Berkshire Hathaway 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

(19) Contingencies and Commitments (Continued)

relating to a wide variety of allegedly wrongful practices by AIG. The allegations relating to General Reinsurance focus on the AIG

Transaction, and the complaint purports to assert causes of action in connection with that transaction for aiding and abetting other

defendants’ breaches of fiduciary duty and for unjust enrichment. The complaint does not specify the amount of damages or the

nature of any other relief sought. Subsequently, the New York Derivative Litigation was stayed by stipulation between the plaintiffs

and AIG. That stay remains in place.

In August 2005, General Reinsurance received a Summons and First Amended Consolidated Shareholders’ Derivative

Complaint in In re American International Group, Inc. Consolidated Derivative Litigation, Case No. 769-N, Delaware Chancery

Court. In June 2007, AIG filed an Amended Complaint in the Delaware Derivative Litigation asserting claims against two of its

former officers, but not against General Reinsurance. On September 28, 2007, AIG and the shareholder plaintiffs filed a Second

Combined Amended Complaint, in which AIG asserted claims against certain of its former officers and the shareholder plaintiffs

asserted claims against a number of other defendants, including General Reinsurance and General Re. The claims asserted in the

Delaware complaint are substantially similar to those asserted in the New York derivative complaint, except that the Delaware

complaint makes clear that the plaintiffs are asserting claims against both General Reinsurance and General Re. General Reinsurance

and General Re filed a motion to dismiss on November 30, 2007. Various parties moved to stay discovery and/or all proceedings in

the Delaware Derivative Litigation. At a hearing held on February 12, 2008, the Court ruled that discovery would be stayed pending

the resolution of the claims asserted against AIG in the AIG Securities Litigation. The parties are currently formulating the text of a

stipulation implementing the Court’ s ruling and establishing a briefing schedule on the motions to dismiss.

FAI/HIH Matter

In December 2003, the Liquidators of both FAI Insurance Limited (“FAI”) and HIH Insurance Limited (“HIH”) advised GRA

and Cologne Re that they intended to assert claims arising from insurance transactions GRA entered into with FAI in May and June

1998. In August 2004, the Liquidators filed claims in the Supreme Court of New South Wales in order to avoid the expiration of a

statute of limitations for certain plaintiffs. The focus of the Liquidators’ allegations against GRA and Cologne Re are the 1998

transactions GRA entered into with FAI (which was acquired by HIH in 1999). The Liquidators contend, among other things, that

GRA and Cologne Re engaged in deceptive conduct that assisted FAI in improperly accounting for such transactions as reinsurance,

and that such deception led to HIH’ s acquisition of FAI and caused various losses to FAI and HIH. The Liquidator of HIH served its

Complaint on GRA and Cologne Re in June 2006 and discovery is ongoing. The FAI Liquidator dismissed his complaint against

GRA and Cologne Re.

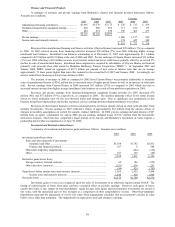

Berkshire has established reserves for certain of the legal proceedings discussed above where it has concluded that the

likelihood of an unfavorable outcome is probable and the amount of the loss can be reasonably estimated. For other legal

proceedings discussed above, either Berkshire has determined that an unfavorable outcome is reasonably possible but it is unable to

estimate a range of possible losses or it is unable to predict the outcome of the matter. Management believes that any liability to the

Company that may arise as a result of current pending civil litigation, including the matters discussed above, will not have a material

effect on Berkshire’ s financial condition or results of operations.

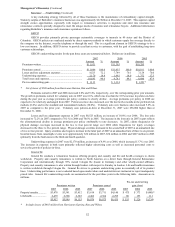

c) Commitments

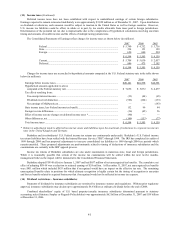

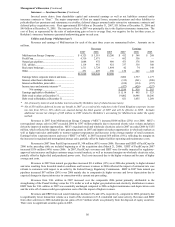

Berkshire subsidiaries lease certain manufacturing, warehouse, retail and office facilities as well as certain equipment. Rent

expense for all leases was $648 million in 2007, $578 million in 2006 and $432 million in 2005. Minimum rental payments for

operating leases having initial or remaining non-cancelable terms in excess of one year are as follows. Amounts are in millions.

After

2008 2009 2010 2011 2012 2012 Total

$541 $457 $351 $272 $214 $661 $2,496

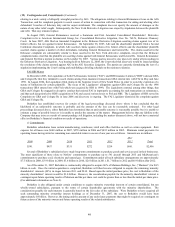

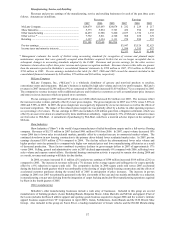

Several of Berkshire’ s subsidiaries have made long-term commitments to purchase goods and services used in their businesses.

The most significant of these relate to NetJets’ commitments to purchase up to 541 aircraft through 2015 and MidAmerican’ s

commitments to purchase coal, electricity and natural gas. Commitments under all such subsidiary arrangements are approximately

$7.3 billion in 2008, $3.9 billion in 2009, $3.6 billion in 2010, $2.6 billion in 2011, $1.7 billion in 2012 and $6.9 billion after 2012.

As of December 31, 2007 Berkshire is contractually obligated to acquire 60% of Marmon Holdings, Inc. (“Marmon”) for $4.5

billion in cash. Once the initial acquisition is completed, Berkshire will then become obligated to acquire the remaining minority

shareholders’ interests (40%) in stages between 2011 and 2014. Based upon the initial purchase price, the cost to Berkshire of the

minority shareholders’ interest would be $3.0 billion. However, the consideration payable for the minority shareholders’ interest is

contingent upon future operating results of Marmon and the per share cost could be greater than or less than the initial per share price.

(For additional information see Note 2).

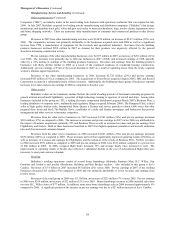

Berkshire is also obligated under certain conditions to acquire minority ownership interests of certain consolidated, but not

wholly-owned subsidiaries, pursuant to the terms of certain shareholder agreements with the minority shareholders. The

consideration payable for such interests is generally based on the fair value of the subsidiary. Were Berkshire to have acquired all

such outstanding minority ownership interest holdings as of December 31, 2007, the cost to Berkshire would have been

approximately $4 billion. However, the timing and the amount of any such future payments that might be required are contingent on

future actions of the minority owners and future operating results of the related subsidiaries.