Blackberry 2007 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 3, 2007

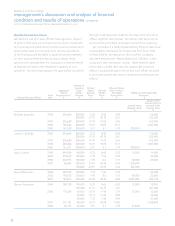

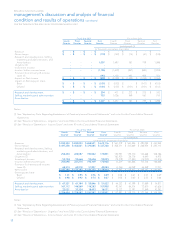

Cash flows from operating activities For the Year Ended March 4, 2006 For the Year Ended February 26, 2005

As Previously

Reported Restatement

Adjustments As Restated As Previously

Reported Restatement

Adjustments As Restated

Net income $ 382,078 $ (7,422) $ 374,656 $ 213,387 $ (7,775) $ 205,612

Items not requiring an outlay of cash:

Amortization 85,873 - 85,873 66,760 - 66,760

Deferred income taxes 77,938 (784) 77,154 (143,651) (991) (144,642)

Share-based payment 159 2,392 2,551 - 2,899 2,899

Other 507 - 507 (137) - (137)

Net changes in working capital items (396,464) 5,814 (390,650) 141,623 5,867 147,490

$ 150,091 $ - $ 150,091 $ 277,982 $ - $ 277,982

Special Note Regarding Forward-Looking Statements

This document contains forward-looking statements within

the meaning of the U.S. Private Securities Litigation Reform

Act of 1995 and applicable Canadian securities laws. The

words “expect”, “anticipate”, “estimate”, “may”, “will”,

“should”, “intend”, “believe”, “plan” and similar expressions

are intended to identify forward-looking statements.

Forward-looking statements are based on estimates and

assumptions made by RIM in light of its experience and

its perception of historical trends, current conditions and

expected future developments, as well as other factors that

RIM believes are appropriate in the circumstances. Many

factors could cause RIM’s actual results, performance or

achievements to differ materially from those expressed

or implied by the forward-looking statements, including,

without limitation, the following factors, which are discussed

in greater detail in the “Risk Factors” section of RIM’s Annual

Information Form, which is included in RIM’s Annual Report

on Form 40-F (copies of such filings may be obtained at www.

sedar.com and www.sec.gov):

• third-party claims for infringement of intellectual property

rights by RIM and the outcome of any litigation with

respect thereto;

• RIM’s ability to successfully obtain patent or other

proprietary or statutory protection for its technologies and

products;

• RIM’s ability to obtain rights to use software or

components supplied by third parties;

• risks related to RIM's internal review of its stock option

granting practices, the restatement of its previously

filed financial statements as a result of the review, and

regulatory investigations or litigation relating to those

matters;

• RIM’s ability to enhance current products and develop new

products;

• the efficient and uninterrupted operation of RIM’s network

operations center and the networks of its carrier partners;

• RIM’s ability to establish new, and to build on existing,

relationships with its network carrier partners and

distributors;

• RIM’s dependence on its carrier partners to grow its

BlackBerry subscriber account base;

• RIM’s dependence on a limited number of significant

customers;

• the occurrence or perception of a breach of RIM’s security

measures, or an inappropriate disclosure of confidential or

personal information;

• intense competition within RIM’s industry, including the

possibility that strategic transactions by RIM’s competitors

or carrier partners could weaken RIM’s competitive

position or that RIM may be required to reduce its prices

to compete effectively;

• the continued quality and reliability of RIM’s products;

• RIM’s reliance on its suppliers for functional components

and the risk that suppliers will not be able to supply

components on a timely basis or in sufficient quantities;

• effective management of growth and ongoing

development of RIM’s service and support operations;