Blackberry 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.65

NATURE OF BUSINESS

Research In Motion Limited (“RIM” or the “Company”) is a

leading designer, manufacturer and marketer of innovative

wireless solutions for the worldwide mobile communications

market. Through the development of integrated hardware,

software and services that support multiple wireless network

standards, RIM provides platforms and solutions for seamless

access to time-sensitive information including email, phone,

short messaging service (SMS), Internet and intranet-based

applications. RIM technology also enables a broad array

of third party developers and manufacturers to enhance

their products and services with wireless connectivity to

data. RIM’s products, services and embedded technologies

are used by thousands of organizations around the world

and include the BlackBerry wireless platform, software

development tools, radio-modems and other hardware

and software. The Company’s sales and marketing efforts

include collaboration with strategic partners and distribution

channel relationships to promote the sales of its products and

services as well as its own supporting sales and marketing

teams. The Company was incorporated on March 7, 1984

under the Ontario Business Corporations Act. The Company’s

shares are traded on The Toronto Stock Exchange under the

symbol RIM and on the NASDAQ National Market under the

symbol RIMM.

1. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

(a) General

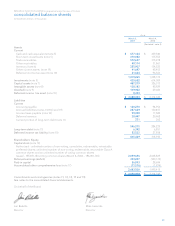

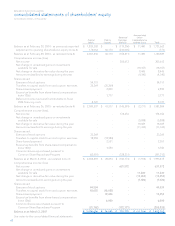

These consolidated financial statements have been prepared

by management in accordance with United States generally

accepted accounting principles (“U.S. GAAP”) on a basis

consistent for all periods presented except as described in

note 2. The significant accounting policies used in these U.S.

GAAP consolidated financial statements are as follows:

(b) Fiscal year

The Company’s fiscal year end date is the 52 or 53 weeks

ending on the last Saturday of February, or the first Saturday

of March. The fiscal years ended March 3, 2007 and February

26, 2005 comprise 52 weeks compared to 53 weeks for the

fiscal year ended March 4, 2006.

(c) Basis of consolidation

The consolidated financial statements include the accounts

of all subsidiaries with intercompany transactions and

balances eliminated on consolidation. All of the Company’s

subsidiaries are wholly-owned and are considered to be fully-

integrated operations.

(d) Use of estimates

The preparation of the Company’s consolidated financial

statements in accordance with U.S. GAAP requires

management to make estimates and assumptions that affect

the reported amounts of assets and liabilities and disclosure

of contingent liabilities as at the dates of the consolidated

financial statements and the reported amounts of revenues

and expenses during the reporting periods. Significant

areas requiring the use of management estimates relate to

the determination of reserves for various litigation claims,

allowance for doubtful accounts, provision for excess

and obsolete inventory, fair values of assets acquired and

liabilities assumed in business combinations, amortization

expense, implied fair value of goodwill, realization of future

tax assets and the related components of the valuation

allowance, provision for warranty and the fair values of

financial instruments. Actual results could differ from these

estimates.

(e) Foreign currency translation

The U.S. dollar is the functional and reporting currency of

the Company. Foreign currency denominated assets and

liabilities of the Company and all of its subsidiaries are

translated into U.S. dollars using the temporal method.

Accordingly, monetary assets and liabilities are translated

using the exchange rates in effect at the consolidated

balance sheet date, non-monetary assets and liabilities at

historical exchange rates, and revenues and expenses at the

rates of exchange prevailing when the transactions occurred.

Resulting exchange gains and losses are included in income.

(f) Cash and cash equivalents

Cash and cash equivalents consist of balances with banks

and highly liquid investments with maturities of three months

or less at the date of acquisition and are carried on the

consolidated balance sheets at fair value.

(g) Trade receivables

Trade receivables which reflect invoiced and accrued revenue

are presented net of an allowance for doubtful accounts.

The allowance was $1,824 at March 3, 2007 (March 4, 2006 -

$1,551). Bad debt expense (recovery) was $274 for the year

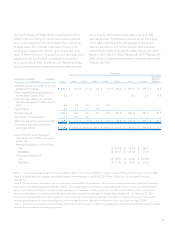

RESEARCH IN MOTION LIMITED

notes to the consolidated financial statements

For the Years Ended March 3, 2007, March 4, 2006 and February 26, 2005

In thousands of United States dollars, except share and per share data, and except as otherwise indicated