Berkshire Hathaway 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

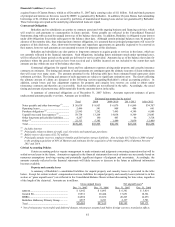

Insurance — Underwriting (Continued)

Berkshire Hathaway Reinsurance Group (Continued)

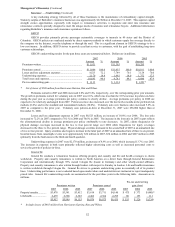

Effective January 1, 2008, BHRG entered into a reinsurance agreement with Swiss Reinsurance Company and its

property-casualty affiliates (“Swiss Re”). Under the agreement, BHRG will assume a 20% quota-share of the premiums and

related losses and expenses on all property-casualty risks of Swiss Re incepting over the five year period ending December 31,

2012. If recent years’ volumes were to continue over the next five years, the annual written premium assumed under this

agreement would be in the $3 billion range, however actual premiums assumed over the five year period could vary significantly

depending on market conditions and opportunities.

Berkshire Hathaway Primary Group

Berkshire’ s primary insurance group consists of a wide variety of smaller insurance businesses that principally write

liability coverages for commercial accounts. These businesses include: National Indemnity Company’ s primary group operation

(“NICO Primary Group”), a writer of motor vehicle and general liability coverages; U.S. Investment Corporation, whose

subsidiaries underwrite specialty insurance coverages; a group of companies referred to internally as “Homestate” operations,

providers of standard multi-line insurance; and Central States Indemnity Company, a provider of credit and disability insurance

to individuals nationwide through financial institutions. Also included are Medical Protective Corporation (“MedPro”), a

provider of professional liability insurance to physicians, dentists and other healthcare providers acquired on June 30, 2005 and

Applied Underwriters, a provider of integrated workers’ compensation solutions acquired on May 19, 2006. Underwriting results

for these two businesses are included in the Berkshire Hathaway Primary Group results beginning on their respective acquisition

dates.

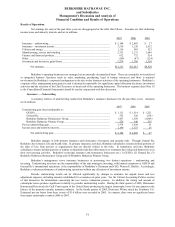

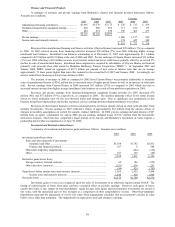

Collectively, Berkshire’ s primary insurance businesses produced earned premiums of $1,999 million in 2007, $1,858

million in 2006 and $1,498 million in 2005. The significant increase in premiums earned in 2006 was primarily attributable to

the impact of the MedPro and Applied Underwriters acquisitions partially offset by a decline in volume of the NICO Primary

Group. Pre-tax underwriting gains as percentages of premiums earned were approximately 14% in 2007, 18% in 2006 and 16%

in 2005. Underwriting gains were achieved by all significant primary insurance businesses.

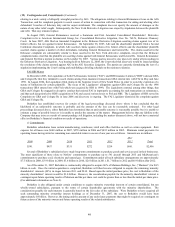

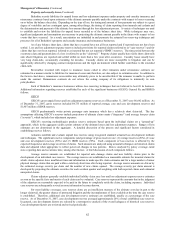

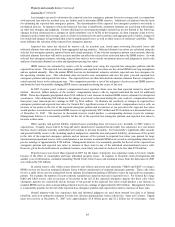

Insurance — Investment Income

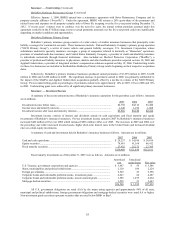

A summary of the net investment income of Berkshire’ s insurance operations for the past three years follows. Amounts

are in millions.

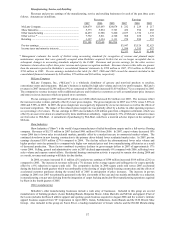

2007 2006 2005

Investment income before taxes...................................................................................... $4,758 $4,316 $3,480

Income taxes and minority interests................................................................................ 1,248 1,196 1,068

Investment income after taxes and minority interests ..................................................... $3,510 $3,120 $2,412

Investment income consists of interest and dividends earned on cash equivalents and fixed maturity and equity

investments of Berkshire’ s insurance businesses. Pre-tax investment income earned in 2007 by Berkshire’ s insurance businesses

increased $442 million (10%) over 2006 which increased $836 million (24%) over 2005. The increases in 2007 and 2006 over

the preceding year reflect increased invested assets, higher short-term interest rates in the United States and increased dividend

rates on certain equity investments.

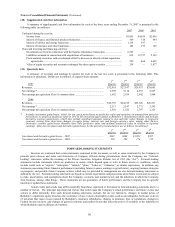

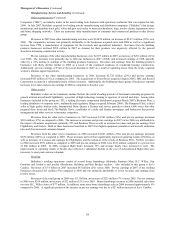

A summary of cash and investments held in Berkshire’ s insurance businesses follows. Amounts are in millions.

2007 2006 2005

Cash and cash equivalents............................................................................................... $ 28,257 $ 34,590 $ 38,814

Equity securities .............................................................................................................. 74,681 61,168 46,412

Fixed maturity securities ................................................................................................. 27,922 25,272 27,385

$130,860 $121,030 $112,611

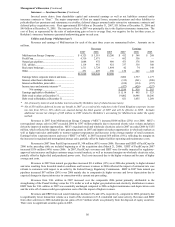

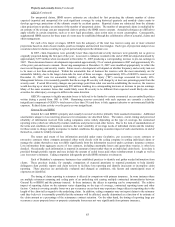

Fixed maturity investments as of December 31, 2007 were as follows. Amounts are in millions.

Amortized

cost

Unrealized

gains/losses

Fair value

U.S. Treasury, government corporations and agencies ................................................. $ 3,487 $ 59 $ 3,546

States, municipalities and political subdivisions ........................................................... 2,120 104 2,224

Foreign governments..................................................................................................... 9,529 29 9,558

Corporate bonds and redeemable preferred stocks, investment grade........................... 4,223 64 4,287

Corporate bonds and redeemable preferred stocks, non-investment grade.................... 3,589 1,075 4,664

Mortgage-backed securities........................................................................................... 3,592 51 3,643

$26,540 $ 1,382 $27,922

All U.S. government obligations are rated AAA by the major rating agencies and approximately 96% of all state,

municipal and political subdivisions, foreign government obligations and mortgage-backed securities were rated AA or higher.

Non-investment grade securities represent securities that are rated below BBB- or Baa3.