Berkshire Hathaway 2007 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

At NetJets, the inventor of fractional-ownership of jets, we also remain the unchallenged leader.

We now operate 487 planes in the U.S. and 135 in Europe, a fleet more than twice the size of that

operated by our three major competitors combined. Because our share of the large-cabin market is

near 90%, our lead in value terms is far greater.

The NetJets brand – with its promise of safety, service and security – grows stronger every year.

Behind this is the passion of one man, Richard Santulli. If you were to pick someone to join you

in a foxhole, you couldn’ t do better than Rich. No matter what the obstacles, he just doesn’ t stop.

Europe is the best example of how Rich’ s tenacity leads to success. For the first ten years we

made little financial progress there, actually running up cumulative losses of $212 million. After

Rich brought Mark Booth on board to run Europe, however, we began to gain traction. Now we

have real momentum, and last year earnings tripled.

In November, our directors met at NetJets headquarters in Columbus and got a look at the

sophisticated operation there. It is responsible for 1,000 or so flights a day in all kinds of weather,

with customers expecting top-notch service. Our directors came away impressed by the facility

and its capabilities – but even more impressed by Rich and his associates.

Finance and Finance Products

Our major operation in this category is Clayton Homes, the largest U.S. manufacturer and

marketer of manufactured homes. Clayton’ s market share hit a record 31% last year. But industry volume

continues to shrink: Last year, manufactured home sales were 96,000, down from 131,000 in 2003, the

year we bought Clayton. (At the time, it should be remembered, some commentators criticized its directors

for selling at a cyclical bottom.)

Though Clayton earns money from both manufacturing and retailing its homes, most of its

earnings come from an $11 billion loan portfolio, covering 300,000 borrowers. That’ s why we include

Clayton’ s operation in this finance section. Despite the many problems that surfaced during 2007 in real

estate finance, the Clayton portfolio is performing well. Delinquencies, foreclosures and losses during the

year were at rates similar to those we experienced in our previous years of ownership.

Clayton’ s loan portfolio is financed by Berkshire. For this funding, we charge Clayton one

percentage point over Berkshire’ s borrowing cost – a fee that amounted to $85 million last year. Clayton’ s

2007 pre-tax earnings of $526 million are after its paying this fee. The flip side of this transaction is that

Berkshire recorded $85 million as income, which is included in “other” in the following table.

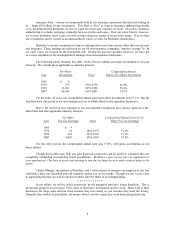

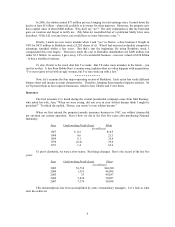

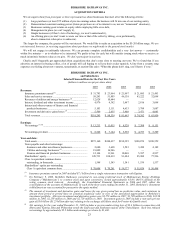

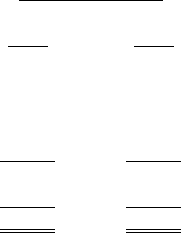

Pre-Tax Earnings

(in millions)

2007 2006

Trading – ordinary income............................. $ 272 $ 274

Life and annuity operation ............................ (60) 29

Leasing operations ........................................ 111 182

Manufactured-housing finance (Clayton)....... 526 513

Other............................................................... 157 159

Income before capital gains............................ 1,006 1,157

Trading – capital gains .................................. 105 938

$1,111 $2,095

The leasing operations tabulated are XTRA, which rents trailers, and CORT, which rents furniture.

Utilization of trailers was down considerably in 2007 and that led to a drop in earnings at XTRA. That

company also borrowed $400 million last year and distributed the proceeds to Berkshire. The resulting

higher interest it is now paying further reduced XTRA’ s earnings.

14