Berkshire Hathaway 2007 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

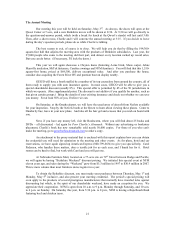

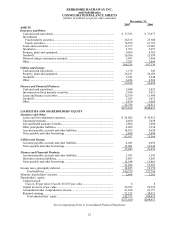

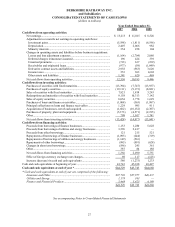

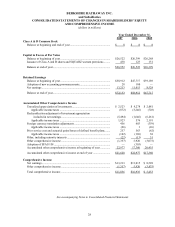

BERKSHIRE HATHAWAY INC.

and Subsidiaries

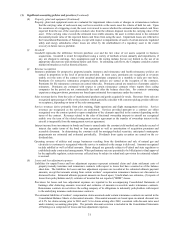

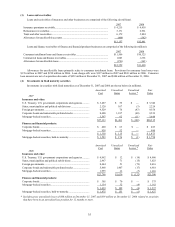

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

AND COMPREHENSIVE INCOME

(dollars in millions)

Year Ended December 31,

2007 2006 2005

Class A & B Common Stock

Balance at beginning and end of year........................................................ $ 8 $ 8 $ 8

Capital in Excess of Par Value

Balance at beginning of year ..................................................................... $26,522 $26,399 $26,268

Issuance of Class A and B shares and SQUARZ warrant premiums ......... 430 123 131

Balance at end of year................................................................................ $26,952 $26,522 $26,399

Retained Earnings

Balance at beginning of year ..................................................................... $58,912 $47,717 $39,189

Adoption of new accounting pronouncements........................................... 28 180 —

Net earnings ............................................................................................... 13,213 11,015 8,528

Balance at end of year................................................................................ $72,153 $58,912 $47,717

Accumulated Other Comprehensive Income

Unrealized appreciation of investments..................................................... $ 2,523 $ 9,278 $ 2,081

Applicable income taxes ...................................................................... (872) (3,246) (728)

Reclassification adjustment of investment appreciation

included in net earnings .................................................................... (5,494) (1,646) (6,261)

Applicable income taxes ...................................................................... 1,923 576 2,191

Foreign currency translation adjustments .................................................. 456 603 (359)

Applicable income taxes ...................................................................... (26) 1 (26)

Prior service cost and actuarial gains/losses of defined benefit plans........ 257 563 (62)

Applicable income taxes ...................................................................... (102) (196) 38

Other, including minority interests ............................................................ (22) (13) 51

Other comprehensive income .................................................................... (1,357) 5,920 (3,075)

Adoption of SFAS 158 .............................................................................. — (303) —

Accumulated other comprehensive income at beginning of year .............. 22,977 17,360 20,435

Accumulated other comprehensive income at end of year ........................ $21,620 $22,977 $17,360

Comprehensive Income

Net earnings............................................................................................... $13,213 $11,015 $ 8,528

Other comprehensive income .................................................................... (1,357) 5,920 (3,075)

Total comprehensive income..................................................................... $11,856 $16,935 $ 5,453

See accompanying Notes to Consolidated Financial Statements