Berkshire Hathaway 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

Notes to Consolidated Financial Statements (Continued)

(1) Significant accounting policies and practices (Continued)

(s) Accounting pronouncements to be adopted in the future (Continued)

Berkshire is continuing to evaluate the impact that these standards will have on its consolidated financial statements but

currently does not anticipate that the adoption of these accounting pronouncements will have a material effect on its

consolidated financial position.

(2) Significant business acquisitions

Berkshire’ s long-held acquisition strategy is to purchase businesses with consistent earning power, good returns on equity and

able and honest management at sensible prices. During the last three years, Berkshire acquired several businesses which are

described in the following paragraphs.

On June 30, 2005, Berkshire acquired Medical Protective Corporation (“MedPro”) from GE Insurance Solutions. MedPro is

one of the nation’ s premier professional liability insurers for physicians, dentists and other primary health care providers. On August

31, 2005, Berkshire acquired Forest River, Inc., (“Forest River”) a leading manufacturer of leisure vehicles in the U.S. Forest River

manufactures a complete line of motorized and towable recreational vehicles, utility trailers, buses, boats and manufactured houses.

Consideration paid for all business acquisitions completed during 2005, including smaller acquisitions directed by certain Berkshire

subsidiaries, was $2.4 billion.

On February 28, 2006, Berkshire acquired Business Wire, a leading global distributor of corporate news, multimedia and

regulatory filings. On March 21, 2006, PacifiCorp, a regulated electric utility providing service to customers in six Western states,

was acquired for approximately $5.1 billion in cash. In conjunction with the acquisition of PacifiCorp, Berkshire acquired additional

common stock of MidAmerican for $3.4 billion, which increased its ownership interest in MidAmerican from approximately 83% to

approximately 88%. On May 19, 2006, Berkshire acquired 85% of Applied Underwriters, an industry leader in integrated workers’

compensation solutions. On July 5, 2006, Berkshire acquired 80% of the Iscar Metalworking Companies (“IMC”) for cash in a

transaction that valued IMC at $5 billion. IMC, headquartered in Israel, is an industry leader in the metal cutting tools business. IMC

provides a comprehensive range of tools for the full scope of metalworking applications. IMC’ s products are manufactured through a

global network of world-class, technologically advanced manufacturing facilities and are sold worldwide. On August 2, 2006,

Berkshire acquired Russell Corporation, a leading branded athletic apparel and sporting goods company. Consideration paid for all

businesses acquired in 2006 was approximately $10.1 billion.

On March 30, 2007, Berkshire acquired TTI, Inc., a privately held electronic components distributor headquartered in Fort

Worth, Texas. TTI, Inc. is a leading distributor specialist of passive, interconnect and electromechanical components. Effective April

1, 2007, Berkshire acquired the intimate apparel business of VF Corporation. During 2007, Berkshire also acquired several other

relatively smaller businesses. Consideration paid for all businesses acquired in 2007 was approximately $1.6 billion.

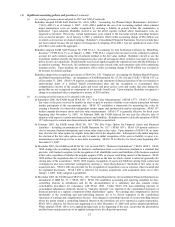

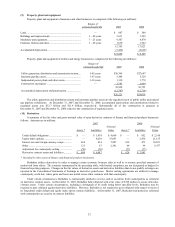

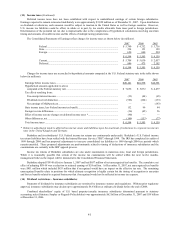

The results of operations for each of these businesses are included in Berkshire’ s consolidated results from the effective date of

each acquisition. The following table sets forth certain unaudited pro forma consolidated earnings data for 2006, as if each

acquisition occurring during 2006 and 2007 was consummated on the same terms at the beginning of 2006. Pro forma consolidated

revenues and net earnings for 2007 are not materially different from the amounts reported. Amounts are in millions, except earnings

per share.

2006

Total revenues.................................................................................................................................... $103,698

Net earnings....................................................................................................................................... 11,159

Earnings per equivalent Class A common share................................................................................ 7,238

On December 25, 2007, Berkshire and Marmon Holdings, Inc (“Marmon”) announced that Berkshire had entered into an

agreement to acquire 60% of Marmon, a private company owned by trusts for the benefit of members of the Pritzker Family of

Chicago for $4.5 billion. The agreement also provides for Berkshire to acquire the remaining 40% through staged acquisitions over a

five to six year period for consideration to be based on the future earnings of Marmon. The acquisition is subject to customary

closing conditions, including regulatory approvals, and is expected to close in the first quarter of 2008.

Marmon consists of 125 manufacturing and service businesses that operate independently within diverse business sectors.

These sectors are Wire & Cable, serving energy related markets, residential and non-residential construction and other industries;

Transportation Services & Engineered Products, including railroad tank cars and intermodal tank containers; Highway Technologies,

primarily serving the heavy-duty highway transportation industry; Distribution Services for specialty pipe and tubing; Flow Products

for the plumbing, HVAC/R, construction and industrial markets; Industrial Products including metal fasteners, safety products and

metal fabrication; Construction Services, providing the leasing and operation of mobile cranes primarily to the energy, mining and

petrochemical markets; Water Treatment equipment for residential, commercial and industrial applications; and Retail Services,

providing store fixtures, food preparation equipment and related services. Marmon has approximately 20,000 employees and

operates more than 250 manufacturing, distribution and service facilities, primarily in North America, Europe and China.

Consolidated revenues in 2007 were approximately $7 billion.