Berkshire Hathaway 2007 Annual Report Download - page 11

Download and view the complete annual report

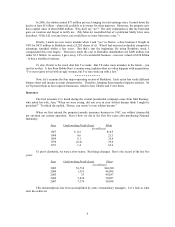

Please find page 11 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• GEICO possesses the widest moat of any of our insurers, one carefully protected and expanded by

Tony Nicely, its CEO. Last year – again – GEICO had the best growth record among major auto

insurers, increasing its market share to 7.2%. When Berkshire acquired control in 1995, that share

was 2.5%. Not coincidentally, annual ad expenditures by GEICO have increased from $31 million

to $751 million during the same period.

Tony, now 64, joined GEICO at 18. Every day since, he has been passionate about the company –

proud of how it could both save money for its customers and provide growth opportunities for its

associates. Even now, with sales at $12 billion, Tony feels GEICO is just getting started. So do I.

Here’ s some evidence. In the last three years, GEICO has increased its share of the motorcycle

market from 2.1% to 6%. We’ ve also recently begun writing policies on ATVs and RVs. And in

November we wrote our first commercial auto policy. GEICO and National Indemnity are

working together in the commercial field, and early results are very encouraging.

Even in aggregate, these lines will remain a small fraction of our personal auto volume.

Nevertheless, they should deliver a growing stream of underwriting profits and float.

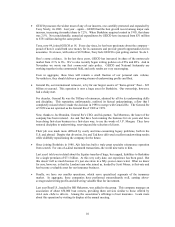

• General Re, our international reinsurer, is by far our largest source of “home-grown” float – $23

billion at yearend. This operation is now a huge asset for Berkshire. Our ownership, however,

had a shaky start.

For decades, General Re was the Tiffany of reinsurers, admired by all for its underwriting skills

and discipline. This reputation, unfortunately, outlived its factual underpinnings, a flaw that I

completely missed when I made the decision in 1998 to merge with General Re. The General Re

of 1998 was not operated as the General Re of 1968 or 1978.

Now, thanks to Joe Brandon, General Re’ s CEO, and his partner, Tad Montross, the luster of the

company has been restored. Joe and Tad have been running the business for six years and have

been doing first-class business in a first-class way, to use the words of J. P. Morgan. They have

restored discipline to underwriting, reserving and the selection of clients.

Their job was made more difficult by costly and time-consuming legacy problems, both in the

U.S. and abroad. Despite that diversion, Joe and Tad have delivered excellent underwriting results

while skillfully repositioning the company for the future.

• Since joining Berkshire in 1986, Ajit Jain has built a truly great specialty reinsurance operation

from scratch. For one-of-a-kind mammoth transactions, the world now turns to him.

Last year I told you in detail about the Equitas transfer of huge, but capped, liabilities to Berkshire

for a single premium of $7.1 billion. At this very early date, our experience has been good. But

this doesn’ t tell us much because it’ s just one straw in a fifty-year-or-more wind. What we know

for sure, however, is that the London team who joined us, headed by Scott Moser, is first-rate and

has become a valuable asset for our insurance business.

• Finally, we have our smaller operations, which serve specialized segments of the insurance

market. In aggregate, these companies have performed extraordinarily well, earning above-

average underwriting profits and delivering valuable float for investment.

Last year BoatU.S., headed by Bill Oakerson, was added to the group. This company manages an

association of about 650,000 boat owners, providing them services similar to those offered by

AAA auto clubs to drivers. Among the association’ s offerings is boat insurance. Learn more

about this operation by visiting its display at the annual meeting.

10