Berkshire Hathaway 2007 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

Management’s Discussion (Continued)

Property and casualty losses (Continued)

General Re and BHRG (Continued)

Under contracts where periodic premium and claims reports are required from ceding companies, such reports are

generally required at quarterly intervals which in the U.S. range from 30 to 90 days after the end of the accounting period. In

continental Europe, reinsurance reporting practices vary since fewer clients report premiums, losses and case reserves on a

quarterly basis. In certain countries, clients report on an annual basis and generally not until 90 to 180 days after the end of the

annual period. Estimates of premiums and losses are accrued based on expected results supplemented when necessary for

estimates of significant known events occurring in the interim. To monitor the timing and receipt of information due, client

reporting requirements are tracked. When clients miss reporting deadlines, the clients are contacted.

Premium and loss data is provided through at least one intermediary (the primary insurer), so there is a greater risk that

the loss data provided is incomplete, inaccurate or outside the coverage terms. Information provided by ceding companies is

reviewed for completeness and compliance with the contract terms. Reinsurance contracts generally allow for Berkshire’ s

reinsurance subsidiaries to have access to the cedant’ s books and records with respect to the subject business and provide them

the ability to conduct audits to determine the accuracy and completeness of information. Such audits are conducted when

management deems it appropriate.

In the regular course of business, disputes with clients may arise concerning whether certain claims are covered under

the reinsurance policies. Most disputes are resolved by the claims departments by discussing coverage aspects with the

appropriate client personnel or by independent outside counsel review and determination. If disputes cannot be resolved,

contracts generally specify whether arbitration, litigation, or alternative dispute resolution will be invoked. There are no

coverage disputes at this time for which an adverse resolution would likely have a material impact on Berkshire’ s results of

operations or financial condition.

In summary, the scope, number and potential variability of assumptions required in estimating ultimate losses from

reinsurance contracts of General Re and BHRG are more uncertain than primary property and casualty insurers due to the factors

previously discussed. Additional information concerning General Re and BHRG follows.

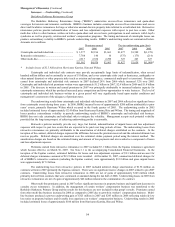

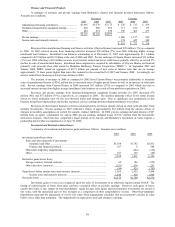

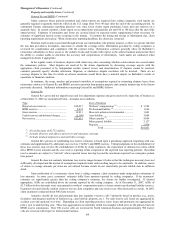

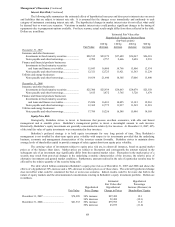

General Re

General Re’ s gross and net unpaid losses and loss adjustment expenses and gross reserves by major line of business as

of December 31, 2007 are summarized below. Amounts are in millions.

Type Line of business

Reported case reserves ............................... $10,957 Workers’ compensation (1) ......................... $ 3,284

IBNR reserves ............................................ 8,874 Professional liability (2) .............................. 1,646

Gross reserves ............................................ 19,831 Mass tort–asbestos/environmental ............. 1,841

Ceded reserves and deferred charges.......... (2,180) Auto liability.............................................. 3,004

Net reserves................................................ $17,651 Other casualty

(3) ........................................ 4,099

Other general liability................................ 3,127

Property ..................................................... 2,830

Total ............................................. $19,831

(1) Net of discounts of $2,732 million.

(2) Includes directors and officers and errors and omissions coverage.

(3) Includes medical malpractice and umbrella coverage.

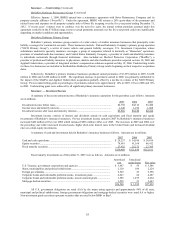

General Re’ s process of establishing loss reserve estimates is based upon a ground-up approach, beginning with case

estimates and supplemented by additional case reserves (“ACRs”) and IBNR reserves. Critical judgments in the establishment of

these loss reserves may involve the establishment of ACRs by claim examiners, the expectation of ultimate loss ratios which

drive IBNR reserve amounts and the case reserve reporting trends compared to the expected loss reporting patterns. Recorded

reserve amounts are subject to “tail risk” where reported losses develop beyond the maximum expected loss emergence pattern

time period.

General Re does not routinely determine loss reserve ranges because it believes that the techniques necessary have not

sufficiently developed and the myriad of assumptions required render such resulting ranges to be unreliable. In addition, counts

of claims or average amounts per claim are not utilized because clients do not consistently provide reliable data in sufficient

detail.

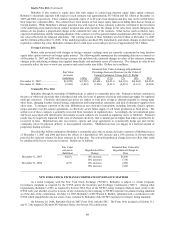

Upon notification of a reinsurance claim from a ceding company, claim examiners make independent evaluations of

loss amounts. In some cases, examiners’ estimates differ from amounts reported by ceding companies. If the examiners’

estimates are significantly greater than the ceding company’ s estimates, the claims are further investigated. If deemed

appropriate, ACRs are established above the amount reported by the ceding company. As of December 31, 2007, ACRs of

$3.3 billion before discounts were concentrated in workers’ compensation and to a lesser extent in professional liability reserves.

Examiners also periodically conduct claim reviews at client companies and case reserves are often increased as a result. In 2007,

claim examiners conducted about 400 claim reviews.

Actuaries classify all loss and premium data into segments (“reserve cells”) primarily based on product (e.g., treaty,

facultative and program) and line of business (e.g., auto liability, property, etc.). For each reserve cell, losses are aggregated by

accident year and analyzed over time. Depending on client reporting practices, some losses and premiums are aggregated by

policy year or underwriting year. These loss aggregations are internally called loss triangles which serve as the primary basis for

IBNR reserve calculations. Over 300 reserve cells are reviewed for North American business and approximately 900 reserve

cells are reviewed with respect to international business.