Berkshire Hathaway 2007 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. What is no puzzle, however, is why CEOs opt for a high investment assumption: It lets them

report higher earnings. And if they are wrong, as I believe they are, the chickens won’ t come home to roost

until long after they retire.

After decades of pushing the envelope – or worse – in its attempt to report the highest number

possible for current earnings, Corporate America should ease up. It should listen to my partner, Charlie: “If

you’ ve hit three balls out of bounds to the left, aim a little to the right on the next swing.”

* * * * * * * * * * * *

Whatever pension-cost surprises are in store for shareholders down the road, these jolts will be

surpassed many times over by those experienced by taxpayers. Public pension promises are huge and, in

many cases, funding is woefully inadequate. Because the fuse on this time bomb is long, politicians flinch

from inflicting tax pain, given that problems will only become apparent long after these officials have

departed. Promises involving very early retirement – sometimes to those in their low 40s – and generous

cost-of-living adjustments are easy for these officials to make. In a world where people are living longer

and inflation is certain, those promises will be anything but easy to keep.

* * * * * * * * * * * *

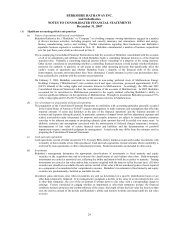

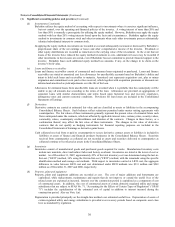

Having laid out the failures of an “honor system” in American accounting, I need to point out that

this is exactly the system existing at Berkshire for a truly huge balance-sheet item. In every report we

make to you, we must guesstimate the loss reserves for our insurance units. If our estimate is wrong, it

means that both our balance sheet and our earnings statement will be wrong. So naturally we do our best to

make these guesses accurate. Nevertheless, in every report our estimate is sure to be wrong.

At yearend 2007, we show an insurance liability of $56 billion that represents our guess as to what

we will eventually pay for all loss events that occurred before yearend (except for about $3 billion of the

reserve that has been discounted to present value). We know of many thousands of events and have put a

dollar value on each that reflects what we believe we will pay, including the associated costs (such as

attorney’ s fees) that we will incur in the payment process. In some cases, among them claims for certain

serious injuries covered by worker’ s compensation, payments will be made for 50 years or more.

We also include a large reserve for losses that occurred before yearend but that we have yet to hear

about. Sometimes, the insured itself does not know that a loss has occurred. (Think of an embezzlement

that remains undiscovered for years.) We sometimes hear about losses from policies that covered our

insured many decades ago.

A story I told you some years back illustrates our problem in accurately estimating our loss

liability: A fellow was on an important business trip in Europe when his sister called to tell him that their

dad had died. Her brother explained that he couldn’ t get back but said to spare nothing on the funeral,

whose cost he would cover. When he returned, his sister told him that the service had been beautiful and

presented him with bills totaling $8,000. He paid up but a month later received a bill from the mortuary for

$10. He paid that, too – and still another $10 charge he received a month later. When a third $10 invoice

was sent to him the following month, the perplexed man called his sister to ask what was going on. “Oh,”

she replied, “I forgot to tell you. We buried Dad in a rented suit.”

At our insurance companies we have an unknown, but most certainly large, number of “rented

suits” buried around the world. We try to estimate the bill for them accurately. In ten or twenty years, we

will even be able to make a good guess as to how inaccurate our present guess is. But even that guess will

be subject to surprises. I personally believe our stated reserves are adequate, but I’ ve been wrong several

times in the past.

20