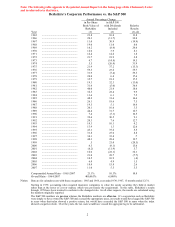

Berkshire Hathaway 2007 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We agreed to purchase 35,464,337 shares of MidAmerican at $35.05 per share in 1999, a year in

which its per-share earnings were $2.59. Why the odd figure of $35.05? I originally decided the business

was worth $35.00 per share to Berkshire. Now, I’ m a “one-price” guy (remember See’ s?) and for several

days the investment bankers representing MidAmerican had no luck in getting me to increase Berkshire’ s

offer. But, finally, they caught me in a moment of weakness, and I caved, telling them I would go to

$35.05. With that, I explained, they could tell their client they had wrung the last nickel out of me. At the

time, it hurt.

Later on, in 2002, Berkshire purchased 6,700,000 shares at $60 to help finance the acquisition of

one of our pipelines. Lastly, in 2006, when MidAmerican bought PacifiCorp, we purchased 23,268,793

shares at $145 per share.

In 2007, MidAmerican earned $15.78 per share. However, 77¢ of that was non-recurring – a

reduction in deferred tax at our British utility, resulting from a lowering of the U.K. corporate tax rate. So

call normalized earnings $15.01 per share. And yes, I’ m glad I wilted and offered the extra nickel.

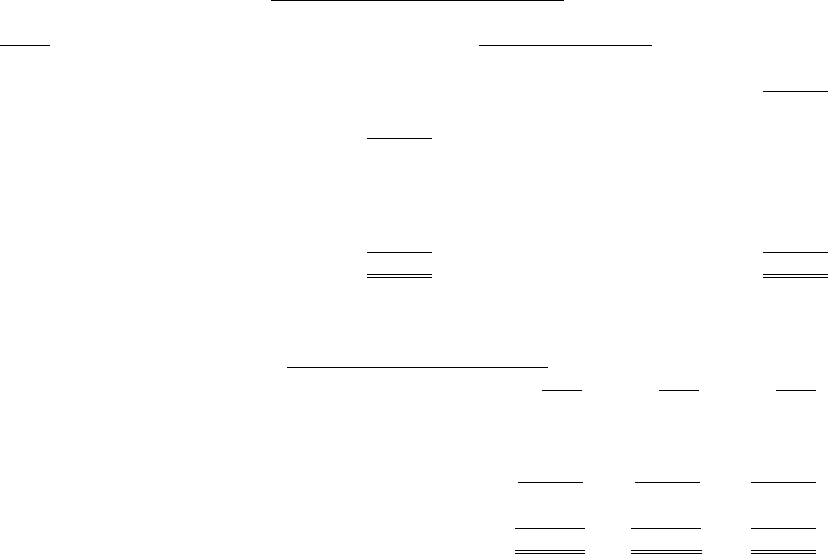

Manufacturing, Service and Retailing Operations

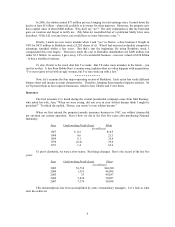

Our activities in this part of Berkshire cover the waterfront. Let’ s look, though, at a summary

balance sheet and earnings statement for the entire group.

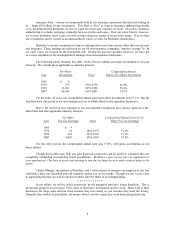

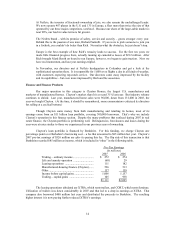

Balance Sheet 12/31/07 (in millions)

Assets Liabilities and Equity

Cash and equivalents .............................. $ 2,080 Notes payable ............................ $ 1,278

Accounts and notes receivable ............... 4,488 Other current liabilities.............. 7,652

Inventory ................................................ 5,793 Total current liabilities .............. 8,930

Other current assets ................................ 470

Total current assets................................. 12,831

Goodwill and other intangibles............... 14,201 Deferred taxes............................ 828

Fixed assets............................................. 9,605 Term debt and other liabilities... 3,079

Other assets............................................. 1,685 Equity ........................................ 25,485

$38,322 $38,322

Earnings Statement (in millions)

2007 2006 2005

Revenues .................................................................................... $59,100 $52,660 $46,896

Operating expenses (including depreciation of $955 in 2007,

$823 in 2006 and $699 in 2005).......................................... 55,026 49,002 44,190

Interest expense .......................................................................... 127 132 83

Pre-tax earnings.......................................................................... 3,947* 3,526* 2,623*

Income taxes and minority interests ........................................... 1,594 1,395 977

Net income ................................................................................. $ 2,353 $ 2,131 $ 1,646

*Does not include purchase-accounting adjustments.

This motley group, which sells products ranging from lollipops to motor homes, earned a pleasing

23% on average tangible net worth last year. It’ s noteworthy also that these operations used only minor

financial leverage in achieving that return. Clearly we own some terrific businesses. We purchased many

of them, however, at large premiums to net worth – a point reflected in the goodwill item shown on the

balance sheet – and that fact reduces the earnings on our average carrying value to 9.8%.

12