Berkshire Hathaway 2007 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

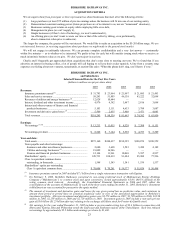

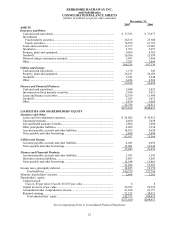

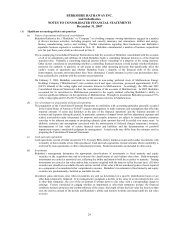

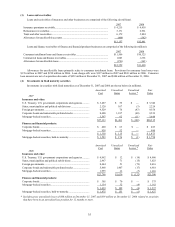

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(dollars in millions except per share amounts)

December 31

,

2007 2006

ASSETS

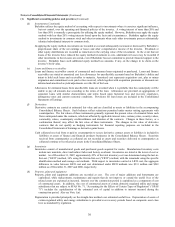

Insurance and Other:

Cash and cash e

q

uivalents .................................................................................... $ 37

,

703 $ 37

,

977

Investments:

Fixed maturit

y

securities................................................................................... 28

,

515 25

,

300

E

q

uit

y

securities................................................................................................ 74

,

999 61

,

533

Loans and

r

eceivables........................................................................................... 13

,

157 12

,

881

Inventories ............................................................................................................ 5

,

793 5

,

257

Pro

p

ert

y,

p

lant and e

q

ui

p

men

t

.............................................................................. 9

,

969 9

,

303

Goodwill............................................................................................................... 26

,

306 25

,

678

Deferred char

g

es reinsurance assumed................................................................. 3

,

987 1

,

964

Othe

r

..................................................................................................................... 7

,

797 7

,

443

208

,

226 187

,

336

Utilities and Ener

gy

:

Cash and cash e

q

uivalents .................................................................................... 1

,

178 343

Pro

p

ert

y,

p

lant and e

q

ui

p

men

t

.............................................................................. 26

,

221 24

,

039

Goodwill............................................................................................................... 5

,

543 5

,

548

Othe

r

..................................................................................................................... 6

,

246 6

,

560

39

,

188 36

,

490

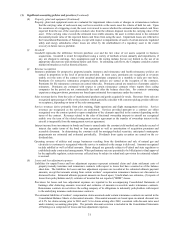

F

inance and Financial Products:

Cash and cash e

q

uivalents .................................................................................... 5

,

448 5

,

423

Investments in fixed maturit

y

securities ............................................................... 3

,

056 3

,

012

Loans and finance receivables.............................................................................. 12

,

359 11

,

498

Goodwill............................................................................................................... 1

,

013 1

,

012

Othe

r

..................................................................................................................... 3

,

870 3

,

666

25

,

746 24

,

611

$273,160 $248,437

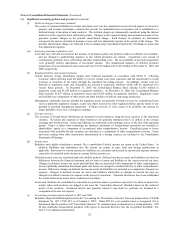

LIABILITIES AND SHAREHOLDERS’ E

Q

UITY

Insurance and Other:

Losses and loss ad

j

ustment ex

p

enses................................................................... $ 56,002 $ 47,612

Unearned

p

remiums............................................................................................. 6,680 7,058

Life and health insurance benefits ....................................................................... 3,804 3,600

Other

p

olic

y

holder liabilities ............................................................................... 4,089 3,938

Accounts

p

a

y

able, accruals and other liabilities .................................................. 10,672 9,654

N

otes

p

a

y

able and other borrowin

g

s ................................................................... 2,680 3,698

83,927 75,560

Utilities and Ener

gy

:

Accounts

p

a

y

able, accruals and other liabilities .................................................. 6,043 6,693

N

otes

p

a

y

able and other borrowin

g

s ................................................................... 19,002 16,946

25,045 23,639

F

inance and Financial Products:

Accounts

p

a

y

able, accruals and other liabilities .................................................. 2,931 3,543

Derivative contract liabilities............................................................................... 6,887 3,883

Notes payable and other borrowings ................................................................... 12,144 11,961

21,962 19,387

Income taxes,

p

rinci

p

all

y

deferre

d

.......................................................................... 18,825 19,170

Total liabilities ................................................................................................. 149,759 137,756

Minorit

y

shareholders’ interests ............................................................................. 2,668 2,262

Shareholders’ e

q

uit

y

:

Common stock:

Class A, $5

p

ar value; Class B, $0.1667

p

ar value .......................................... 8 8

Ca

p

ital in excess of

p

ar value .............................................................................. 26,952 26,522

Accumulated other com

p

rehensive income ......................................................... 21

,

620 22

,

977

Retained earnin

g

s................................................................................................. 72,153 58,912

Total shareholders’ e

q

uit

y

.............................................................................. 120,733 108,419

$273,160 $248,437

See accompanying Notes to Consolidated Financial Statements