Berkshire Hathaway 2007 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

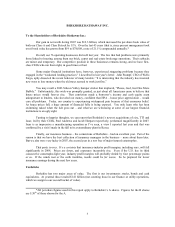

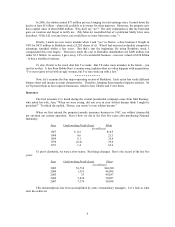

In 2006, the station earned $73 million pre-tax, bringing its total earnings since I turned down the

deal to at least $1 billion – almost all available to its owner for other purposes. Moreover, the property now

has a capital value of about $800 million. Why did I say “no”? The only explanation is that my brain had

gone on vacation and forgot to notify me. (My behavior resembled that of a politician Molly Ivins once

described: “If his I.Q. was any lower, you would have to water him twice a day.”)

Finally, I made an even worse mistake when I said “yes” to Dexter, a shoe business I bought in

1993 for $433 million in Berkshire stock (25,203 shares of A). What I had assessed as durable competitive

advantage vanished within a few years. But that’ s just the beginning: By using Berkshire stock, I

compounded this error hugely. That move made the cost to Berkshire shareholders not $400 million, but

rather $3.5 billion. In essence, I gave away 1.6% of a wonderful business – one now valued at $220 billion

– to buy a worthless business.

To date, Dexter is the worst deal that I’ ve made. But I’ ll make more mistakes in the future – you

can bet on that. A line from Bobby Bare’ s country song explains what too often happens with acquisitions:

“I’ ve never gone to bed with an ugly woman, but I’ ve sure woke up with a few.”

* * * * * * * * * * * *

Now, let’ s examine the four major operating sectors of Berkshire. Each sector has vastly different

balance sheet and income account characteristics. Therefore, lumping them together impedes analysis. So

we’ ll present them as four separate businesses, which is how Charlie and I view them.

Insurance

The best anecdote I’ ve heard during the current presidential campaign came from Mitt Romney,

who asked his wife, Ann, “When we were young, did you ever in your wildest dreams think I might be

president?” To which she replied, “Honey, you weren’ t in my wildest dreams.”

When we first entered the property/casualty insurance business in 1967, my wildest dreams did

not envision our current operation. Here’ s how we did in the first five years after purchasing National

Indemnity:

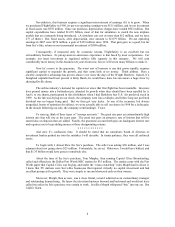

Year Underwriting Profit (Loss) Float

(in millions)

1967 $ 0.4 $18.5

1968 0.6 21.3

1969 0.1 25.4

1970 (0.4) 39.4

1971 1.4 65.6

To put it charitably, we were a slow starter. But things changed. Here’ s the record of the last five

years:

Year Underwriting Profit (Loss) Float

(in millions)

2003 $1,718 $44,220

2004 1,551 46,094

2005 53 49,287

2006 3,838 50,887

2007 3,374 58,698

This metamorphosis has been accomplished by some extraordinary managers. Let’ s look at what

each has achieved.

9