Berkshire Hathaway 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

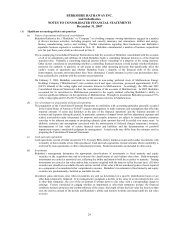

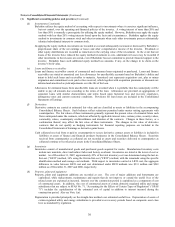

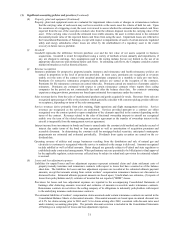

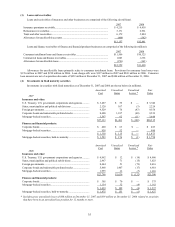

(9) Property, plant and equipment

Property, plant and equipment of insurance and other businesses is comprised of the following (in millions):

Ranges of

estimated useful life 2007 2006

Land......................................................................................... — $ 607 $ 548

Buildings and improvements .................................................. 3 – 40 years 3,611 3,203

Machinery and equipment....................................................... 3 – 25 years 9,507 8,470

Furniture, fixtures and other.................................................... 3 – 20 years 1,670 1,702

15,395 13,923

Accumulated depreciation ...................................................... (5,426) (4,620)

$ 9,969 $ 9,303

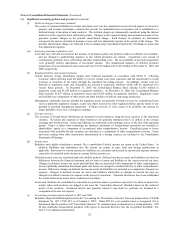

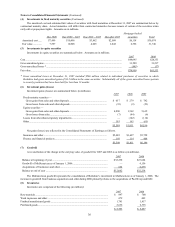

Property, plant and equipment of utilities and energy businesses is comprised of the following (in millions):

Ranges of

estimated useful life 2007 2006

Utility generation, distribution and transmission system.... 5-85 years $30,369 $27,687

Interstate pipeline assets..................................................... 3-67 years 5,484 5,329

Independent power plants and other assets......................... 3-30 years 1,330 1,770

Construction in progress .................................................... — 1,745 1,969

38,928 36,755

Accumulated depreciation and amortization ...................... (12,707) (12,716)

$26,221 $24,039

The utility generation and distribution system and interstate pipeline assets are the regulated assets of public utility and natural

gas pipeline subsidiaries. At December 31, 2007 and December 31, 2006, accumulated depreciation and amortization related to

regulated assets was $12.3 billion and $11.9 billion, respectively. Substantially all of the construction in progress at

December 31, 2007 and December 31, 2006 related to the construction of regulated assets.

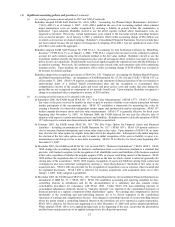

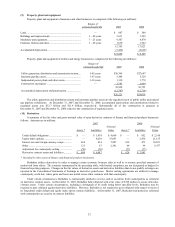

(10) Derivatives

A summary of the fair value and gross notional value of open derivative contracts of finance and financial products businesses

follows. Amounts are in millions.

2007 2006

Notional Notional

Assets * Liabilities Value Assets * Liabilities Value

Credit default obligations................................... $ — $ 1,838 $ 4,660 $ — $ 952 $ 2,510

Equity index options .......................................... — 4,610 35,043 — 2,436 21,155

Interest rate and foreign currency swaps ............ 626 434 7,887 632 473 10,851

Other .................................................................. 123 55 2,301 69 99 5,477

Adjustment for counterparty netting .................. (50) (50) (77) (77)

Derivative contract assets and liabilities ............ $ 699 $ 6,887 $ 624 $ 3,883

* Included in other assets of finance and financial products businesses.

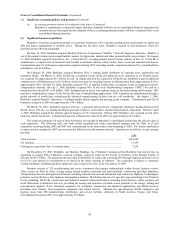

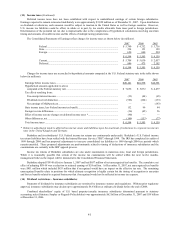

Berkshire utilizes derivatives in order to manage certain economic business risks as well as to assume specified amounts of

market risk from others. The contracts summarized in the preceding table, with limited exceptions, are not designated as hedges for

financial reporting purposes. Changes in the fair values of derivative assets and derivative liabilities that do not qualify as hedges are

reported in the Consolidated Statements of Earnings as derivative gains/losses. Master netting agreements are utilized to manage

counterparty credit risk, where gains and losses are netted across other contracts with that counterparty.

Under certain circumstances, Berkshire is contractually entitled to receive cash or securities from counterparties as collateral

on derivative contract assets. At December 31, 2007, Berkshire held collateral with a fair value of $328 million to secure derivative

contract assets. Under certain circumstances, including a downgrade of its credit rating below specified levels, Berkshire may be

required to post collateral against derivative liabilities. However, Berkshire is not required to post collateral with respect to most of

its long-dated credit default and equity index option contract liabilities. At December 31, 2007, Berkshire had posted no collateral

with counterparties as security on contract liabilities.