Blackberry 2007 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.76

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements continued

For the Years Ended March 3, 2007, March 4, 2006 and February 26, 2005

In thousands of United States dollars, except share and per share data, and except as otherwise indicated

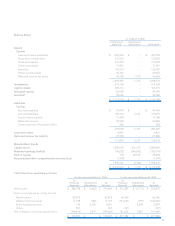

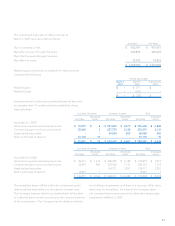

(1) Variable Accounting for the “Net Settlement” Feature

Under a “net settlement” feature that existed in the Stock

Option Plan prior to February 27, 2002, instead of paying

the total consideration of the options exercised in cash, an

employee could forgo the receipt of a number of Company

shares equal in value to the total exercise consideration

otherwise payable upon exercise of the options. Under

U.S. GAAP, the Company is required to apply variable plan

accounting for all stock options granted prior to February

27, 2002 because the total number of shares an individual

employee was entitled to receive under the “net settlement”

feature was not fixed. Variable plan accounting for these

options ceased on February 27, 2002 with the elimination of

the “net settlement” feature from the Stock Option Plan. On

that date, all unexercised awards became fixed awards and

the remaining unamortized compensation cost became fixed

and is required to be expensed over the remaining vesting

period of the related options. The variable plan accounting

compensation expense for options issued during the period

of the “net settlement” feature includes (1) all realized gains

on exercise of stock options prior to February 27, 2002, and

(2) an allocation of all unrealized gains for unexercised stock

options based on the stock’s trading price at each reporting

period. The application of variable plan accounting causes

significant fluctuations in the accounting expense/recovery

when the Company’s share price is experiencing periods of

high volatility. The accounting impact for the restatement

adjustments related to the variable plan accounting is set out

in the table above.

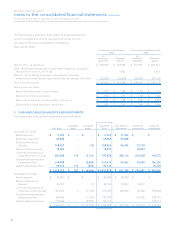

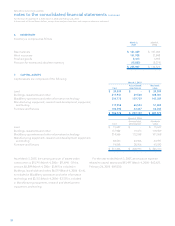

(2) Share-Based Awards Granted Prior to the Stock

Option Plan

Prior to the IPO and the Company’s adoption of the Stock

Option Plan, the Company issued 444,000 restricted Class A

Common Shares at a price of CAD $0.05 per share pursuant

to employee stock agreements and 1,306,000 options to

acquire shares at an exercise price of CAD $0.05 under

an employee stock plan (such agreements and such plan,

together, the “Pre-IPO Plans”). The terms of both awards

provided that employees could “put” the shares back to the

Company for per share book value while the Company was

private and for fair value when the Company became public.

Due to the put feature, under U.S. GAAP, the Company

was required to account for these awards under variable

plan accounting. Upon adoption of the Stock Option Plan

in 1996, all previously unexercised options under the Pre-

IPO Plans became subject to the terms and conditions of

the Stock Option Plan. As such, the awards issued under

the Pre-IPO Plans continued to be accounted for under

variable plan accounting subsequent to the Company’s IPO

as they were then subject to the “net settlement” feature as

described above. The accounting impact for the restatement

adjustment related to the stock based awards issued under

the Pre-IPO Plans is set out in the table above.

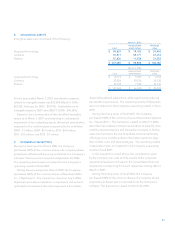

(3) Misapplication of the Determination of an Appropriate

Accounting Measurement Date

As a result of the Review, it has been determined that, in

many cases, incorrect measurement dates were used for

financial accounting purposes for certain stock option

grants in prior periods. For options issued prior to February

27, 2002, the determination of an appropriate accounting

measurement date does not impact the restated accounting

expense as all options issued prior to that date are accounted

for under variable plan accounting. For this reason, separate

disclosure is made of errors in measurement dates made

pre- and post-February 27, 2002. The determination of

the appropriate measurement dates for the period prior to

February 27, 2002 does, however, impact the Company’s

restated pro forma stock-based compensation disclosures

under SFAS 123, as set out in Note 12.

Consistent with the accounting literature and recent

guidance from the staff of the SEC, the Special Committee

undertook a process to categorize, based on grant type, each

option granted by the Company. The Special Committee

analyzed the evidence related to each grant and, based on

the relevant facts and circumstances, applied the accounting

standards to determine an appropriate measurement date

for each grant. Where the measurement date was found

to not be the originally assigned grant date, an accounting

adjustment was determined to account for the stock-

based compensation expense. The results of the work

conducted by the Special Committee were provided to the

Board of Directors, and the findings and the accounting

adjustments have been reviewed by and accepted by the

Company. Hereafter, reference to the Company’s actions and

determinations includes the actions and determinations of

the Special Committee.

For the purposes of identifying a measurement date with

finality for grants of options to persons other than the

C-level officers, the Company looked to objective evidence

supporting the approval of the number and exercise price