Berkshire Hathaway 2007 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

(13) Income taxes (Continued)

Deferred income taxes have not been established with respect to undistributed earnings of certain foreign subsidiaries.

Earnings expected to remain reinvested indefinitely were approximately $3,028 million as of December 31, 2007. Upon distribution

as dividends or otherwise, such amounts would be subject to taxation in the United States as well as foreign countries. However,

U.S. income tax liabilities could be offset, in whole or in part, by tax credits allowable from taxes paid to foreign jurisdictions.

Determination of the potential net tax due is impracticable due to the complexities of hypothetical calculations involving uncertain

timing and amounts of taxable income and the effects of multiple taxing jurisdictions.

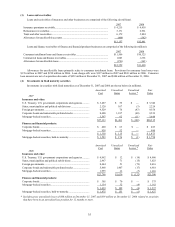

The Consolidated Statements of Earnings reflect charges for income taxes as shown below (in millions).

2007 2006 2005

Federal............................................................................................................. $ 5,740 $ 4,752 $ 3,736

State................................................................................................................. 234 153 129

Foreign ............................................................................................................ 620 600 294

$ 6,594 $ 5,505 $ 4,159

Current............................................................................................................. $ 5,708 $ 5,030 $ 2,057

Deferred........................................................................................................... 886 475 2,102

$ 6,594 $ 5,505 $ 4,159

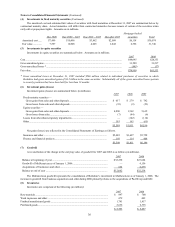

Charges for income taxes are reconciled to hypothetical amounts computed at the U.S. Federal statutory rate in the table shown

below (in millions).

2007 2006 2005

Earnings before income taxes................................................................................................ $20,161 $16,778 $12,791

Hypothetical amounts applicable to above

computed at the Federal statutory rate ............................................................................... $ 7,056 $ 5,872 $ 4,477

Tax effects resulting from:

Tax-exempt interest income............................................................................................... (33) (44) (65)

Dividends received deduction ............................................................................................ (306) (224) (133)

Net earnings of MidAmerican............................................................................................ — — (183)

State income taxes, less Federal income tax benefit.............................................................. 152 99 84

Foreign tax rate differences................................................................................................... (36) (45) 56

Effect of income tax rate changes on deferred income taxes *.............................................. (90) — —

Other differences, net ............................................................................................................ (149) (153) (77)

Total income taxes ................................................................................................................ $ 6,594 $ 5,505 $ 4,159

* Relates to adjustments made to deferred income tax assets and liabilities upon the enactment of reductions to corporate income tax

rates in the United Kingdom and Germany.

Berkshire and its subsidiaries’ U.S. Federal income tax returns are continuously under audit. Berkshire’ s U.S. Federal income

tax return liabilities have been settled with the Internal Revenue Service (“IRS”) through 1998. The IRS has completed its audits of

1999 through 2004 and has proposed adjustments to increase consolidated tax liabilities in 1999 through 2004 tax periods which

remain unsettled. These proposed adjustments are predominantly related to timing of deductions of insurance subsidiaries and the

examinations are currently in the IRS’ appeals process.

Income tax returns of Berkshire subsidiaries are also under examination in numerous state, local and foreign jurisdictions.

While it is reasonably possible that certain of the income tax examinations will be settled within the next twelve months,

management believes the impact will be immaterial to the Consolidated Financial Statements.

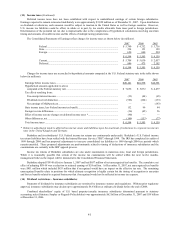

Berkshire adopted FIN 48 effective January 1, 2007 and had $857 million of net unrecognized tax benefits. The cumulative net

effect of adopting FIN 48 was a reduction to retained earnings of $24 million. At December 31, 2007, net unrecognized tax benefits

were $851 million which included $635 million that if recognized would have an impact on the effective tax rate. The remaining

unrecognized benefits relate to positions for which ultimate recognition is highly certain but the timing of recognition is uncertain

and for tax benefits related to acquired businesses that if recognized would not be reflected in income tax expense.

(14) Dividend restrictions – Insurance subsidiaries

Payments of dividends by insurance subsidiaries are restricted by insurance statutes and regulations. Without prior regulatory

approval, insurance subsidiaries may declare up to approximately $6.6 billion as ordinary dividends before the end of 2008.

Combined shareholders’ equity of U.S. based property/casualty insurance subsidiaries determined pursuant to statutory

accounting rules (Statutory Surplus as Regards Policyholders) was approximately $62 billion at December 31, 2007 and $59 billion

at December 31, 2006.