Blackberry 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

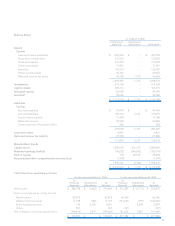

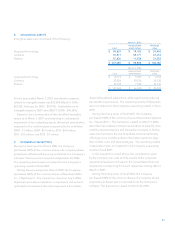

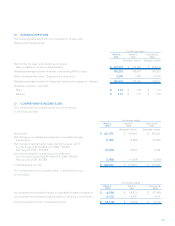

For the year ended

March 3,

2007 March 4,

2006 February 26,

2005

(Restated -

note 4) (Restated -

note 4)

Income before income taxes:

Canadian $ 718,004 $ 445,749 $ 50,147

Foreign 140,941 35,770 16,025

$ 858,945 $ 481,519 $ 66,172

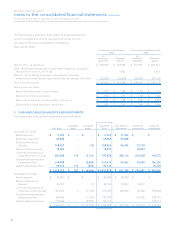

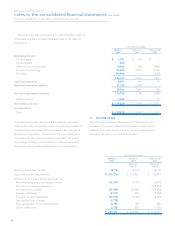

The provision for (recovery of) income taxes consists of

the following:

For the year ended

March 3,

2007 March 4,

2006 February 26,

2005

(Restated -

note 4) (Restated -

note 4)

Provision for (recovery of) income taxes:

Current

Canadian $ 114,073 $ 11,608 $ 655

Foreign 9,480 2,907 770

Deferred

Canadian 100,261 92,340 (143,061)

Foreign 3,559 8 2,196

$ 227,373 $ 106,863 $ (139,440)

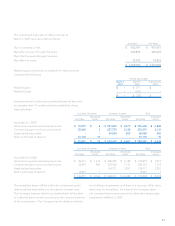

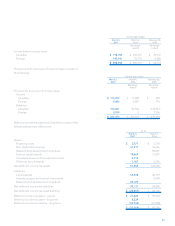

Deferred income tax assets and liabilities consist of the

following temporary differences:

As at

March 3,

2007 March 4,

2006

Assets

Financing costs $ 3,077 $ 6,378

Non-deductible reserves 41,917 16,166

Research and development incentives -84,487

Tax loss carryforwards 18,669 11,201

Unrealized losses on financial instruments 2,712 -

Other tax carryforwards 1,187 5,276

Net deferred income tax assets 67,562 123,508

Liabilities

Capital assets 63,408 46,193

Unrealized gains on financial instruments -8,609

Research and development incentives 26,723 -

Net deferred income tax liabilities 90,131 54,802

Net deferred income tax asset (liability) $ (22,569) $ 68,706

Deferred income tax asset - current $ 21,624 $ 96,564

Deferred income tax asset - long term 8,339 -

Deferred income tax liability - long-term (52,532) (27,858)

$ (22,569) $ 68,706