Berkshire Hathaway 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

51

BERKSHIRE HATHAWAY INC.

and Subsidiaries

Management’s Discussion and Analysis of

Financial Condition and Results of Operations

Results of Operations

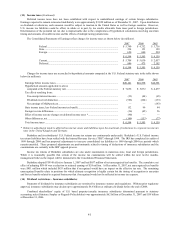

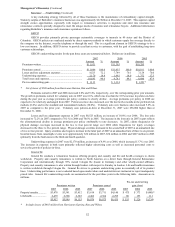

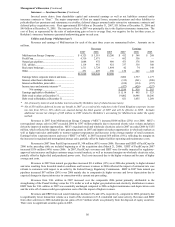

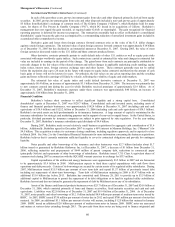

Net earnings for each of the past three years are disaggregated in the table that follows. Amounts are after deducting

income taxes and minority interests and are in millions.

2007 2006 2005

Insurance – underwriting............................................................................................... $ 2,184 $ 2,485 $ 27

Insurance – investment income..................................................................................... 3,510 3,120 2,412

Utilities and energy ....................................................................................................... 1,114 885 523

Manufacturing, service and retailing............................................................................. 2,353 2,131 1,646

Finance and financial products...................................................................................... 632 732 514

Other ............................................................................................................................. (159) (47) (124)

Investment and derivative gains/losses ......................................................................... 3,579 1,709 3,530

Net earnings...................................................................................................... $13,213 $11,015 $8,528

Berkshire’ s operating businesses are managed on an unusually decentralized basis. There are essentially no centralized

or integrated business functions (such as sales, marketing, purchasing, legal or human resources) and there is minimal

involvement by Berkshire’ s corporate headquarters in the day-to-day business activities of the operating businesses. Berkshire’ s

corporate office management participates in and is ultimately responsible for significant capital allocation decisions, investment

activities and the selection of the Chief Executive to head each of the operating businesses. The business segment data (Note 18

to the Consolidated Financial Statements) should be read in conjunction with this discussion.

Insurance — Underwriting

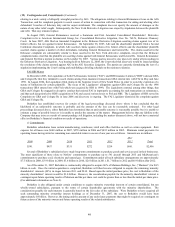

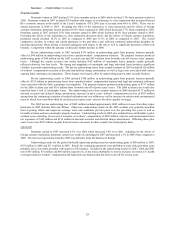

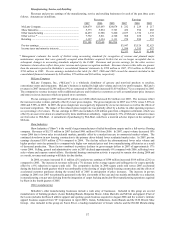

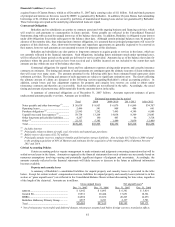

A summary follows of underwriting results from Berkshire’ s insurance businesses for the past three years. Amounts

are in millions.

2007 2006 2005

Underwriting gain (loss) attributable to:

GEICO.................................................................................................................... $ 1,113 $ 1,314 $ 1,221

General Re .............................................................................................................. 555 526 (334)

Berkshire Hathaway Reinsurance Group................................................................ 1,427 1,658 (1,069)

Berkshire Hathaway Primary Group....................................................................... 279 340 235

Pre-tax underwriting gain.............................................................................................. 3,374 3,838 53

Income taxes and minority interests.............................................................................. 1,190 1,353 26

Net underwriting gain....................................................................................... $ 2,184 $ 2,485 $ 27

Berkshire engages in both primary insurance and reinsurance of property and casualty risks. Through General Re,

Berkshire also reinsures life and health risks. In primary insurance activities, Berkshire subsidiaries assume defined portions of

the risks of loss from persons or organizations that are directly subject to the risks. In reinsurance activities, Berkshire

subsidiaries assume defined portions of similar or dissimilar risks that other insurers or reinsurers have subjected themselves to in

their own insuring activities. Berkshire’ s principal insurance and reinsurance businesses are: (1) GEICO, (2) General Re, (3)

Berkshire Hathaway Reinsurance Group and (4) Berkshire Hathaway Primary Group.

Berkshire’ s management views insurance businesses as possessing two distinct operations – underwriting and

investing. Underwriting decisions are the responsibility of the unit managers; investing, with limited exceptions at GEICO and

General Re’ s international operations, is the responsibility of Berkshire’ s Chairman and CEO, Warren E. Buffett. Accordingly,

Berkshire evaluates performance of underwriting operations without any allocation of investment income.

Periodic underwriting results can be affected significantly by changes in estimates for unpaid losses and loss

adjustment expenses, including amounts established for occurrences in prior years. See the Critical Accounting Policies section

of this discussion for information concerning the loss reserve estimation process. In addition, the timing and amount of

catastrophe losses produce significant volatility in periodic underwriting results. During the third quarter of 2005, Hurricanes

Katrina and Rita struck the Gulf Coast region of the United States producing the largest catastrophe losses for any quarter in the

history of the property/casualty insurance industry. In the fourth quarter of 2005, Hurricane Wilma struck the Southeast U.S.

Estimated pre-tax losses from these events of $3.4 billion were recorded in 2005. In contrast, there were no significant losses

from major catastrophe events in 2006 or 2007.