Berkshire Hathaway 2007 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

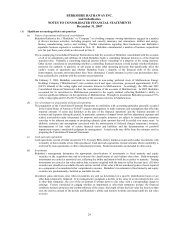

Notes to Consolidated Financial Statements (Continued)

(1) Significant accounting policies and practices (Continued)

(l) Deferred charges reinsurance assumed

The excess of estimated liabilities for claims and claim costs over the consideration received with respect to retroactive

property and casualty reinsurance contracts that provide for indemnification of insurance risk is established as a

deferred charge at inception of such contracts. The deferred charges are subsequently amortized using the interest

method over the expected claim settlement periods. Changes to the expected timing and estimated amount of loss

payments produce changes in the periodic amortization charge. Such changes in estimates are determined

retrospectively and are included in insurance losses and loss adjustment expense in the period of the change. The

periodic amortization charges are reflected in the accompanying Consolidated Statements of Earnings as losses and

loss adjustment expenses.

(m) Insurance premium acquisition costs

Costs that vary with and are related to the issuance of insurance policies are deferred, subject to ultimate recoverability,

and are charged to underwriting expenses as the related premiums are earned. Acquisition costs consist of

commissions, premium taxes, advertising and other underwriting costs. The recoverability of premium acquisition

costs generally reflects anticipation of investment income. The unamortized balances of deferred premium

acquisition costs are included in other assets and were $1,519 million and $1,432 million at December 31, 2007 and

2006, respectively.

(n) Regulated utilities and energy businesses

Certain domestic energy subsidiaries prepare their financial statements in accordance with SFAS 71, reflecting

economic effects deriving from the ability to recover certain costs from customers and the requirement to return

revenues to customers in the future through the regulated rate-setting process. Accordingly, certain costs are

deferred as regulatory assets and obligations are accrued as regulatory liabilities which will be amortized over

various future periods. At December 31, 2007, the Consolidated Balance Sheet includes $1,503 million in

regulatory assets and $1,629 million in regulatory liabilities. At December 31, 2006, the Consolidated Balance

Sheet includes $1,827 million in regulatory assets and $1,839 million in regulatory liabilities. Regulatory assets

and liabilities are components of other assets and other liabilities of utilities and energy businesses.

Management continually assesses whether the regulatory assets are probable of future recovery by considering factors

such as applicable regulatory changes, recent rate orders received by other regulated entities and the status of any

pending or potential deregulation legislation. If future recovery of costs ceases to be probable, the amount no

longer probable of recovery is charged to earnings.

(p) Foreign currency

The accounts of foreign-based subsidiaries are measured in most instances using the local currency as the functional

currency. Revenues and expenses of these businesses are generally translated into U.S. dollars at the average

exchange rate for the period. Assets and liabilities are translated at the exchange rate as of the end of the reporting

period. Gains or losses from translating the financial statements of foreign-based operations are included in

shareholders’ equity as a component of accumulated other comprehensive income. Unrealized gains or losses

associated with available-for-sale securities are included as a component of other comprehensive income. Gains

and losses arising from other transactions denominated in a foreign currency are included in the Consolidated

Statements of Earnings.

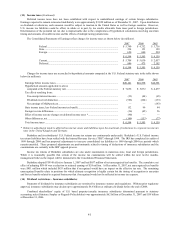

(q) Income taxes

Berkshire and eligible subsidiaries currently file a consolidated Federal income tax return in the United States. In

addition, Berkshire and subsidiaries also file income tax returns in state, local and foreign jurisdictions as

applicable. Provisions for current income tax liabilities are calculated and accrued on income and expense amounts

expected to be included in the income tax returns for the current year.

Deferred income taxes are calculated under the liability method. Deferred income tax assets and liabilities are based on

differences between the financial statement and tax bases of assets and liabilities at the current enacted tax rates.

Changes in deferred income tax assets and liabilities that are associated with components of other comprehensive

income (primarily unrealized investment gains and losses) are charged or credited directly to other comprehensive

income. Otherwise, changes in deferred income tax assets and liabilities are included as a component of income tax

expense. Changes in deferred income tax assets and liabilities attributable to changes in enacted tax rates are

charged or credited to income tax expense in the period of enactment. Valuation allowances have been established

for certain deferred tax assets where realization is not likely.

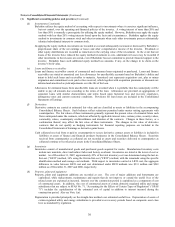

Assets and liabilities are established for uncertain tax positions taken or positions expected to be taken in income tax

returns when such positions are judged to not meet the “more-likely-than-not” threshold based on the technical

merits of the positions. Estimated interest and penalties related to uncertain tax positions are included as a

component of income tax expense.

(r) Accounting pronouncements adopted in 2007 and 2006

Berkshire adopted FASB Interpretation No.48 “Accounting for Uncertainty in Income Taxes-an interpretation of FASB

Statement No. 109” (“FIN 48”) as of January 1, 2007. Under FIN 48, a tax position taken is recognized if it is

determined that the position will “more-likely-than-not” be sustained upon examination by a taxing authority. FIN

48 also establishes measurement guidance with respect to positions that have met the recognition threshold. See

Note 13 for additional information.