumulative

to fiscal

1999 (1)

Variable accounting relating to “net

settlement” feature $ 223.3 $ 0.5 $ 1.1 $ 3.6 $ 11.3 $ (46.5) $ (317.1) $ 551.2 $ 19.2

Share-based awards granted prior to the

Stock Option Plan 9.2 - - - - - 0.2 0.5 8.5

Intrinsic value related to options issued

subsequent to February 27, 2002 5.0 1.9 1.8 1.1 0.2 - - - -

Payroll taxes 5.0 2.1 2.1 0.8 - - - - -

Pre-tax amount 242.5 4.5 5.0 5.5 11.5 (46.5) (316.9) 551.7 27.7

Tax impact of restatement 5.7 2.9 2.8 - - - - - -

After-tax impact on net income (2) $ 248.2 $ 7.4 $ 7.8 $ 5.5 $ 11.5 $ (46.5) $ (316.9) $ 551.7 $ 27.7

Cumulative impact on retained

earnings (deficit) $ 248.2 $248.2 $240.8 $233.0 $ 227.5 $ 216.0 $ 262.5 $ 579.4 $ 27.7

Selected share price data (see discussion on variable accounting below (3))

Average share price in fiscal year

TSX $ 19.18 $ 53.85 $ 26.01

NASDAQ $ 12.37 $ 36.30 $ 17.35

Closing share price (4)

TSX $ 18.81 $ 29.50 $ 101.00

NASDAQ $ 11.94 $ 19.34 $ 67.62

Note 1: The annual charge to Net Income is as follows: $0.7 million in Fiscal 1997, $9.7 million in Fiscal 1998 and $17.3 million in Fiscal 1999.

Note 2: Additionally, the Company has restated the pro forma expense under SFAS 123 in Note 12(b) to the Consolidated Financial

Statements.

Note 3: The application of variable plan accounting causes significant fluctuations in the accounting expense/recovery when the Company’s

share price is experiencing periods of high volatility. The variable plan accounting non-cash expense for options issued during the period

of the “net settlement” feature includes (1) all realized gains on exercise of stock options prior to February 27, 2002, and (2) an allocation

of all unrealized gains for unexercised stock options based on the stock’s trading price at each reporting period. On February 27, 2002,

the unexercised awards became fixed awards and the remaining unamortized compensation cost became fixed and is expensed over the

remaining vesting period of the related options. All share data has been adjusted to reflect the 2-for-1 stock split on May 27, 2004.

Note 4: The closing share price noted for Fiscal 2002 reflects the February 27, 2002 closing share price, being the day that the variable awards

became fixed awards for accounting purposes.

(1) Variable Accounting for the “Net Settlement” Feature

Under a “net settlement” feature that existed in the Stock

Option Plan prior to February 27, 2002, instead of paying

the total consideration of the options exercised in cash, an

employee could forgo the receipt of a number of Company

shares equal in value to the total exercise consideration

otherwise payable upon exercise of the options. Prior to

2004, there were no accounting implications relating to this

feature under Canadian GAAP, which the Company used as

its primary GAAP at that time. However, under U.S. GAAP,

the Company is required to apply variable plan accounting for

all stock options granted prior to February 27, 2002 because

the total number of shares an individual employee was

entitled to receive under the “net settlement” feature was not

fixed. Variable plan accounting for these options ceased on

February 27, 2002 with the elimination of the “net settlement”

feature from the Stock Option Plan. On that date, all

unexercised awards became fixed awards and the remaining

unamortized compensation cost became fixed and is

required to be expensed over the remaining vesting period of

the related options. The variable plan accounting non-cash

compensation expense for options issued during the period

of the “net settlement” feature includes (1) all realized gains

on exercise of stock options prior to February 27, 2002, and