Blackberry 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 3, 2007

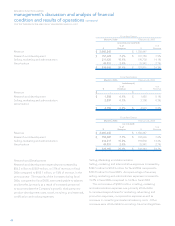

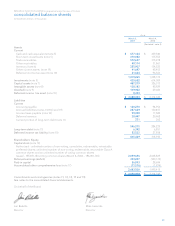

Aggregate Contractual Obligations

The following table sets out aggregate information about the

Company’s contractual obligations and the periods in which

payments are due as at March 3, 2007:

Total Less than

One Year One to

Three Years Four to

Five Years Greater than

Five Years

Long-term debt $ 6,613 $ 271 $ 6,342 $ - $ -

Operating lease obligations 88,372 11,201 30,383 15,258 31,530

Purchase obligations and commitments 1,374,721 1,282,921 91,800 - -

Total $ 1,469,706 $ 1,294,393 $ 128,525 $ 15,258 $ 31,530

Purchase obligations and commitments of $1.37 billion as of

March 3, 2007, in the form of purchase orders or contracts,

are primarily for the purchase of raw materials, as well as for

capital assets and other goods and services. The expected

timing of payment of these purchase obligations and

commitments is estimated based upon current information.

Timing of payment and actual amounts paid may be different

depending upon the time of receipt of goods and services or

changes to agreed-upon amounts for some obligations.

The Company has commitments on account of capital

expenditures of approximately $25.9 million included in

the $1.37 billion above, primarily for manufacturing and IT,

including service operations. The Company intends to fund

current and future capital asset expenditure requirements

from existing financial resources and cash flows.

The Company has not declared any cash dividends in the last

three fiscal years.

Cash, cash equivalents, short-term investments and

investments were $1.41 billion as at March 3, 2007. The

Company believes its financial resources, together with

expected future earnings, are sufficient to meet funding

requirements for current financial commitments, for future

operating and capital expenditures not yet committed, and

also provide the necessary financial capacity to meet current

and future growth expectations.

During fiscal 2007, the Company amended an existing

credit facility and now has a $100 million Demand Credit

Facility (“the Facility”). The Company has utilized $15.9

million of the Facility to secure operating and financing

requirements. As at March 3, 2007, $84.1 million of the

Facility was unused. The Company has pledged specific

investments as security for this Facility. The Company had

previously utilized $48 million of the Facility in order to fund a

letter of credit to partially satisfy the Company’s liability and

funding obligation in the NTP litigation matter. As a result

of the settlement of the NTP litigation matter, the Company

cancelled the letter of credit on March 6, 2006.

The Company has an additional demand facility in

the amount of $17.0 million to support and secure other

operating and financing requirements. As at March 3, 2007,

$15.6 million of this facility was unused. A general security

agreement and a general assignment of book debts have

been provided as collateral for this facility.

Market Risk of Financial Instruments

The Company is engaged in operating and financing

activities that generate risk in three primary areas:

Foreign Exchange

The Company is exposed to foreign exchange risk as a

result of transactions in currencies other than its functional

currency, the U.S. dollar. The majority of the Company’s

revenues in fiscal 2007 are transacted in U.S. dollars. Portions

of the revenues are denominated in British Pounds, Canadian

dollars, and Euros. Purchases of raw materials are primarily

transacted in U.S. dollars. Other expenses, consisting

of the majority of salaries, certain operating costs and

manufacturing overhead are incurred primarily in Canadian

dollars. At March 3, 2007, approximately 3% of cash and cash

equivalents, 30% of trade receivables and 14% of accounts

payable and accrued liabilities are denominated in foreign

currencies (March 4, 2006 – 5%, 28% and 19%, respectively).

These foreign currencies primarily include the British Pound,

Canadian dollar, and Euro. As part of its risk management

strategy, the Company maintains net monetary asset and/

or liability balances in foreign currencies and engages in

foreign currency hedging activities using derivative financial

instruments, including currency forward contracts and