Berkshire Hathaway 2007 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

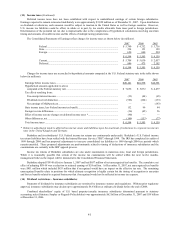

(1) Significant accounting policies and practices (Continued)

(r) Accounting pronouncements adopted in 2007 and 2006 (Continued)

Berkshire adopted FASB Staff Position No. AUG AIR-1 “Accounting for Planned Major Maintenance Activities”

(“AUG AIR-1”) as of January 1, 2007. AUG AIR-1 prohibits the use of an accounting method where planned

major maintenance costs are ratably recognized by accruing a liability in periods before the maintenance is

performed. Upon adoption, Berkshire elected to use the direct expense method where maintenance costs are

expensed as incurred. Previously, certain maintenance costs related to the fractional aircraft ownership business

were accrued in advance. As of January 1, 2007, a cumulative effect of this accounting change of $52 million was

recorded as an increase in retained earnings. Berkshire’ s Consolidated Financial Statements for prior periods have

not been restated because the net impact of retrospectively adopting AUG AIR-1 was not significant in each of the

prior three years and in the aggregate.

Berkshire adopted FASB Staff Position No. FTB 85-4-1, “Accounting for Life Settlement Contracts by Third-Party

Investors” (“FTB 85-4-1”) as of January 1, 2006. FTB 85-4-1 requires that investors in life settlement contracts

account for such contracts using the investment method or the fair value method. Berkshire elected to use the

investment method whereby the initial transaction price plus all subsequent direct external costs paid to keep the

policy in force are capitalized. Death benefits received are applied against the capitalized costs and the difference is

recorded in earnings. Previously, life settlement contracts were valued at the cash surrender value of the underlying

insurance policy. Upon adoption, the cumulative effect of this accounting change of $180 million was recorded as

an increase in retained earnings.

Berkshire adopted the recognition provisions of SFAS No. 158, “Employers’ Accounting for Defined Benefit Pension

and Other Postretirement Plans – an amendment of FASB Statements No. 87, 88, 106 and 132(R)” (“SFAS 158”) as

of December 31, 2006. SFAS 158 requires recognition in the statement of financial position of the over-funded or

under-funded status of a defined benefit postretirement plan and the recognition in accumulated other

comprehensive income of the actuarial gains and losses and prior service costs and credits that arise during the

period that are not recognized as components of net periodic benefit cost. Upon adoption, Berkshire recognized a

charge to accumulated other comprehensive income of $303 million.

(s) Accounting pronouncements to be adopted in the future

In September 2006, the FASB issued SFAS No. 157, “Fair Value Measurements” (“SFAS 157”). SFAS 157 defines

fair value as the price received to transfer an asset or paid to transfer a liability in an orderly transaction between

market participants at the measurement date. SFAS 157 establishes a framework for measuring fair value by

creating a hierarchy for observable independent market inputs and unobservable market assumptions. SFAS 157

further expands disclosures about such fair value measurements. SFAS 157 is generally effective for fiscal years

beginning after November 15, 2007. In February 2008, the FASB delayed for one year the effective date of

adoption with respect to certain non-financial assets and liabilities. Berkshire intends to defer the adoption of SFAS

157 with respect to certain non-financial assets and liabilities as permitted.

In February 2007, the FASB issued SFAS No. 159, “The Fair Value Option for Financial Assets and Financial

Liabilities - Including an amendment of FASB Statement No. 115” (“SFAS 159”). SFAS 159 permits entities to

elect to measure financial instruments and certain other items at fair value. Upon adoption of SFAS 159, an entity

may elect the fair value option for eligible items that exist at the adoption date. Subsequent to the initial adoption,

the election of the fair value option can only be made at initial recognition of the asset or liability or upon a re-

measurement event that gives rise to new-basis accounting. SFAS 159 is effective for fiscal years beginning after

November 15, 2007.

In December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business Combinations” (“SFAS 141R”). SFAS

141R changes the accounting model for business combinations from a cost allocation standard to a standard that

provides, with limited exception, for the recognition of all identifiable assets and liabilities of the business acquired

at fair value, regardless of whether the acquirer acquires 100% or a lesser controlling interest of the business. SFAS

141R defines the acquisition date of a business acquisition as the date on which control is achieved (generally the

closing date of the acquisition). SFAS 141R requires recognition of assets and liabilities arising from contractual

contingencies and non-contractual contingencies meeting a “more-likely-than-not” threshold at fair value at the

acquisition date. SFAS 141R also provides for the recognition of acquisition costs as expenses when incurred and

for expanded disclosures. SFAS 141R is effective for business acquisitions with acquisition dates on or after

January 1, 2009. Early adoption is prohibited.

In December 2007, the FASB issued SFAS No. 160, “Noncontrolling Interests in Consolidated Financial Statements an

amendment of ARB No. 51” (“SFAS 160”). SFAS 160 establishes accounting and reporting standards for non-

controlling interests in subsidiaries and for the deconsolidation of a subsidiary and also amends certain

consolidation procedures for consistency with SFAS 141R. Under SFAS 160, non-controlling interests in

consolidated subsidiaries (formerly known as “minority interests”) are reported in the consolidated statement of

financial position as a separate component within shareholders’ equity. Net earnings and comprehensive income

attributable to the controlling and non-controlling interests are to be shown separately in the consolidated

statements of earnings and comprehensive income. Any changes in ownership interests of a non-controlling interest

where the parent retains a controlling financial interest in the subsidiary are to be reported as equity transactions.

SFAS 160 is effective for fiscal years beginning on or after December 15, 2008 with earlier adoption prohibited.

When adopted, SFAS 160 is to be applied prospectively at the beginning of the year, except that the presentation

and disclosure requirements are to be applied retrospectively for all periods presented.