Berkshire Hathaway 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

(16) Common stock (Continued)

Each share of Class B common stock has dividend and distribution rights equal to one-thirtieth (1/30) of such rights of a Class

A share. Accordingly, on an equivalent Class A common stock basis there are 1,547,693 shares outstanding as of December 31, 2007

and 1,542,649 shares as of December 31, 2006.

Each share of Class A common stock is convertible, at the option of the holder, into thirty shares of Class B common stock.

Class B common stock is not convertible into Class A common stock. On July 6, 2006, Berkshire’ s Chairman and CEO, Warren E.

Buffett converted 124,998 shares of Class A common stock into 3,749,940 shares of Class B common stock. Each share of Class B

common stock possesses voting rights equivalent to one-two-hundredth (1/200) of the voting rights of a share of Class A common

stock. Class A and Class B common shares vote together as a single class.

During 2007, holders of SQUARZ securities exercised the warrant component of the securities and received Class A and Class

B shares. In connection with these exercises, Berkshire received $333 million.

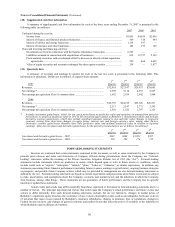

(17) Pension plans

Several Berkshire subsidiaries individually sponsor defined benefit pension plans covering certain employees. Benefits under

the plans are generally based on years of service and compensation, although benefits under certain plans are based on years of

service and fixed benefit rates. The companies generally make contributions to the plans to meet regulatory requirements plus

additional amounts as determined by management based on actuarial valuations.

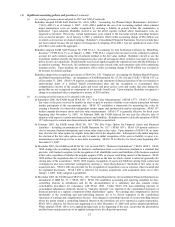

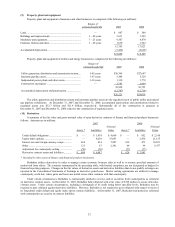

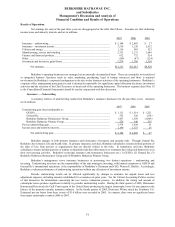

The components of net periodic pension expense for each of the three years ending December 31, 2007 are as follows (in

millions).

2007 2006 2005

Service cost ................................................................................................................... $ 202 $ 199 $ 113

Interest cost ................................................................................................................... 439 390 190

Expected return on plan assets....................................................................................... (444) (393) (186)

Net gain/loss amortization, other................................................................................... 65 67 9

Net pension expense...................................................................................................... $ 262 $ 263 $ 126

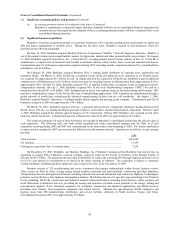

The accumulated benefit obligation is the actuarial present value of benefits earned based on service and compensation prior to

the valuation date. As of December 31, 2007 and 2006, the accumulated benefit obligation was $6,990 million and $7,056 million,

respectively. The projected benefit obligation is the actuarial present value of benefits earned based upon service and compensation

prior to the valuation date and includes assumptions regarding future compensation levels when benefits are based on those amounts.

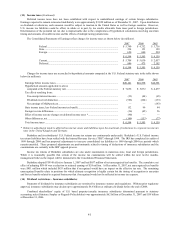

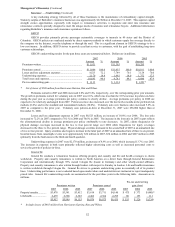

Information regarding the projected benefit obligations is shown in the table that follows (in millions).

2007 2006

Projected benefit obligation, beginning of year..................................................................................... $7,926 $3,602

Service cost ........................................................................................................................................... 202 199

Interest cost ........................................................................................................................................... 439 390

Benefits paid.......................................................................................................................................... (476) (370)

Consolidation of MidAmerican............................................................................................................. — 2,237

Business acquisitions............................................................................................................................. — 1,519

Actuarial (gain) or loss and other .......................................................................................................... (408) 349

Projected benefit obligation, end of year............................................................................................... $7,683 $7,926

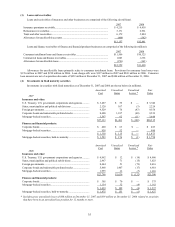

Benefit obligations under qualified U.S. defined benefit plans are funded through assets held in trusts and are not included as

assets in Berkshire’ s Consolidated Financial Statements. Pension obligations under certain non-U.S. plans and non-qualified U.S.

plans are unfunded. As of December 31, 2007, projected benefit obligations of non-qualified U.S. plans and non-U.S. plans which

are not funded through assets held in trusts were $637 million. A reconciliation of the changes in plan assets and a summary of plan

assets held as of December 31, 2007 and 2006 is presented in the table that follows (in millions).

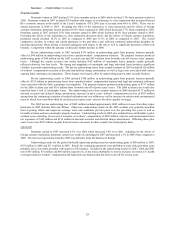

2007 2006 2007 2006

Plan assets at fair value, beginning of year........... $6,792 $3,101 Cash and equivalents................. $ 427 $ 818

Employer contributions ........................................ 262 228 U.S. Government obligations.... 186 554

Benefits paid......................................................... (476) (370) Mortgage-backed securities ...... 390 602

Actual return on plan assets.................................. 447 612 Corporate obligations................ 1,005 963

Consolidation of MidAmerican............................ — 2,238 Equity securities........................ 4,169 3,440

Business acquisitions............................................ — 967 Other ......................................... 886 415

Other and expenses............................................... 38 16 $7,063 $6,792

Plan assets at fair value, end of year..................... $7,063 $6,792

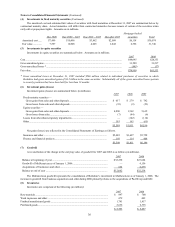

Pension plan assets are generally invested with the long-term objective of earning sufficient amounts to cover expected benefit

obligations, while assuming a prudent level of risk. There are no target investment allocation percentages with respect to individual

or categories of investments. Allocations may change as a result of changing market conditions and investment opportunities. The

expected rates of return on plan assets reflect Berkshire’ s subjective assessment of expected invested asset returns over a period of

several years. Berkshire generally does not give significant consideration to past investment returns when establishing assumptions

for expected long-term rates of returns on plan assets. Actual experience will differ from the assumed rates.