Blackberry 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

83

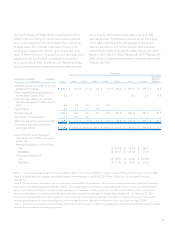

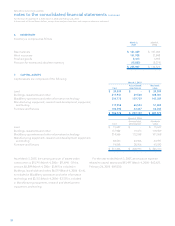

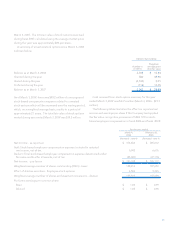

The contractual maturities of debt securities at

March 3, 2007 were recorded as follows:

Cost Basis Fair Value

Due in one year or less $ 958,797 $ 957,551

Due after one year through five years 430,800 425,652

Due after five years through ten years - -

Due after ten years 18,423 18,423

$ 1,408,020 $ 1,401,626

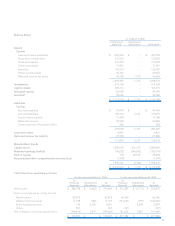

Realized gains and losses on available-for-sale securities

comprise the following:

For the year ended

March 3,

2007 March 4,

2006 February 26,

2005

Realized gains $ - $ 211 $ -

Realized losses -(236) -

$ - $ (25) $ -

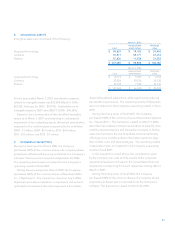

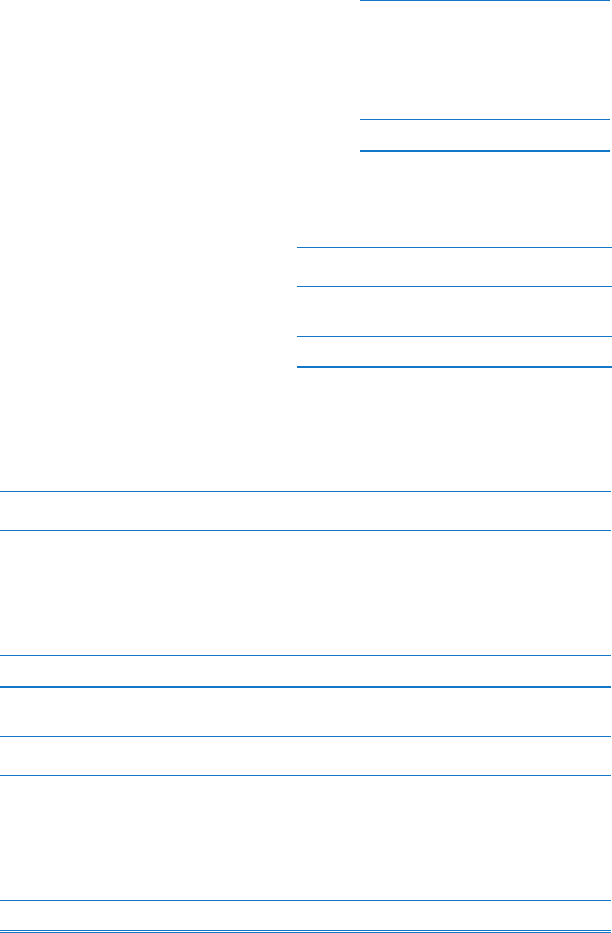

Investments with continuous unrealized losses for less than

and greater than 12 months and their related fair values

were as follows:

Less than 12 months 12 months or more Total

Fair Value Unrealized

losses Fair Value Unrealized

losses Fair Value Unrealized

losses

As at March 3, 2007

Government sponsored enterprise notes $ 15,057 $ 6 $ 241,635 $ 2,677 $ 256,692 $ 2,683

Commercial paper and corporate bonds 25,440 3 227,775 3,128 253,215 3,131

Asset-backed securities - - 60,060 802 60,060 802

Bank certificates of deposit 12,118 10 - - 12,118 10

$ 52,615 $ 19 $ 529,470 $ 6,607 $ 582,085 $ 6,626

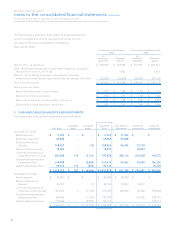

Less than 12 months 12 months or more Total

Fair Value Unrealized

losses Fair Value Unrealized

losses Fair Value Unrealized

losses

As at March 4, 2006

Government sponsored enterprise notes $ 86,015 $ 1,615 $ 286,255 $ 6,198 $ 372,270 $ 7,813

Commercial paper and corporate bonds 26,810 400 229,965 7,173 256,775 7,573

Asset-backed securities - - 136,711 2,851 136,711 2,851

Bank certificates of deposit 14,046 1 - - 14,046 1

$ 126,871 $ 2,016 $ 652,931 $ 16,222 $ 779,802 $ 18,238

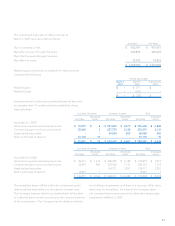

The unrealized losses of $6.6 million for investment grade

debt securities were related to increases in interest rates.

The Company believes that it is probable that it will be able

to collect all amounts due according to the contractual terms

of the investments. The Company has the ability and intent

to hold these investments until there is a recovery of fair value

which may be at maturity. As a result, the Company does

not consider these investments to be other-than-temporarily

impaired as at March 3, 2007.