Blackberry 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.67

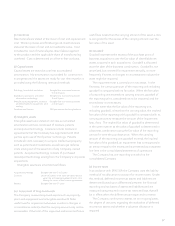

(j) Inventories

Raw materials are stated at the lower of cost and replacement

cost. Work in process and finished goods inventories are

stated at the lower of cost and net realizable value. Cost

includes the cost of materials plus direct labour applied

to the product and the applicable share of manufacturing

overhead. Cost is determined on a first-in-first-out basis.

(k) Capital assets

Capital assets are stated at cost less accumulated

amortization. No amortization is provided for construction

in progress until the assets are ready for use. Amortization is

provided using the following rates and methods:

Buildings, leaseholds and other Straight-line over terms between

5 and 40 years

BlackBerry operations and other

information technology

Straight-line over terms between

3 and 5 years

Manufacturing equipment, research

and development equipment, and

tooling

Straight-line over terms between

2 and 8 years

Furniture and fixtures 20% per annum declining balance

(l) Intangible assets

Intangible assets are stated at cost less accumulated

amortization and are comprised of licenses, patents

and acquired technology. Licenses include licenses or

agreements that the Company has negotiated with third

parties upon use of third parties’ technology. Patents

include all costs necessary to acquire intellectual property

such as patents and trademarks, as well as legal defense

costs arising out of the assertion of any Company-owned

patents. Acquired technology consists of purchased

developed technology arising from the Company’s corporate

acquisitions.

Intangible assets are amortized as follows:

Acquired technology Straight-line over 2 to 5 years

Licenses Lesser of 5 years or on a per unit basis based

upon the anticipated number of units sold

during the terms of the license agreements

Patents Straight-line over 17 years

(m) Impairment of long-lived assets

The Company reviews long-lived assets such as property,

plant and equipment and intangible assets with finite

useful lives for impairment whenever events or changes in

circumstances indicate that the carrying amount may not be

recoverable. If the total of the expected undiscounted future

cash flows is less than the carrying amount of the asset, a loss

is recognized for the excess of the carrying amount over the

fair value of the asset.

(n) Goodwill

Goodwill represents the excess of the purchase price of

business acquisitions over the fair value of identifiable net

assets acquired in such acquisitions. Goodwill is allocated

as at the date of the business combination. Goodwill is not

amortized, but is tested for impairment annually, or more

frequently if events or changes in circumstances indicate the

asset might be impaired.

The impairment test is carried out in two steps. In the

first step, the carrying amount of the reporting unit including

goodwill is compared with its fair value. When the fair value

of a reporting unit exceeds its carrying amount, goodwill of

the reporting unit is considered not to be impaired, and the

second step is unnecessary.

In the event that the fair value of the reporting unit,

including goodwill, is less than the carrying value, the implied

fair value of the reporting unit’s goodwill is compared with its

carrying amount to measure the amount of the impairment

loss, if any. The implied fair value of goodwill is determined

in the same manner as the value of goodwill is determined in

a business combination using the fair value of the reporting

unit as if it were the purchase price. When the carrying

amount of the reporting unit goodwill exceeds the implied

fair value of the goodwill, an impairment loss is recognized in

an amount equal to the excess and is presented as a separate

line item in the consolidated statements of operations.

The Company has one reporting unit which is the

consolidated Company.

(o) Income taxes

In accordance with SFAS 109, the Company uses the liability

method of tax allocation to account for income taxes. Under

this method, deferred income tax assets and liabilities are

determined based upon differences between the financial

reporting and tax bases of assets and liabilities and are

measured using enacted income tax rates and laws that will

be in effect when the differences are expected to reverse.

The Company continues to assess, on an on-going basis,

the degree of certainty regarding the realization of deferred

income tax assets and whether a valuation allowance is

required.