Berkshire Hathaway 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

Notes to Consolidated Financial Statements (Continued)

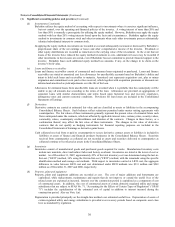

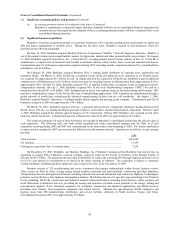

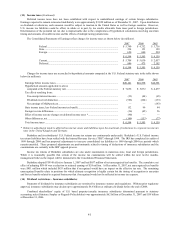

(12) Notes payable and other borrowings (Continued)

2007 2006

Finance and financial products:

Issued by Berkshire Hathaway Finance Corporation (“BHFC”) and guaranteed by Berkshire:

Notes due 2007 ............................................................................................................................ $ — $ 700

Notes due 2008 ............................................................................................................................ 3,100 3,098

Notes due 2010 ............................................................................................................................ 1,996 1,994

Notes due 2012-2015 ................................................................................................................... 3,790 3,039

Issued by other subsidiaries and guaranteed by Berkshire due 2008-2027 ........................................ 804 398

Issued by other subsidiaries and not guaranteed by Berkshire due 2008-2030 .................................. 2,454 2,732

$12,144 $11,961

BHFC, a wholly-owned subsidiary of Berkshire, issued senior notes at various times in recent years. In the third quarter of

2007, BHFC issued $750 million par amount of senior notes due in 2012. BHFC issued $2 billion par amount of senior notes in

January 2008, including $1.5 billion par amount of notes due in 2011 and $500 million par amount of notes due in 2013 and repaid

maturing notes of $1.25 billion par amount. Borrowings by BHFC are used to provide financing for installment loans issued or

acquired by subsidiaries of Clayton Homes. At December 31, 2007, debt issued by other finance subsidiaries and not guaranteed by

Berkshire includes approximately $1.4 billion whereby all principal and interest collected under certain manufactured housing loan

portfolios, together with any repurchased principal on such loans will be used to pay the principal and interest on these borrowings.

During 2007, XTRA Finance Corporation, a wholly owned subsidiary, issued $400 million par amount of senior notes due 2017,

which is included in other subsidiary borrowings guaranteed by Berkshire.

Berkshire subsidiaries in the aggregate have approximately $4.8 billion of available unused lines of credit and commercial

paper capacity to support their short-term borrowing programs and provide additional liquidity. Generally, Berkshire’ s guarantee of

a subsidiary’ s debt obligation is an absolute, unconditional and irrevocable guarantee for the full and prompt payment when due of all

present and future payment obligations of the issuer.

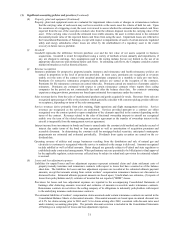

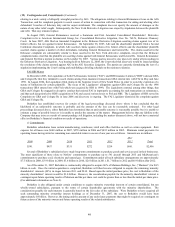

Principal payments expected during the next five years are as follows (in millions).

2008 2009 2010 2011 2012

Insurance and other........................................................................ $1,268 $ 298 $ 55 $ 12 $ 21

Utilities and energy........................................................................ 2,096 422 140 1,138 1,461

Finance and financial products ...................................................... 3,938 198 2,165 139 1,632

$7,302 $ 918 $2,360 $1,289 $3,114

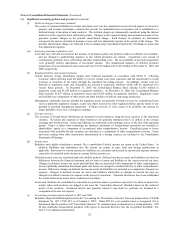

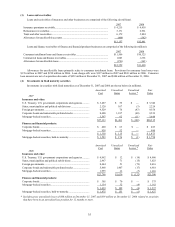

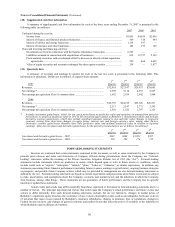

(13) Income taxes

The liability for income taxes as of December 31, 2007 and 2006 as reflected in the accompanying Consolidated Balance

Sheets is as follows (in millions).

2007 2006

Payable currently............................................................................................. $ (182) $ 189

Deferred........................................................................................................... 18,156 18,271

Other................................................................................................................ 851 710

$18,825 $19,170

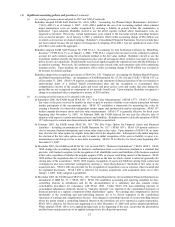

The tax effects of temporary differences that give rise to significant portions of deferred tax assets and deferred tax liabilities at

December 31, 2007 and 2006 are shown below (in millions).

2007 2006

Deferred tax liabilities:

Investments – unrealized appreciation and cost basis differences ................ $13,501 $14,520

Deferred charges reinsurance assumed......................................................... 1,395 687

Property, plant and equipment...................................................................... 4,890 4,775

Other ............................................................................................................ 2,743 2,591

22,529 22,573

Deferred tax assets:

Unpaid losses and loss adjustment expenses ................................................ (756) (681)

Unearned premiums ..................................................................................... (425) (443)

Accrued liabilities ........................................................................................ (1,259) (1,335)

Other ............................................................................................................ (1,933) (1,843)

(4,373) (4,302)

Net deferred tax liability.................................................................................. $18,156 $18,271