Berkshire Hathaway 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

Management’s Discussion (Continued)

Manufacturing, Service and Retailing (Continued)

Other manufacturing (Continued)

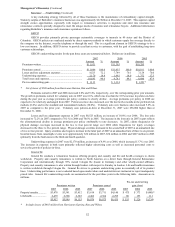

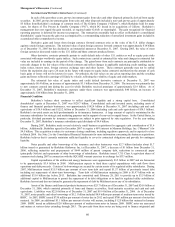

Companies (“IMC”), an industry leader in the metal cutting tools business with operations worldwide that was acquired in July

2006. In July 2007, Berkshire acquired two leading jewelry manufacturing and distribution companies (“Richline”) that design,

manufacture and distribute karat gold, silver and gem set jewelry to mass merchandisers, large jewelry chains, department stores

and home shopping networks. There are numerous other manufacturers of consumer and commercial products in this diverse

group.

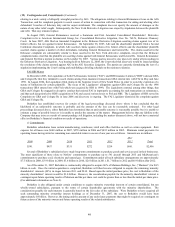

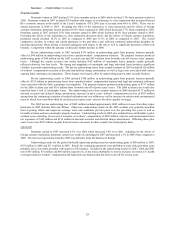

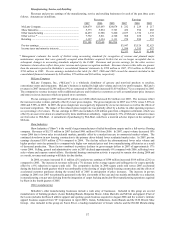

Revenues in 2007 from other manufacturing activities were $14,459 million, an increase of $2,471 million (21%) over

2006. The comparative increase was primarily attributable to the businesses acquired since mid-2006 as well as a significant

increase from CTB, a manufacturer of equipment for the livestock and agricultural industries. Revenues from the building

products businesses declined $292 million in 2007 as demand for their products was negatively affected by the general

slowdown in housing construction activity.

Pre-tax earnings of the other manufacturing businesses were $2,037 million in 2007, an increase of $281 million (16%)

over 2006. The increases were primarily due to full-year inclusion in 2007 of IMC and increased earnings of CTB, partially

offset by a 22% decline in earnings of the building products businesses. Revenues and earnings from the building products

businesses will likely decline further in 2008 as a result of the continued weakness in residential housing construction.

Additionally, pre-tax earnings of Fruit of the Loom declined in 2007 as a result of operating losses from the newly acquired

women’ s intimate apparel operations.

Revenues of the other manufacturing businesses in 2006 increased $2,728 million (29%) and pre-tax earnings

increased $421 million (32%) as compared to 2005. The acquisitions of Forest River (acquired August 2005), IMC and Russell

Corporation account for a substantial portion of these increases. Additionally, the building products group of businesses reported

increases in revenues and pre-tax earnings in 2006 as compared to the prior year.

Other service

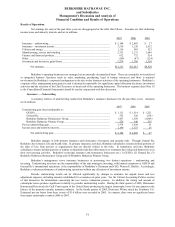

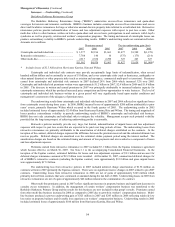

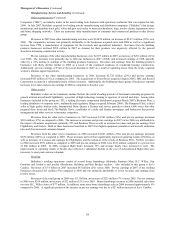

Berkshire’ s other service businesses include NetJets, the world’ s leading provider of fractional ownership programs for

general aviation aircraft and FlightSafety, a provider of high technology training to operators of aircraft and ships. Among other

businesses included in this group are: TTI, a leading electronic components distributor (acquired March 2007); Business Wire, a

leading distributor of corporate news, multimedia and regulatory filings (acquired February 2006); The Pampered Chef, a direct

seller of high quality kitchen tools; International Dairy Queen, a licensor and service provider to about 6,000 stores that offer

prepared dairy treats and food; The Buffalo News, a publisher of a daily and Sunday newspaper; and businesses that provide

management and other services to insurance companies.

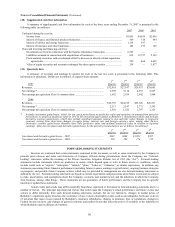

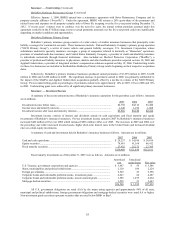

Revenues from the other service businesses in 2007 increased $1,981 million (34%) and pre-tax earnings increased

$310 million (47%) as compared to 2006. The increase in revenues and pre-tax earnings in 2007 versus 2006 was attributable to

the impact of business acquisitions (primarily TTI and Business Wire) as well as increased revenues and pre-tax earnings from

FlightSafety and NetJets. Both of these businesses benefited in 2007 from higher equipment (simulators and aircraft) utilization

rates and from increased customer demand.

Revenues from the other service businesses in 2006 increased $1,083 million (23%) and pre-tax earnings increased

$329 million (100%) as compared to 2005. These increases derived from significantly improved operating results of NetJets, as

well as increases in revenues and earnings for FlightSafety and the inclusion of the results of Business Wire. NetJets’ revenues

in 2006 increased $759 million as compared to 2005 and pre-tax earnings in 2006 were $143 million compared to a pre-tax loss

of $80 million in 2005. In 2006, occupied flight hours increased 19% and average hourly rates increased as well. The

improvement in operating results at NetJets also reflected a substantial decline in the cost of subcontracted flights that were

necessary to meet peak customer demand.

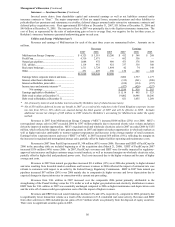

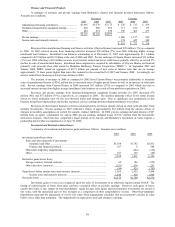

Retailing

Berkshire’ s retailing operations consist of several home furnishings (Nebraska Furniture Mart, R.C. Willey, Star

Furniture and Jordan’ s) and jewelry (Borsheims, Helzberg and Ben Bridge) retailers. Also included in this group is See’ s

Candies. Revenues of $3.4 billion in 2007 increased $63 million (2%) versus 2006. Pre-tax earnings in 2007 of the retailing

businesses decreased $15 million (5%) compared to 2006 and was primarily attributable to lower revenues and earnings from

jewelry stores.

Revenues of the retail group in 2006 were $3.3 billion, an increase of $223 million (7%) versus 2005. Pre-tax earnings

in 2006 were $289 million, an increase of $32 million (12%) over 2005. Home furnishings revenues in 2006 included sales from

two new R.C. Willey stores of $77 million. In addition, same store home furnishings sales in 2006 increased approximately 6%

compared to 2005. A significant portion of the increase in pre-tax earnings was due to a $27 million increase at See’ s Candies.