Blackberry 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.41

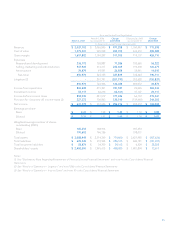

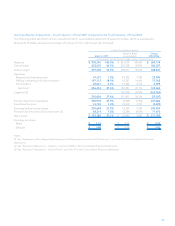

respect to these capital asset expenditures incurred during

fiscal 2006 and also incremental amortization with respect to

capital asset expenditures incurred during fiscal 2007. See

also note 7 to the Consolidated Financial Statements.

Amortization expense with respect to licenses (a

component of Intangible assets) is charged to Cost of sales

and was $19.6 million in fiscal 2007 compared to $17.5 million

in fiscal 2006.

Total amortization expense with respect to Intangible

assets was $32.9 million in fiscal 2007 compared to $23.2

million in fiscal 2006. See also notes 1(l) and 8 to the

Consolidated Financial Statements and “Critical Accounting

Policies and Estimates - Valuation of long-lived assets,

intangible assets and goodwill”.

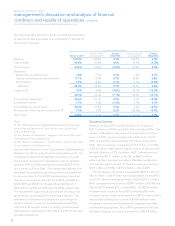

Litigation

As more fully disclosed in the Consolidated Financial

Statements and notes for the fiscal years ended March 3,

2007, March 4, 2006 and February 26, 2005, the Company

was the defendant in a patent litigation matter brought

by NTP alleging that the Company infringed on eight of

NTP’s patents (See note 13(b) to the Consolidated Financial

Statements).

On March 3, 2006, the Company and NTP signed

definitive licensing and settlement agreements. All terms of

the agreement were finalized and the litigation against the

Company was dismissed by a court order on March 3, 2006.

The agreement eliminated the need for any further court

proceedings or decisions relating to damages or injunctive

relief. On March 3, 2006, the Company paid NTP $612.5

million in full and final settlement of all claims against the

Company, as well as for a perpetual, fully-paid up license

going forward. This amount included money already

escrowed by the Company as of March 3, 2006.

The licensing and settlement agreement relates to all

patents owned and controlled by NTP and covers all of

the Company’s products, services and technologies. NTP

granted the Company an unfettered right to continue its

business, including its BlackBerry related business. The

resolution permits the Company and its partners to sell

the Company’s products and services completely free and

clear of any claim by NTP, including any claims that NTP may

have against wireless carriers, channel partners, suppliers or

customers in relation to the Company’s products or services,

(including BlackBerry Connect and Built-In technologies), or

in relation to third party products and services, to the extent

they are used in connection with the Company’s products

and services.

As at February 26, 2005, the Company had an accrued

liability of $450.0 million in respect of the NTP litigation

which included an intangible asset of $20.0 million. As the

full and final settlement amount paid on March 3, 2006

was $612.5 million, an additional charge to earnings in the

amount of $162.5 million was recorded in the fiscal 2006

operating results. During fiscal 2006, the Patent Office

issued various office actions rejecting all claims in all NTP

patents. Accordingly, though the rulings of the Patent Office

are subject to appeal by NTP, given the conclusions and the

strength of the conclusions reached by the Patent Office, no

value has been ascribed to the NTP license. This resulted in

an additional charge to earnings of $18.3 million reflecting

the book value of the intangible asset at the time the Term

Sheet was ruled unenforceable. The charge of $162.5 million,

the write-off of the intangible asset of $18.3 million as well

as incremental legal and professional fees in respect of the

litigation resulted in a charge to earnings of $201.8 million in

fiscal 2006.

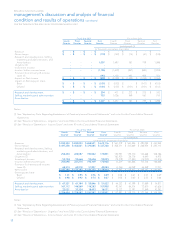

Investment Income

Investment income decreased by $14.1 million to $52.1 million

in fiscal 2007 from $66.2 million for the same period last year.

The decrease reflects the decrease in cash, cash equivalents,

short-term investments and investments when compared

to the prior year resulting primarily from the funding of the

NTP litigation settlement in the amount of $612.5 million

in the fourth quarter of fiscal 2006 as well as the common

shares of the Company repurchased as part of the Company’s

Common Share Repurchase Program at an aggregate cost of

$595.1 million, offset in part by improved interest rate yields.

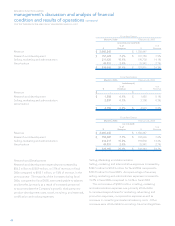

Income Taxes

For fiscal 2007, the Company’s income tax expense was $227.4

million resulting in an effective tax rate of 26.5% compared to

an income tax expense of $106.9 million or a 22.2% effective

tax rate for the same period last year. During the first

quarter of fiscal 2006, the tax provision was reduced by $27.0

million as a result of the Company recognizing incremental

cumulative ITCs attributable to prior fiscal years. ITCs are

generated as a result of the Company incurring eligible

SR&ED expenditures, which, under the “flow-through”

method, are credited as a reduction of income tax expense.

The Company recorded this $27.0 million reduction in its