Berkshire Hathaway 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

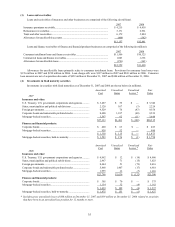

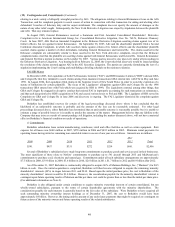

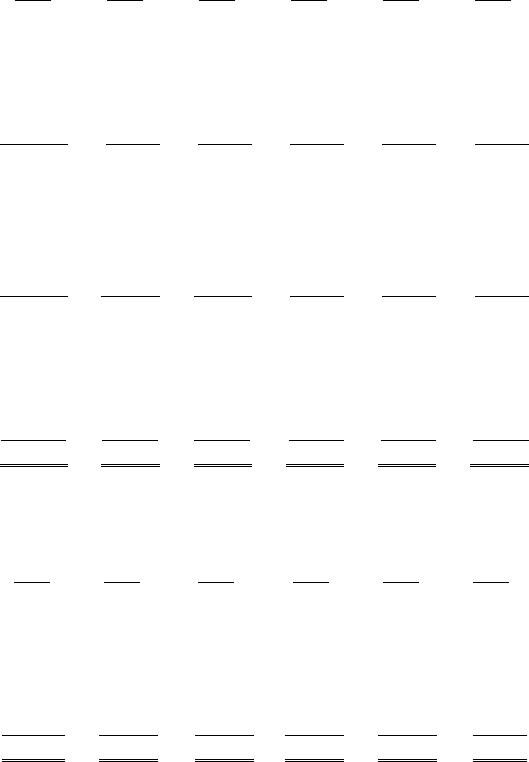

(18) Business segment data (Continued)

Other businesses not specifically identified with reportable business segments consist of a large, diverse group of

manufacturing, service and retailing businesses.

Manufacturing Acme Building Brands, Benjamin Moore, H.H. Brown Shoe

Group, CTB, Fechheimer Brothers, Forest River, Fruit of the

Loom, Garan, IMC, Johns Manville, Justin Brands, Larson-Juhl,

MiTek, Richline, Russell and Scott Fetzer

Service Buffalo News, Business Wire, FlightSafety, International Dairy

Queen, Pampered Chef, NetJets and TTI

Retailing Ben Bridge Jeweler, Borsheims, Helzberg Diamond Shops,

Jordan’ s Furniture, Nebraska Furniture Mart, See’ s, Star Furniture

and R.C. Willey

A disaggregation of Berkshire’ s consolidated data for each of the three most recent years is presented in the tables which

follow on this and the following page. Amounts are in millions.

Earnings (loss) before taxes

Operating Businesses: Revenues and minority interests

Insurance group: 2007 2006 2005 2007 2006 2005

Premiums earned:

GEICO ..................................................................... $ 11,806 $11,055 $10,101 $ 1,113 $ 1,314 $ 1,221

General Re ............................................................... 6,076 6,075 6,435 555 526 (334)

Berkshire Hathaway Reinsurance Group ................. 11,902 4,976 3,963 1,427 1,658 (1,069)

Berkshire Hathaway Primary Group........................ 1,999 1,858 1,498 279 340 235

Investment income ...................................................... 4,791 4,347 3,501 4,758 4,316 3,480

Total insurance group..................................................... 36,574 28,311 25,498 8,132 8,154 3,533

Finance and financial products....................................... 5,119 5,124 4,559 1,006 1,157 822

McLane Company.......................................................... 28,079 25,693 24,074 232 229 217

MidAmerican ................................................................. 12,628 10,644 — 1,774 1,476 —

Shaw Industries .............................................................. 5,373 5,834 5,723 436 594 485

Other businesses............................................................. 25,648 21,133 17,099 3,279 2,703 1,921

113,421 96,739 76,953 14,859 14,313 6,978

Reconciliation of segments to consolidated amount:

Investment and derivative gains/losses ....................... 5,509 2,635 5,494 5,509 2,635 5,494

Equity in earnings of MidAmerican............................ — — — — — 523

Interest expense, not allocated to segments................. — — — (52) (76) (72)

Eliminations and other ................................................ (685) (835) (784) (155) (94) (132)

$118,245 $98,539 $81,663 $20,161 $16,778 $12,791

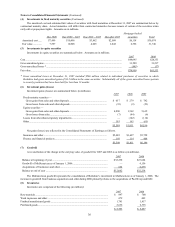

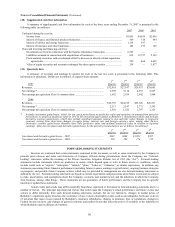

Depreciation

Capital expenditures * of tangible assets

Operating Businesses: 2007 2006 2005 2007 2006 2005

Insurance group.............................................................. $ 52 $ 65 $ 60 $ 69 $ 64 $ 62

Finance and financial products....................................... 322 334 354 226 230 221

McLane Company.......................................................... 175 193 125 100 94 96

MidAmerican ................................................................. 3,513 2,423 — 1,157 949 —

Shaw Industries.............................................................. 144 189 209 144 134 113

Other businesses............................................................. 1,167 1,367 1,447 711 595 490

$ 5,373 $ 4,571 $ 2,195 $ 2,407 $ 2,066 $ 982

* Excludes capital expenditures which were part of business acquisitions.