Berkshire Hathaway 2007 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. When the dollar falls, it both makes our products cheaper for foreigners to buy and their products

more expensive for U.S. citizens. That’ s why a falling currency is supposed to cure a trade deficit. Indeed,

the U.S. deficit has undoubtedly been tempered by the large drop in the dollar. But ponder this: In 2002

when the Euro averaged 94.6¢, our trade deficit with Germany (the fifth largest of our trading partners) was

$36 billion, whereas in 2007, with the Euro averaging $1.37, our deficit with Germany was up to $45

billion. Similarly, the Canadian dollar averaged 64¢ in 2002 and 93¢ in 2007. Yet our trade deficit with

Canada rose as well, from $50 billion in 2002 to $64 billion in 2007. So far, at least, a plunging dollar has

not done much to bring our trade activity into balance.

There’ s been much talk recently of sovereign wealth funds and how they are buying large pieces

of American businesses. This is our doing, not some nefarious plot by foreign governments. Our trade

equation guarantees massive foreign investment in the U.S. When we force-feed $2 billion daily to the rest

of the world, they must invest in something here. Why should we complain when they choose stocks over

bonds?

Our country’ s weakening currency is not the fault of OPEC, China, etc. Other developed

countries rely on imported oil and compete against Chinese imports just as we do. In developing a sensible

trade policy, the U.S. should not single out countries to punish or industries to protect. Nor should we take

actions likely to evoke retaliatory behavior that will reduce America’ s exports, true trade that benefits both

our country and the rest of the world.

Our legislators should recognize, however, that the current imbalances are unsustainable and

should therefore adopt policies that will materially reduce them sooner rather than later. Otherwise our $2

billion daily of force-fed dollars to the rest of the world may produce global indigestion of an unpleasant

sort. (For other comments about the unsustainability of our trade deficits, see Alan Greenspan’ s comments

on November 19, 2004, the Federal Open Market Committee’ s minutes of June 29, 2004, and Ben

Bernanke’ s statement on September 11, 2007.)

* * * * * * * * * * * *

At Berkshire we held only one direct currency position during 2007. That was in – hold your

breath – the Brazilian real. Not long ago, swapping dollars for reals would have been unthinkable. After

all, during the past century five versions of Brazilian currency have, in effect, turned into confetti. As has

been true in many countries whose currencies have periodically withered and died, wealthy Brazilians

sometimes stashed large sums in the U.S. to preserve their wealth.

But any Brazilian who followed this apparently prudent course would have lost half his net worth

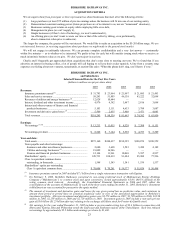

over the past five years. Here’ s the year-by-year record (indexed) of the real versus the dollar from the end

of 2002 to yearend 2007: 100; 122; 133; 152; 166; 199. Every year the real went up and the dollar fell.

Moreover, during much of this period the Brazilian government was actually holding down the value of the

real and supporting our currency by buying dollars in the market.

Our direct currency positions have yielded $2.3 billion of pre-tax profits over the past five years,

and in addition we have profited by holding bonds of U.S. companies that are denominated in other

currencies. For example, in 2001 and 2002 we purchased €310 million Amazon.com, Inc. 6 7/8 of 2010 at

57% of par. At the time, Amazon bonds were priced as “junk” credits, though they were anything but.

(Yes, Virginia, you can occasionally find markets that are ridiculously inefficient – or at least you can find

them anywhere except at the finance departments of some leading business schools.)

The Euro denomination of the Amazon bonds was a further, and important, attraction for us. The

Euro was at 95¢ when we bought in 2002. Therefore, our cost in dollars came to only $169 million. Now

the bonds sell at 102% of par and the Euro is worth $1.47. In 2005 and 2006 some of our bonds were

called and we received $253 million for them. Our remaining bonds were valued at $162 million at

yearend. Of our $246 million of realized and unrealized gain, about $118 million is attributable to the fall

in the dollar. Currencies do matter.

17