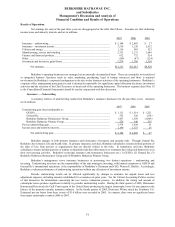

Berkshire Hathaway 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

Insurance — Underwriting (Continued)

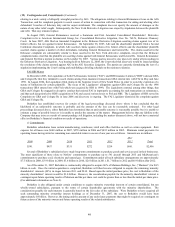

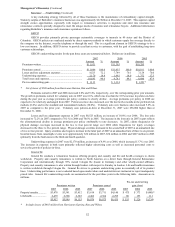

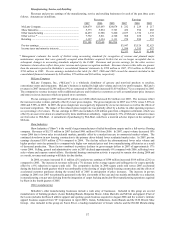

Property/casualty

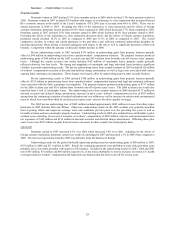

Premiums written in 2007 declined 2.9% from amounts written in 2006 which declined 7.0% from amounts written in

2005. Premiums written in 2007 included $114 million with respect to a reinsurance to close transaction that increased General

Re’ s economic interest in the runoff of the Lloyd’ s Syndicate 435’ s 2001 year of account from 60% to 100%. There was no

similar transaction in 2006 or 2005. Excluding the effect of the reinsurance to close transaction and the effects of foreign

currency translation, premiums written declined 10.9% when compared to 2006 which decreased 5.7% when compared to 2005.

Premiums earned in 2007 declined 2.6% from amounts earned in 2006 which declined 10.4% from amounts earned in 2005.

Excluding the effects of the reinsurance to close transaction discussed above and the effects of foreign currency translation,

premiums earned declined 10.1% in 2007 as compared to 2006 and 11.3% in 2006 as compared to 2005. The overall

comparative declines in written and earned premiums in the past three years reflected continued underwriting discipline by

rejecting transactions where pricing is deemed inadequate with respect to the risk as well as significant decreases in finite risk

business. Competition within the industry could lead to further declines in 2008.

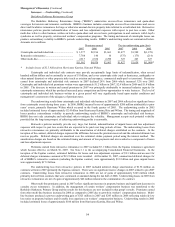

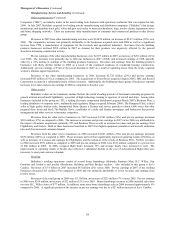

Pre-tax underwriting results in 2007 included $519 million in underwriting gains from property business partially

offset by $44 million in underwriting losses from casualty/workers’ compensation business. The property business produced

underwriting gains of $90 million for the 2007 accident year and $429 million from favorable run-off of prior years’ property

losses. Although the current accident year results included $192 million of catastrophe losses, property results generally

reflected relatively low loss levels. The timing and magnitude of catastrophe and large individual losses produces significant

volatility in periodic underwriting results. The pre-tax underwriting losses from casualty business in 2007 included $120 million

of workers’ compensation accretion of discount and deferred charge amortization, as well as legal costs associated with various

ongoing finite reinsurance investigations. These charges were largely offset by underwriting gains in other casualty business.

Pre-tax underwriting results in 2006 included $708 million in underwriting gains from property business partially

offset by $335 million in underwriting losses from casualty/workers’ compensation business and legal and estimated settlement

costs associated with the finite reinsurance investigations. The property business produced underwriting gains of $317 million

for the 2006 accident year and $391 million from favorable run-off of prior years’ losses. The 2006 accident year results also

benefited from a lack of catastrophe losses. The underwriting losses from casualty business in 2006 included $137 million in

discount accretion and deferred charge amortization, increases in prior years’ workers’ compensation reserves of $103 million

arising from the continuing escalation of medical utilization and cost inflation as well as increases in asbestos and environmental

reserves which were somewhat offset by net decreases in prior years’ reserves for other casualty coverages.

The 2005 pre-tax underwriting loss of $445 million included approximately $685 million in losses from three major

hurricanes in 2005 (Katrina, Rita and Wilma). Otherwise, underwriting results for the 2005 accident year generally benefited

from re-pricing efforts and improved coverage terms and conditions put into place over the preceding few years as well as

favorable aviation and non-catastrophe property business. Underwriting results in 2005 also included losses attributable to prior

accident years consisting of net reserve increases on workers’ compensation of $228 million, asbestos and environmental mass

tort exposures of $102 million and $136 million in discount accretion and deferred charge amortization. Offsetting these prior

years’ losses were $527 million in gains from net reserve decreases in other casualty lines and property lines.

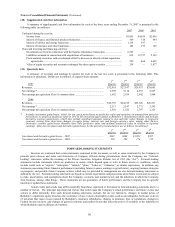

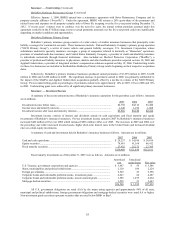

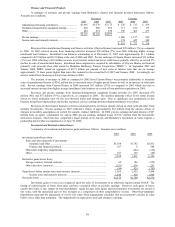

Life/health

Premiums earned in 2007 increased 4.1% over 2006 which increased 3.0% over 2005. Adjusting for the effects of

foreign currency translation, premiums earned were relatively unchanged in 2007 and increased 2.3% in 2006 when compared to

2005. The increase in premiums earned in 2006 was primarily from life business in Europe.

Underwriting results for the global life/health operations produced pre-tax underwriting gains of $80 million in 2007,

$153 million in 2006 and $111 million in 2005. Results for continuing operations were profitable in each of the past three years

primarily due to favorable mortality with respect to life business. Included in the underwriting results for 2007, 2006 and 2005

were $105 million, $31 million and $66 million, respectively, of net losses attributable to reserve increases on certain U.S. health

coverages related to workers’ compensation and long-term-care business that has been in run-off for several years.