Berkshire Hathaway 2007 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

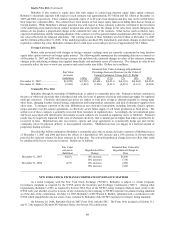

Equity Price Risk (Continued)

Berkshire is also subject to equity price risk with respect to certain long duration equity index option contracts.

Berkshire’ s maximum exposure with respect to such contracts was approximately $35 billion and $21 billion at December 31,

2007 and 2006, respectively. These contracts generally expire 15 to 20 years from inception and they may not be settled before

their respective expiration dates. The contracts have been written on four major equity indexes including three that are based on

foreign markets. While Berkshire’ s ultimate potential loss with respect to these contracts is directly correlated to the movement

of the underlying stock index between contract inception date and expiration, the change in fair value from current changes in the

indexes do not produce a proportional change in the estimated fair value of the contracts. Other factors (such as interest rates,

expected dividend rates and the remaining duration of the contract as well as general market assumptions) affect the estimates of

fair value reflected in the financial statements. The carrying amount of these liabilities was $4.6 billion at December 31, 2007

and $2.4 billion at December 31, 2006. If the underlying indexes declined 30% immediately, and absent changes in other factors

required to estimate fair value, Berkshire estimates that it could incur a non-cash pre-tax loss of approximately $2.3 billion.

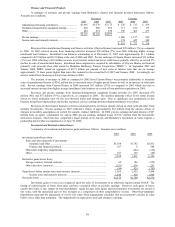

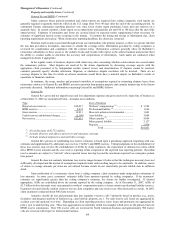

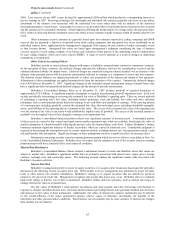

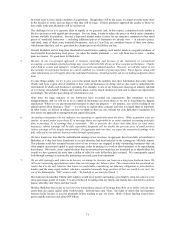

Foreign Currency Risk

Market risks associated with changes in foreign currency exchange rates are currently concentrated in long duration

equity index option contracts on foreign equity indexes. The following table summarizes the outstanding derivatives contracts as

of December 31, 2007 and 2006 with foreign currency risk and shows the estimated changes in values of the contracts assuming

changes in the underlying exchange rates applied immediately and uniformly across all currencies. The changes in value do not

necessarily reflect the best or worst case scenarios and actual results may differ. Dollars are in millions.

Estimated Fair Value Assuming a Hypothetical

Fair Value Percentage Increase (Decrease) in the Value of

net assets

Foreign Currencies Versus the U.S. Dollar

(liabilities) (20%) (10%) (1%) 1% 10% 20%

December 31, 2007......................... $(4,070) $(3,293) $(3,681) $(4,031) $(4,110) $(4,464) $(4,862)

December 31, 2006......................... (2,041) (1,819) (1,936) (2,031) (2,051) (2,131) (2,200)

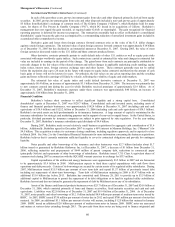

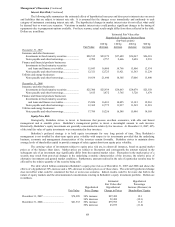

Commodity Price Risk

Berkshire, through its ownership of MidAmerican, is subject to commodity price risk. Exposures include variations in

the price of wholesale electricity that is purchased and sold, fuel costs to generate electricity and natural gas supply for regulated

retail gas customers. Electricity and natural gas prices are subject to wide price swings as demand responds to, among many

other items, changing weather, limited storage, transmission and transportation constraints, and lack of alternative supplies from

other areas. To mitigate a portion of the risk, MidAmerican uses derivative instruments, including forwards, futures, options,

swaps and other over-the-counter agreements, to effectively secure future supply or sell future production at fixed prices. The

settled cost of these contracts is generally recovered from customers in regulated rates. Accordingly, the net unrealized gains

and losses associated with interim price movements on such contracts are recorded as regulatory assets or liabilities. Financial

results may be negatively impacted if the costs of wholesale electricity, fuel or natural gas are higher than what is permitted to be

recovered in rates. MidAmerican also uses futures, options and swap agreements to economically hedge gas and electric

commodity prices for physical delivery to non-regulated customers. MidAmerican does not engage in a material amount of

proprietary trading activities.

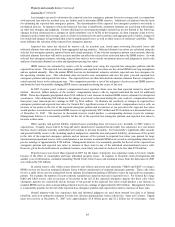

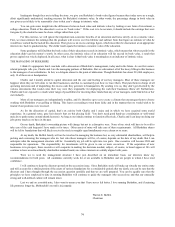

The table that follows summarizes Berkshire’ s commodity price risk on energy derivative contracts of MidAmerican as

of December 31, 2007 and 2006 and shows the effects of a hypothetical 10% increase and a 10% decrease in forward market

prices by the expected volumes for these contracts as of that date. The selected hypothetical change does not reflect what could

be considered the best or worst case scenarios. Dollars are in millions.

Fair Value

net assets

(liabilities)

Hypothetical Price

Change

Estimated Fair Value after

Hypothetical Change in

Price

December 31, 2007 $(263) 10% increase $(208)

10% decrease (318)

December 31, 2006 (273) 10% increase (220)

10% decrease (326)

NEW YORK STOCK EXCHANGE CORPORATE GOVERNANCE MATTERS

As a listed Company with the New York Stock Exchange (“NYSE”), Berkshire is subject to certain Corporate

Governance standards as required by the NYSE and/or the Securities and Exchange Commission (“SEC”). Among other

requirements, Berkshire’ s CEO, as required by Section 303A.12(a) of the NYSE Listing Company Manual, must certify to the

NYSE each year whether or not he is aware of any violations by the Company of NYSE Corporate Governance listing standards

as of the date of the certification. On May 14, 2007, Berkshire’ s CEO Warren E. Buffett, submitted such a certification to the

NYSE which stated that he was not aware of any violation by Berkshire of the NYSE Corporate Governance listing standards.

On February 29, 2008, Berkshire filed its 2007 Form 10-K with the SEC. The Form 10-K included as Exhibits 31.1

and 31.2 the required CEO and CFO Sarbanes-Oxley Act Section 302 certifications.