Berkshire Hathaway 2007 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. A second, somewhat related, point about these managers is that they have exactly the job they

want for the rest of their working years. At almost any other company, key managers below the top aspire

to keep climbing the pyramid. For them, the subsidiary or division they manage today is a way station – or

so they hope. Indeed, if they are in their present positions five years from now, they may well feel like

failures.

Conversely, our CEOs’ scorecards for success are not whether they obtain my job but instead are

the long-term performances of their businesses. Their decisions flow from a here-today, here-forever

mindset. I think our rare and hard-to-replicate managerial structure gives Berkshire a real advantage.

Acquisitions

Though our managers may be the best, we will need large and sensible acquisitions to get the

growth in operating earnings we wish. Here, we made little progress in 2007 until very late in the year.

Then, on Christmas day, Charlie and I finally earned our paychecks by contracting for the largest cash

purchase in Berkshire’ s history.

The seeds of this transaction were planted in 1954. That fall, only three months into a new job, I

was sent by my employers, Ben Graham and Jerry Newman, to a shareholders’ meeting of Rockwood

Chocolate in Brooklyn. A young fellow had recently taken control of this company, a manufacturer of

assorted cocoa-based items. He had then initiated a one-of-a-kind tender, offering 80 pounds of cocoa

beans for each share of Rockwood stock. I described this transaction in a section of the 1988 annual report

that explained arbitrage. I also told you that Jay Pritzker – the young fellow mentioned above – was the

business genius behind this tax-efficient idea, the possibilities for which had escaped all the other experts

who had thought about buying Rockwood, including my bosses, Ben and Jerry.

At the meeting, Jay was friendly and gave me an education on the 1954 tax code. I came away

very impressed. Thereafter, I avidly followed Jay’ s business dealings, which were many and brilliant. His

valued partner was his brother, Bob, who for nearly 50 years ran Marmon Group, the home for most of the

Pritzker businesses.

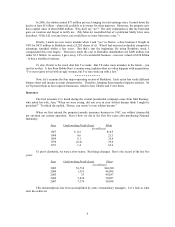

Jay died in 1999, and Bob retired early in 2002. Around then, the Pritzker family decided to

gradually sell or reorganize certain of its holdings, including Marmon, a company operating 125

businesses, managed through nine sectors. Marmon’ s largest operation is Union Tank Car, which together

with a Canadian counterpart owns 94,000 rail cars that are leased to various shippers. The original cost of

this fleet is $5.1 billion. All told, Marmon has $7 billion in sales and about 20,000 employees.

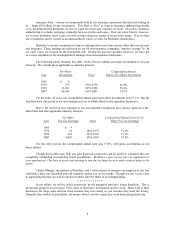

We will soon purchase 60% of Marmon and will acquire virtually all of the balance within six

years. Our initial outlay will be $4.5 billion, and the price of our later purchases will be based on a formula

tied to earnings. Prior to our entry into the picture, the Pritzker family received substantial consideration

from Marmon’ s distribution of cash, investments and certain businesses.

This deal was done in the way Jay would have liked. We arrived at a price using only Marmon’ s

financial statements, employing no advisors and engaging in no nit-picking. I knew that the business

would be exactly as the Pritzkers represented, and they knew that we would close on the dot, however

chaotic financial markets might be. During the past year, many large deals have been renegotiated or killed

entirely. With the Pritzkers, as with Berkshire, a deal is a deal.

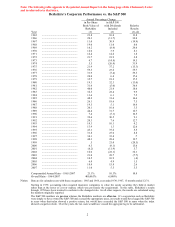

Marmon’ s CEO, Frank Ptak, works closely with a long-time associate, John Nichols. John was

formerly the highly successful CEO of Illinois Tool Works (ITW), where he teamed with Frank to run a

mix of industrial businesses. Take a look at their ITW record; you’ ll be impressed.

5