Blackberry 2007 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

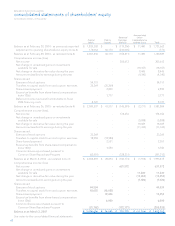

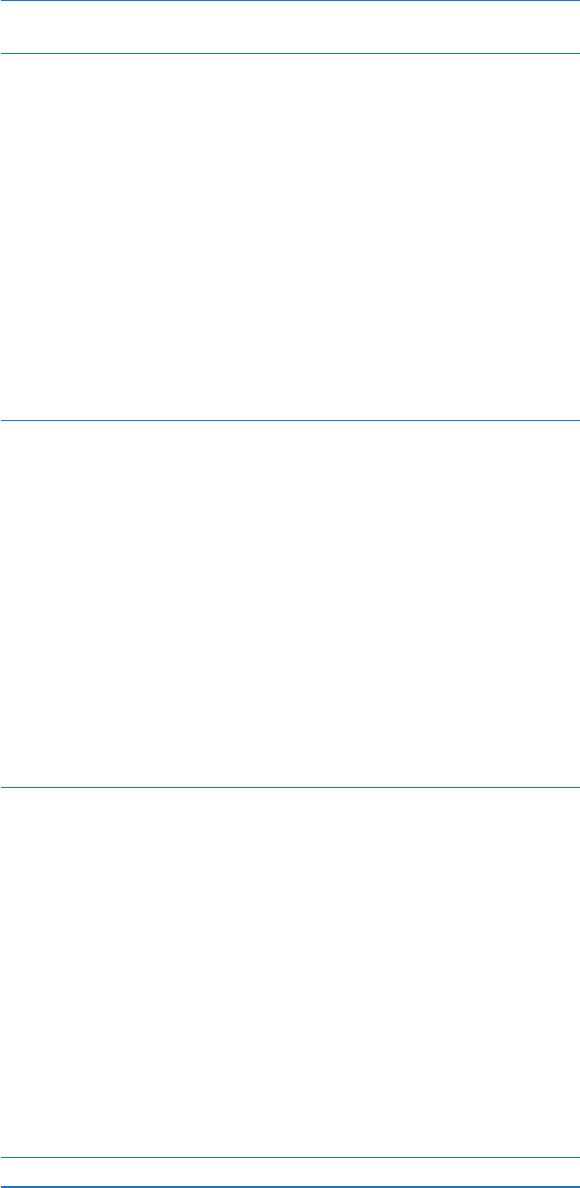

62

Capital

Stock Paid-In

Capital

Retained

Earnings

(Deficit)

Accumulated

Other

Comprehensive

Income (Loss) Total

Balance as at February 28, 2004 - as previously reported $ 1,829,388 $ - $ (119,206) $ 11,480 $ 1,721,662

Adjustment to opening shareholders’s equity (note 4) 172,062 60,170 (233,005) - (773)

Balance as at February 28, 2004 - as restated (note 4) 2,001,450 60,170 (352,211) 11,480 1,720,889

Comprehensive income (loss):

Net income - - 205,612 - 205,612

Net change in unrealized gains on investments

available for sale - - - (18,357) (18,357)

Net change in derivative fair value during the year - - - 8,446 8,446

Amounts reclassified to earnings during the year - - - (4,340) (4,340)

Shares issued:

Exercise of stock options 54,151 - - - 54,151

Transfers to capital stock from stock option exercises 25,269 (25,269) - - -

Share-based payment - 2,899 - - 2,899

Excess tax benefits from share-based compensation

(note 12(b)) - 3,777 - - 3,777

Deferred income tax benefit attributable to fiscal -

2004 financing costs 8,727 - - - 8,727

Balance as at February 26, 2005 - as restated (note 4) $ 2,089,597 $ 41,577 $ (146,599) $ (2,771) $ 1,981,804

Comprehensive income (loss):

Net income - - 374,656 - 374,656

Net change in unrealized gains on investments

available for sale - - - (5,888) (5,888)

Net change in derivative fair value during the year - - - 18,029 18,029

Amounts reclassified to earnings during the year - - - (11,344) (11,344)

Shares issued:

Exercise of stock options 23,269 - - - 23,269

Transfers to capital stock from stock option exercises 18,984 (18,984) - - -

Share-based payment - 2,551 - - 2,551

Excess tax benefits from share-based compensation

(note 12(b)) - 3,550 - - 3,550

Common shares repurchased pursuant to

Common Share Repurchase Program (62,981) - (328,231) - (391,212)

Balance as at March 4, 2006 - as restated (note 4) $ 2,068,869 $ 28,694 $ (100,174) $ (1,974) $ 1,995,415

Comprehensive income (loss):

Net income - - 631,572 - 631,572

Net change in unrealized gains on investments

available for sale - - - 11,839 11,839

Net change in derivative fair value during the year - - - (13,455) (13,455)

Amounts reclassified to earnings during the year - - - (7,926) (7,926)

Shares issued:

Exercise of stock options 44,534 - - - 44,534

Transfers to capital stock from stock option exercises 18,055 (18,055) - - -

Share-based payment - 19,454 - - 19,454

Excess tax benefits from share-based compensation

(note 12(b)) - 6,000 - - 6,000

Common shares repurchased pursuant to

Common Share Repurchase Program (31,762) - (172,171) - (203,933)

Balance as at March 3, 2007 $ 2,099,696 $ 36,093 $ 359,227 $ (11,516) $ 2,483,500

See notes to the consolidated financial statements.

RESEARCH IN MOTION LIMITED

consolidated statements of shareholders’ equity

(United States Dollars, in thousands)