Berkshire Hathaway 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

Notes to Consolidated Financial Statements (Continued)

(14) Dividend restrictions – Insurance subsidiaries (Continued)

Statutory surplus differs from the corresponding amount determined on the basis of GAAP. The major differences between

statutory basis accounting and GAAP are that deferred charges reinsurance assumed, deferred policy acquisition costs, unrealized

gains and losses on investments in fixed maturity securities and related deferred income taxes are recognized under GAAP but not for

statutory reporting purposes. In addition, statutory accounting for goodwill of acquired businesses requires amortization of goodwill

over 10 years, whereas under GAAP, goodwill is not amortized and is subject to periodic tests for impairment.

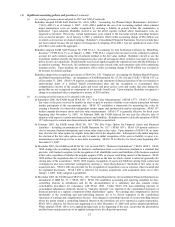

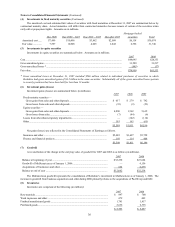

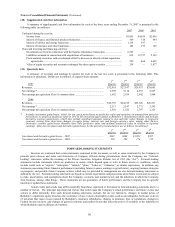

(15) Fair values of financial instruments

The estimated fair values of Berkshire’ s financial instruments as of December 31, 2007 and 2006 are as follows (in millions).

Carrying Value Fair Value

2007 2006 2007 2006

Insurance and other:

Investments in fixed maturity securities....................................................... $28,515 $25,300 $28,515 $25,300

Investments in equity securities ................................................................... 74,999 61,533 74,999 61,533

Notes payable and other borrowings............................................................ 2,680 3,698 2,709 3,815

Finance and financial products:

Investments in fixed maturity securities....................................................... 3,056 3,012 3,231 3,164

Derivative contract assets

(a) ....................................................................... 699 624 699 624

Loans and finance receivables ..................................................................... 12,359 11,498 12,612 11,862

Notes payable and other borrowings............................................................ 12,144 11,961 12,317 11,787

Derivative contract liabilities....................................................................... 6,887 3,883 6,887 3,883

Utilities and energy:

Derivative contract assets

(a) ....................................................................... 397 484 397 484

Notes payable and other borrowings............................................................ 19,002 16,946 19,834 17,789

Derivative contract liabilities

(b).................................................................. 765 889 765 889

(a) Included in Other assets

(b) Included in Accounts payable, accruals and other liabilities

In determining fair value of financial instruments, Berkshire used quoted market prices when available. For instruments where

quoted market prices were not available, independent pricing services or appraisals by Berkshire’ s management were used. The

pricing services and appraisals reflect the estimated present values of future expected cash flows utilizing current risk adjusted market

rates of similar instruments. The carrying values of cash and cash equivalents, accounts receivable and accounts payable, accruals

and other liabilities are deemed to be reasonable estimates of their fair values.

Considerable judgment is required in interpreting market data used to develop the estimates of fair value. Accordingly, the

estimates presented herein are not necessarily indicative of the amounts that could be realized in a current market exchange. The use

of different market assumptions and/or estimation methodologies may have a material effect on the estimated fair value.

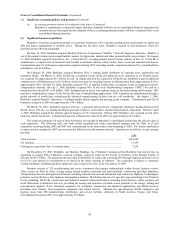

(16) Common stock

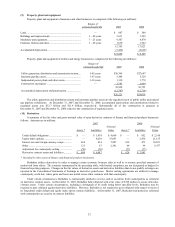

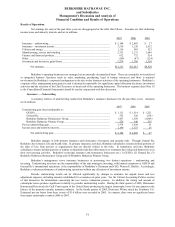

Changes in issued and outstanding Berkshire common stock during the three years ended December 31, 2007 are shown in the

table below.

Class A Common, $5 Par Value Class B Common, $0.1667 Par Value

(1,650,000 shares authorized) (55,000,000 shares authorized)

Shares Issued and Shares Issued and

Outstanding Outstanding

Balance December 31, 2004.............................................. 1,268,783 8,099,175

Conversions of Class A common stock

to Class B common stock and other............................... (7,863) 294,908

Balance December 31, 2005.............................................. 1,260,920 8,394,083

Conversions of Class A common stock

to Class B common stock and other............................... (143,352) 4,358,348

Balance December 31, 2006.............................................. 1,117,568 12,752,431

Issuance of shares on exercise of SQUARZ warrants ....... 2,325 41,706

Conversions of Class A common stock

to Class B common stock and other............................... (38,869) 1,205,943

Balance December 31, 2007.............................................. 1,081,024 14,000,080