Berkshire Hathaway 2007 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

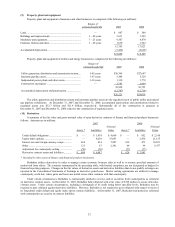

35

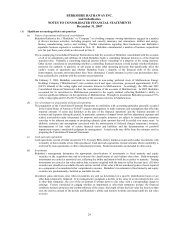

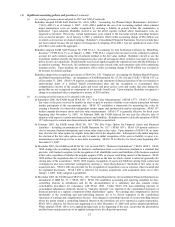

(3) Loans and receivables

Loans and receivables of insurance and other businesses are comprised of the following (in millions).

2007 2006

Insurance premiums receivable...................................................................................... $ 4,215 $ 4,418

Reinsurance recoverables............................................................................................... 3,171 2,961

Trade and other receivables ........................................................................................... 6,179 5,884

Allowances for uncollectible accounts .......................................................................... (408) (382)

$13,157 $12,881

Loans and finance receivables of finance and financial products businesses are comprised of the following (in millions).

2007 2006

Consumer installment loans and finance receivables .................................................... $11,506 $10,325

Commercial loans and finance receivables.................................................................... 1,003 1,336

Allowances for uncollectible loans................................................................................ (150) (163)

$12,359 $11,498

Allowances for uncollectible loans primarily relate to consumer installment loans. Provisions for consumer loan losses were

$176 million in 2007 and $210 million in 2006. Loan charge-offs were $197 million in 2007 and $243 million in 2006. Consumer

loan amounts are net of acquisition discounts of $452 million at December 31, 2007 and $484 million at December 31, 2006.

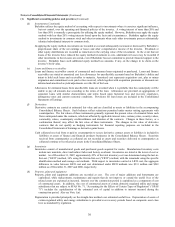

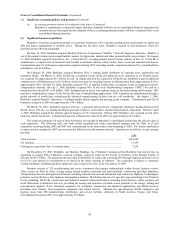

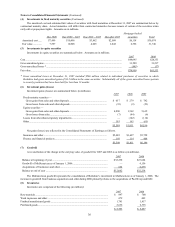

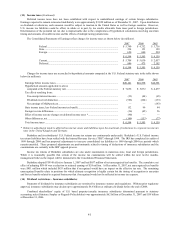

(4) Investments in fixed maturity securities

Investments in securities with fixed maturities as of December 31, 2007 and 2006 are shown below (in millions).

A

mortized Unrealized Unrealized Fai

r

Cost Gains

L

osses *

V

alue

2007

Insurance and other:

U.S. Treasury, U.S. government corporations and agencies ........... $ 3,487 $ 59 $ — $ 3,546

States, municipalities and political subdivisions ............................. 2,120 107 (3) 2,224

Foreign governments ....................................................................... 9,529 76 (47) 9,558

Corporate bonds and redeemable preferred stocks.......................... 8,400 1,187 (48) 9,539

Mortgage-backed securities ............................................................. 3,597 62 (11) 3,648

$27,133 $1,491 $ (109) $28,515

Finance and financial products:

Corporate bonds............................................................................... $ 420 $ 63 $ — $ 483

Mortgage-backed securities ............................................................. 938 52 — 990

$ 1,358 $ 115 $ — $ 1,473

Mortgage-backed securities, held-to-maturity................................. $ 1,583 $ 176 $ (1) $ 1,758

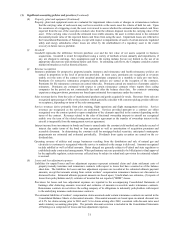

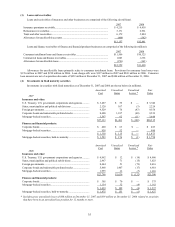

A

mortized Unrealized Unrealized Fai

r

Cost Gains

L

osses * Value

20

0

6

Insurance and other:

U.S. Treasury, U.S. government corporations and agencies ........... $ 4,962 $ 12 $ (14) $ 4,960

States, municipalities and political subdivisions ............................. 2,967 71 (15) 3,023

Foreign governments ....................................................................... 8,444 51 (79) 8,416

Corporate bonds and redeemable preferred stocks.......................... 5,468 1,467 (17) 6,918

Mortgage-backed securities ............................................................. 1,955 35 (7) 1,983

$23,796 $1,636 $ (132) $25,300

Finance and financial products:

Corporate bonds............................................................................... $ 305 $ 70 $ — $ 375

Mortgage-backed securities ............................................................. 1,134 32 (4) 1,162

$ 1,439 $ 102 $ (4) $ 1,537

Mortgage-backed securities, held-to-maturity................................. $ 1,475 $ 153 $ (1) $ 1,627

* Includes gross unrealized losses of $60 million at December 31, 2007 and $69 million at December 31, 2006 related to securities

that have been in an unrealized loss position for 12 months or more.