Blackberry 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.46

RESEARCH IN MOTION LIMITED

management’s discussion and analysis of financial

condition and results of operations continued

FOR THE THREE MONTHS AND FISCAL YEAR ENDED MARCH 3, 2007

2006. The agreement eliminated the need for any further

court proceedings or decisions relating to damages or

injunctive relief. On March 3, 2006, the Company paid

NTP $612.5 million in full and final settlement of all claims

against the Company, as well as for a perpetual, fully-paid up

license going forward. This amount included money already

escrowed by the Company as of March 3, 2006.

As at February 26, 2005, the Company had an accrued

liability of $450.0 million in respect of the NTP litigation

which included an intangible asset of $20.0 million. As the

full and final settlement amount paid on March 3, 2006

was $612.5 million, an additional charge to earnings in the

amount of $162.5 million was recorded in the fiscal 2006

operating results. During fiscal 2006, the Patent Office

issued various office actions rejecting all claims in all NTP

patents. Accordingly, though the rulings of the Patent Office

are subject to appeal by NTP, given the conclusions and the

strength of the conclusions reached by the Patent Office, no

value has been ascribed to the NTP license. This resulted in

an additional charge to earnings of $18.3 million reflecting

the book value of the intangible asset at the time the Term

Sheet was ruled unenforceable. The charge of $162.5 million,

the write-off of the intangible asset of $18.3 million as well

as incremental legal and professional fees in respect of the

litigation resulted in a charge to earnings of $201.8 million in

fiscal 2006.

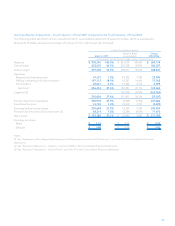

Investment Income

Investment income increased by $29.1 million to $66.2 million

in fiscal 2006 from $37.1 million in fiscal 2005. The increase

primarily reflects the incremental interest income as a result

of improved interest rate yields in fiscal 2006 compared to

fiscal 2005 as well as the significant increase in cash, cash

equivalents, short-term investments and investments during

fiscal 2006 primarily from higher net earnings compared to

the prior year.

Income Taxes

The Company’s income tax expense in fiscal 2006 was $106.9

million, resulting in an effective tax rate of 22.2%. During

the first quarter of fiscal 2006, the income tax provision

was reduced by $27.0 million because of the Company

recognizing incremental cumulative ITCs attributable to prior

fiscal years. ITCs are generated as a result of the Company

incurring eligible SR&ED expenditures, which, under the

“flow-through” method, are credited as a reduction of

income tax expense. The Company recorded this $27.0 million

reduction in its deferred income tax provision as a result of a

favorable tax ruling involving another Canadian technology

corporation, but also applicable to the Company. The tax

ruling determined that stock option benefits are considered

eligible SR&ED expenditures.

The deferred income tax asset recorded on the balance

sheet relates primarily to ITCs and other tax loss carry-

forwards. The Company’s fiscal 2006 current tax expense

primarily reflects certain large corporation taxes, and certain

other minimum and foreign taxes.

The Company has not provided for Canadian income

taxes or foreign withholding taxes that would apply on the

distribution of the earnings of its non-Canadian subsidiaries,

as these earnings are intended to be reinvested indefinitely

by these subsidiaries.

In fiscal 2005, the Company recorded an income tax

recovery of $139.4 million. The Company’s recognition of its

deferred income tax assets in the fourth quarter of fiscal 2005

was primarily responsible for the income tax recovery. In the

fourth quarter of fiscal 2005, the Company determined that

it was more likely than not that it could realize the full value

of its deferred tax assets and that a valuation allowance was

no longer required. Accordingly, the Company recognized

the full value of its deferred income tax assets on its balance

sheet at the end of fiscal 2005.

Net Income

Net income increased by $169.1 million to $374.7 million, or

$1.98 per share basic and $1.91 per share diluted, in fiscal

2006 compared to net income of $205.6 million, or $1.10

per share basic and $1.04 per share diluted in the prior year.

The increase reflects primarily higher operating profit/gross

margin resulting from increased device shipments as well as

lower litigation costs in fiscal 2006 when compared to fiscal

2005 (see “Litigation”).

The weighted average number of shares outstanding was

188.9 million common shares for basic EPS and 196.2 million

common shares for diluted EPS for the year ended March 4,

2006 compared to 187.7 million common shares for basic EPS

and 198.0 million common shares for diluted EPS for fiscal

year 2005.