Berkshire Hathaway 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30

Notes to Consolidated Financial Statements (Continued)

(1) Significant accounting policies and practices (Continued)

(d) Investments (Continued)

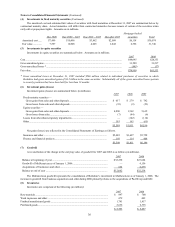

Berkshire utilizes the equity method of accounting with respect to investments where it exercises significant influence,

but not control, over the operating and financial policies of the investee. A voting interest of more than 20% and

less than 50% is normally a prerequisite for utilizing the equity method. However, Berkshire may apply the equity

method with less than 20% voting interests based upon the facts and circumstances. Berkshire applies the equity

method to investments in common stock and other investments when such other investments possess substantially

identical subordinated interests to common stock.

In applying the equity method, investments are recorded at cost and subsequently increased or decreased by Berkshire’ s

proportionate share of the net earnings or losses and other comprehensive income of the investee. Dividends or

other equity distributions are recorded as reductions in the carrying value of the investment. In the event that net

losses of the investee have reduced the equity method investment to zero, additional net losses may be recorded if

other investments in the investee are at-risk, even if Berkshire has not committed to provide financial support to the

investee. Berkshire bases such additional equity method loss amounts, if any, on the change in its claim on the

investee’ s book value.

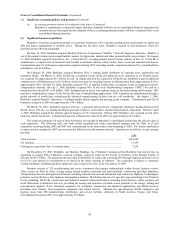

(e) Loans and finance receivables

Loans and finance receivables consist of commercial and consumer loans originated or purchased. Loans and finance

receivables are stated at amortized cost less allowances for uncollectible accounts based on Berkshire’ s ability and

intent to hold such loans and receivables to maturity. Amortized cost represents acquisition cost, plus or minus

origination and commitment costs paid or fees received, which together with acquisition premiums or discounts are

deferred and amortized as yield adjustments over the life of the loan.

Allowances for estimated losses from uncollectible loans are recorded when it is probable that the counterparty will be

unable to pay all amounts due according to the terms of the loan. Allowances are provided on aggregations of

consumer loans with similar characteristics and terms based upon historical loss and recovery experience,

delinquency rates and current economic conditions. Provisions for loan losses are included in the Consolidated

Statements of Earnings.

(f) Derivatives

Derivative contracts are carried at estimated fair value and are classified as assets or liabilities in the accompanying

Consolidated Balance Sheets. Such balances reflect reductions permitted under master netting agreements with

counterparties. The fair values of these instruments generally represent the present value of estimated future cash

flows anticipated under the contracts, which are affected by applicable interest rates, currency rates, security values,

commodity values, counterparty creditworthiness and duration of the contracts. Changes in these factors, or a

combination thereof, may affect the fair value of these instruments. The changes in fair value of derivative

contracts that do not qualify as hedging instruments for financial reporting purposes are included in the

Consolidated Statements of Earnings as derivative gains/losses.

Cash collateral received from or paid to counterparties to secure derivative contract assets or liabilities is included in

liabilities or assets of finance and financial products businesses in the Consolidated Balance Sheets. Securities

received from counterparties as collateral are not recorded as assets and securities delivered to counterparties as

collateral continue to be reflected as assets in the Consolidated Balance Sheets.

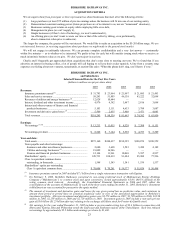

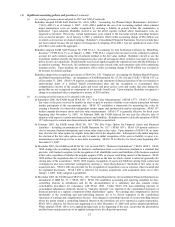

(g) Inventories

Inventories consist of manufactured goods and purchased goods acquired for resale. Manufactured inventory costs

include raw materials, direct and indirect labor and factory overhead. Inventories are stated at the lower of cost or

market. As of December 31, 2007, approximately 45% of the total inventory cost was determined using the last-in-

first-out (“LIFO”) method, 34% using the first-in-first-out (“FIFO”) method, with the remainder using the specific

identification method and average cost methods. With respect to inventories carried at LIFO cost, the aggregate

difference in value between LIFO cost and cost determined under FIFO methods was $331 million and $263

million as of December 31, 2007 and 2006, respectively.

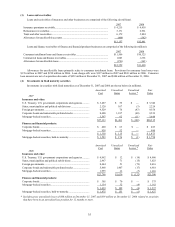

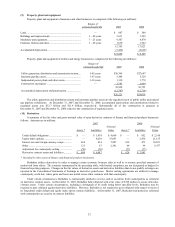

(h) Property, plant and equipment

Property, plant and equipment additions are recorded at cost. The cost of major additions and betterments are

capitalized, while replacements, maintenance and repairs that do not improve or extend the useful lives of the

related assets are expensed as incurred. Interest over the construction period is capitalized as a component of cost

of constructed assets. In addition, the cost of constructed assets of certain domestic regulated utility and energy

subsidiaries that are subject to SFAS No. 71, “Accounting for the Effects of Certain Types of Regulation” (“SFAS

71”) includes the capitalization of the estimated cost of capital in addition to interest incurred during the

construction period. Also see Note 1(n).

Depreciation is provided principally on the straight-line method over estimated useful lives. Depreciation of assets of

certain regulated utility and energy subsidiaries is provided over recovery periods based on composite asset class

lives as mandated by regulation.