Berkshire Hathaway 2007 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Clayton, XTRA and CORT are all good businesses, very ably run by Kevin Clayton, Bill Franz

and Paul Arnold. Each has made tuck-in acquisitions during Berkshire’ s ownership. More will come.

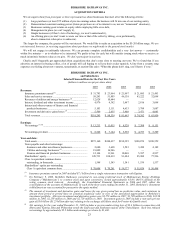

Investments

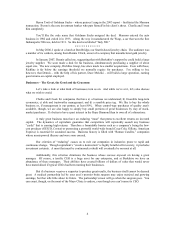

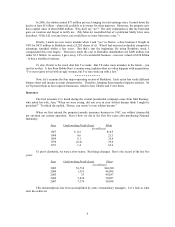

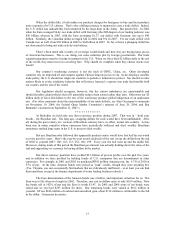

We show below our common stock investments at yearend, itemizing those with a market value of

at least $600 million.

12/31/07

Percentage of

Shares Company Company Owned Cost* Market

(in millions)

151,610,700 American Express Company ................... 13.1 $ 1,287 $ 7,887

35,563,200 Anheuser-Busch Companies, Inc............. 4.8 1,718 1,861

60,828,818 Burlington Northern Santa Fe.................. 17.5 4,731 5,063

200,000,000 The Coca-Cola Company ........................ 8.6 1,299 12,274

17,508,700 Conoco Phillips ....................................... 1.1 1,039 1,546

64,271,948 Johnson & Johnson.................................. 2.2 3,943 4,287

124,393,800 Kraft Foods Inc........................................ 8.1 4,152 4,059

48,000,000 Moody’ s Corporation .............................. 19.1 499 1,714

3,486,006 POSCO.................................................... 4.5 572 2,136

101,472,000 The Procter & Gamble Company ............ 3.3 1,030 7,450

17,170,953 Sanofi-Aventis......................................... 1.3 1,466 1,575

227,307,000 Tesco plc.................................................. 2.9 1,326 2,156

75,176,026 U.S. Bancorp ........................................... 4.4 2,417 2,386

17,072,192 USG Corp................................................ 17.2 536 611

19,944,300 Wal-Mart Stores, Inc. .............................. 0.5 942 948

1,727,765 The Washington Post Company .............. 18.2 11 1,367

303,407,068 Wells Fargo & Company......................... 9.2 6,677 9,160

1,724,200 White Mountains Insurance Group Ltd. .. 16.3 369 886

Others ......................................................

5,238 7,633

Total Common Stocks ............................. $39,252 $74,999

*This is our actual purchase price and also our tax basis; GAAP “cost” differs in a few cases

because of write-ups or write-downs that have been required.

Overall, we are delighted by the business performance of our investees. In 2007, American

Express, Coca-Cola and Procter & Gamble, three of our four largest holdings, increased per-share earnings

by 12%, 14% and 14%. The fourth, Wells Fargo, had a small decline in earnings because of the popping of

the real estate bubble. Nevertheless, I believe its intrinsic value increased, even if only by a minor amount.

In the strange world department, note that American Express and Wells Fargo were both

organized by Henry Wells and William Fargo, Amex in 1850 and Wells in 1852. P&G and Coke began

business in 1837 and 1886 respectively. Start-ups are not our game.

I should emphasize that we do not measure the progress of our investments by what their market

prices do during any given year. Rather, we evaluate their performance by the two methods we apply to the

businesses we own. The first test is improvement in earnings, with our making due allowance for industry

conditions. The second test, more subjective, is whether their “moats” – a metaphor for the superiorities

they possess that make life difficult for their competitors – have widened during the year. All of the “big

four” scored positively on that test.

15