Berkshire Hathaway 2007 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

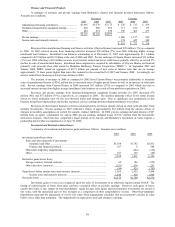

Property and casualty losses (Continued)

General Re (Continued)

Loss triangles are used to determine the expected case loss emergence patterns for most coverages and, in conjunction

with expected loss ratios by accident year, are further used to determine IBNR reserves. Additional calculations form the basis

for estimating the expected loss emergence pattern. The determination of the expected loss emergence pattern is not strictly a

mechanical process. In instances where the historical loss data is insufficient, estimation formulas are used along with reliance

on other loss triangles and judgment. Factors affecting loss development triangles include but are not limited to the following:

changes in client claims practices, changes in claim examiners’ use of ACRs or the frequency of client company claim reviews,

changes in policy terms and coverage (such as client loss retention levels and occurrence and aggregate policy limits), changes in

loss trends and changes in legal trends that result in unanticipated losses, as well as other sources of statistical variability. These

items influence the selection of the expected loss emergence patterns.

Expected loss ratios are selected by reserve cell, by accident year, based upon reviewing forecasted losses and

indicated ultimate loss ratios predicted from aggregated pricing statistics. Indicated ultimate loss ratios are calculated using the

selected loss emergence pattern, reported losses and earned premium. If the selected emergence pattern is not accurate, then the

indicated ultimate loss ratios will not be accurate and this can affect the selected loss ratios and hence the IBNR reserve. As with

selected loss emergence patterns, selecting expected loss ratios is not a strictly mechanical process and judgment is used in the

analysis of indicated ultimate loss ratios and department pricing loss ratios.

IBNR reserves are estimated by reserve cell, by accident year, using the expected loss emergence patterns and the

expected loss ratios. The expected loss emergence patterns and expected loss ratios are the critical IBNR reserving assumptions

and are updated annually. Once the annual IBNR reserves are determined, actuaries calculate expected case loss emergence for

the upcoming calendar year. This calculation does not involve new assumptions and uses the prior year-end expected loss

emergence patterns and expected loss ratios. The expected losses are then allocated into interim estimates that are compared to

actual reported losses in the subsequent year. This comparison provides a test of the adequacy of prior year-end IBNR reserves

and forms the basis for possibly changing IBNR reserve assumptions during the course of the year.

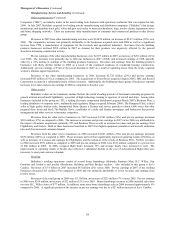

In 2007, for prior years’ workers’ compensation losses, reported claims were less than expected claims by about $74

million. However, further analysis of the workers’ compensation reserve cells by segment indicated the need for additional

IBNR. These developments precipitated about $218 million of a net increase in nominal IBNR reserve estimates for unreported

occurrences. After deducting $20 million for the change in net reserve discounts during the year, workers’ compensation losses

from prior years reduced pre-tax earnings in 2007 by $164 million. To illustrate the sensitivity of changes in expected loss

emergence patterns and expected loss ratios for General Re’ s significant excess of loss workers’ compensation reserve cells, an

increase of ten points in the tail of the expected emergence pattern and an increase of ten percent in the expected loss ratios

would produce a net increase in nominal IBNR reserves of approximately $587 million and $334 million on a discounted basis as

of December 31, 2007. The increase in discounted reserves would produce a corresponding decrease in pre-tax earnings.

Management believes it is reasonably possible for the tail of the expected loss emergence patterns and expected loss ratios to

increase at these rates.

Other casualty and general liability reported losses (excluding mass tort losses) were favorable in 2007 relative to

expectations. Casualty losses tend to be long-tail and it should not be assumed that favorable loss experience in a year means

that loss reserve amounts currently established will continue to develop favorably. For General Re’ s significant other casualty

and general liability reserve cells (including medical malpractice, umbrella, auto and general liability), an increase of five points

in the tails of the expected emergence patterns and an increase of five percent in expected loss ratios (one percent for large

international proportional reserve cells) would produce a net increase in nominal IBNR reserves and a corresponding reduction in

pre-tax earnings of approximately $720 million. Management believes it is reasonably possible for the tail of the expected loss

emergence patterns and expected loss ratios to increase at these rates in any of the individual aforementioned reserve cells.

However, given the diversification in worldwide business, more likely outcomes are believed to be less than $720 million.

Property losses were lower than expected in 2007 but the nature of property loss experience tends to be more volatile

because of the effect of catastrophes and large individual property losses. In response to favorable claim developments and

another year of information, estimated remaining World Trade Center losses and estimated losses from the hurricanes in 2005

were reduced by $93 million.

In certain reserve cells within excess directors and officers and errors and omissions (“D&O and E&O”) coverages,

IBNR reserves are based on estimated ultimate losses without consideration of expected emergence patterns. These cells often

involve a spike in loss activity arising from recent industry developments making it difficult to select an expected loss emergence

pattern. For example, the number of recent corporate scandals has caused an increase in reported losses. For General Re’ s large

D&O and E&O reserve cells an increase of ten points in the tail of the expected emergence pattern (for those cells where

emergence patterns are considered) and an increase of ten percent in the expected loss ratios would produce a net increase in

nominal IBNR reserves and a corresponding reduction in pre-tax earnings of approximately $210 million. Management believes

it is reasonably possible for the tail of the expected loss emergence patterns and expected loss ratios to increase at these rates.

Overall industry-wide loss experience data and informed judgment are used when internal loss data is of limited

reliability, such as in setting the estimates for mass tort, asbestos and hazardous waste (collectively, “mass tort”) claims. Unpaid

mass tort reserves at December 31, 2007 were approximately $1.8 billion gross and $1.2 billion net of reinsurance. Such