Berkshire Hathaway 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BERKSHIRE HATHAWAY INC.

2007 ANNUAL REPORT

TABLE OF CONTENTS

Business Activities........................................................Inside Front Cover

Corporate Performance vs. the S&P 500 ................................................ 2

Chairman’ s Letter* ................................................................................. 3

Acquisition Criteria ................................................................................23

Selected Financial Data For The

Past Five Years .................................................................................. 23

Management’ s Report on Internal Control

Over Financial Reporting ...................................................................24

Report of Independent Registered Public Accounting Firm................... 24

Consolidated Financial Statements......................................................... 25

Management’ s Discussion ...................................................................... 51

Owner’ s Manual .....................................................................................70

Common Stock Data............................................................................... 75

Operating Companies ............................................................................. 76

Directors and Officers of the Company.........................Inside Back Cover

*Copyright © 2008 By Warren E. Buffett

All Rights Reserved

Table of contents

-

Page 1

BERKSHIRE HATHAWAY INC. 2007 ANNUAL REPORT TABLE OF CONTENTS Business Activities...Inside Front Cover Corporate Performance vs. the S&P 500 ...2 Chairman' s Letter* ...3 Acquisition Criteria ...23 Selected Financial Data For The Past Five Years ...23 Management' s Report on Internal Control Over ... -

Page 2

..., a real estate brokerage firm. Berkshire' s finance and financial products businesses primarily engage in proprietary investing strategies (BH Finance), commercial and consumer lending (Berkshire Hathaway Credit Corporation and Clayton Homes) and transportation equipment and furniture leasing (XTRA... -

Page 3

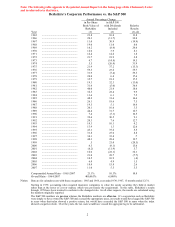

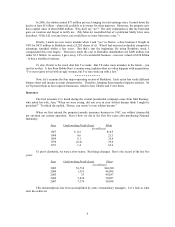

... table appears in the printed Annual Report on the facing page of the Chairman's Letter and is referred to in that letter. Berkshire's Corporate Performance vs. the S&P 500 Annual Percentage Change in Per-Share in S&P 500 Book Value of with Dividends Berkshire Included (1) (2) 23.8 10.0 20.3 (11... -

Page 4

... INC. To the Shareholders of Berkshire Hathaway Inc.: Our gain in net worth during 2007 was $12.3 billion, which increased the per-share book value of both our Class A and Class B stock by 11%. Over the last 43 years (that is, since present management took over) book value has grown from $19 to... -

Page 5

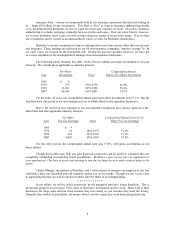

... money we temporarily hold in our insurance operations that does not belong to us - funds $59 billion of our investments. This float is "free" as long as insurance underwriting breaks even, meaning that the premiums we receive equal the losses and expenses we incur. Of course, insurance underwriting... -

Page 6

... they manage today is a way station - or so they hope. Indeed, if they are in their present positions five years from now, they may well feel like failures. Conversely, our CEOs' scorecards for success are not whether they obtain my job but instead are the long-term performances of their businesses... -

Page 7

... returns on invested capital. The dynamics of capitalism guarantee that competitors will repeatedly assault any business "castle" that is earning high returns. Therefore a formidable barrier such as a company' s being the lowcost producer (GEICO, Costco) or possessing a powerful world-wide brand... -

Page 8

... few states, accounts for nearly half of the entire industry' s earnings. At See' s, annual sales were 16 million pounds of candy when Blue Chip Stamps purchased the company in 1972. (Charlie and I controlled Blue Chip at the time and later merged it into Berkshire.) Last year See' s sold 31 million... -

Page 9

... for airlines, we were actually able to sell our shares in 1998 for a hefty gain. In the decade following our sale, the company went bankrupt. Twice. To sum up, think of three types of "savings accounts." The great one pays an extraordinarily high interest rate that will rise as the years pass. The... -

Page 10

... using Berkshire stock, I compounded this error hugely. That move made the cost to Berkshire shareholders not $400 million, but rather $3.5 billion. In essence, I gave away 1.6% of a wonderful business - one now valued at $220 billion - to buy a worthless business. To date, Dexter is the worst deal... -

Page 11

...of our insurers, one carefully protected and expanded by Tony Nicely, its CEO. Last year - again - GEICO had the best growth record among major auto insurers, increasing its market share to 7.2%. When Berkshire acquired control in 1995, that share was 2.5%. Not coincidentally, annual ad expenditures... -

Page 12

... utility ...Western utilities (acquired March 21, 2006) ...Pipelines ...HomeServices...Other (net) ...Earnings before corporate interest and taxes ...Interest, other than to Berkshire ...Interest on Berkshire junior debt ...Income tax ...Net earnings...Earnings applicable to Berkshire* ...Debt owed... -

Page 13

... of the U.K. corporate tax rate. So call normalized earnings $15.01 per share. And yes, I' m glad I wilted and offered the extra nickel. Manufacturing, Service and Retailing Operations Our activities in this part of Berkshire cover the waterfront. Let' s look, though, at a summary balance sheet and... -

Page 14

...her career as a cab driver.) Finally, at Nebraska Furniture Mart, earnings hit a record as our Omaha and Kansas City stores each had sales of about $400 million. These, by some margin, are the two top home furnishings stores in the country. In a disastrous year for many furniture retailers, sales at... -

Page 15

... finance (Clayton)...Other...Income before capital gains...Trading - capital gains ... The leasing operations tabulated are XTRA, which rents trailers, and CORT, which rents furniture. Utilization of trailers was down considerably in 2007 and that led to a drop in earnings at XTRA. That company... -

Page 16

..., Bill Franz and Paul Arnold. Each has made tuck-in acquisitions during Berkshire' s ownership. More will come. Investments We show below our common stock investments at yearend, itemizing those with a market value of at least $600 million. 12/31/07 Shares Company Percentage of Company Owned Cost... -

Page 17

... that in our catastrophe insurance business, we are always ready to trade increased volatility in reported earnings in the short run for greater gains in net worth in the long run. That is our philosophy in derivatives as well The U.S. dollar weakened further in 2007 against major currencies, and... -

Page 18

... was actually holding down the value of the real and supporting our currency by buying dollars in the market. Our direct currency positions have yielded $2.3 billion of pre-tax profits over the past five years, and in addition we have profited by holding bonds of U.S. companies that are denominated... -

Page 19

... price below market value. No problem. To avoid that bothersome rule, a number of companies surreptitiously backdated options to falsely indicate that they were granted at current market prices, when in fact they were dished out at prices well below market. Decades of option-accounting nonsense... -

Page 20

... most likely outcome? Dividends continue to run about 2%. Even if stocks were to average the 5.3% annual appreciation of the 1900s, the equity portion of plan assets - allowing for expenses of .5% - would produce no more than 7% or so. And .5% may well understate costs, given the presence of layers... -

Page 21

.... Public pension promises are huge and, in many cases, funding is woefully inadequate. Because the fuse on this time bomb is long, politicians flinch from inflicting tax pain, given that problems will only become apparent long after these officials have departed. Promises involving very early... -

Page 22

... Carefree awnings and NFM furniture). You will find that this 1,550square-foot home, priced at $69,500, delivers exceptional value. And after you purchase the house, consider also acquiring the Forest River RV and pontoon boat on display nearby. GEICO will have a booth staffed by a number of its top... -

Page 23

..., we have long had jobs that we love, in which we are helped in countless ways by talented and cheerful associates. Every day is exciting to us; no wonder we tap-dance to work. But nothing is more fun for us than getting together with our shareholder-partners at Berkshire' s annual meeting. So... -

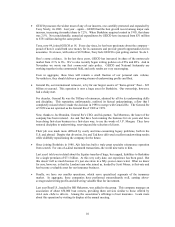

Page 24

...know it' s me." BERKSHIRE HATHAWAY INC. and Subsidiaries Selected Financial Data for the Past Five Years (dollars in millions except per share data) 2007 Revenues: Insurance premiums earned (1) ...Sales and service revenues ...Revenues of utilities and energy businesses (2) ...Interest, dividend and... -

Page 25

... Report of Independent Registered Public Accounting Firm To the Board of Directors and Shareholders of Berkshire Hathaway Inc. We have audited the accompanying consolidated balance sheets of Berkshire Hathaway Inc. and subsidiaries (the "Company") as of December 31, 2007 and 2006, and the related... -

Page 26

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED BALANCE SHEETS (dollars in millions except per share amounts) December 31, 2007 ASSETS Insurance and Other: Cash and cash equivalents ...Investments: Fixed maturity securities ...Equity securities...Loans and receivables...Inventories ...Property... -

Page 27

...663 Costs and expenses: Insurance and Other: Insurance losses and loss adjustment expenses ...Life and health insurance benefits ...Insurance underwriting expenses...Cost of sales and services ...Selling, general and administrative expenses ...Interest expense ...Utilities and Energy: Cost of sales... -

Page 28

... maturities ...Sales of equity securities ...Purchases of loans and finance receivables ...Principal collections on loans and finance receivables...Acquisitions of businesses, net of cash acquired...Purchases of property, plant and equipment...Other...Net cash flows from investing activities...Cash... -

Page 29

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS' EQUITY AND COMPREHENSIVE INCOME (dollars in millions) Year Ended December 31, 2006 2005 2007 Class A & B Common Stock Balance at beginning and end of year ...$ 8 $ 8 $ 8 Capital in Excess of Par Value ... -

Page 30

... with the current year presentation. On February 9, 2006, Berkshire converted its investment in non-voting preferred stock of MidAmerican Energy Holdings Company ("MidAmerican") into common stock and upon conversion, possessed approximately 83.4% (80.5% diluted) of the voting rights and economic... -

Page 31

...zero, additional net losses may be recorded if other investments in the investee are at-risk, even if Berkshire has not committed to provide financial support to the investee. Berkshire bases such additional equity method loss amounts, if any, on the change in its claim on the investee' s book value... -

Page 32

... ceding companies for the period are not contractually due until after the balance sheet date. For contracts containing experience rating provisions, premiums are based upon estimated loss experience under the contract. Sales revenues derive from the sales of manufactured products and goods acquired... -

Page 33

... that provide for indemnification of insurance risk is established as a deferred charge at inception of such contracts. The deferred charges are subsequently amortized using the interest method over the expected claim settlement periods. Changes to the expected timing and estimated amount of loss... -

Page 34

...that investors in life settlement contracts account for such contracts using the investment method or the fair value method. Berkshire elected to use the investment method whereby the initial transaction price plus all subsequent direct external costs paid to keep the policy in force are capitalized... -

Page 35

... Services, providing the leasing and operation of mobile cranes primarily to the energy, mining and petrochemical markets; Water Treatment equipment for residential, commercial and industrial applications; and Retail Services, providing store fixtures, food preparation equipment and related services... -

Page 36

... Cost 2007 Insurance and other: U.S. Treasury, U.S. government corporations and agencies ...States, municipalities and political subdivisions ...Foreign governments ...Corporate bonds and redeemable preferred stocks ...Mortgage-backed securities ...Finance and financial products: Corporate bonds... -

Page 37

...and other disposals ...Gross losses from sales...Losses from other-than-temporary impairments ...Other...$ 657 (35) 4,880 (7) - 103 $5,598 Net gains (losses) are reflected in the Consolidated Statements of Earnings as follows. Insurance and other ...Finance and financial products...$5,405 193 $5,598... -

Page 38

... are reported in the Consolidated Statements of Earnings as derivative gains/losses. Master netting agreements are utilized to manage counterparty credit risk, where gains and losses are netted across other contracts with that counterparty. Under certain circumstances, Berkshire is contractually... -

Page 39

... losses and loss adjustment expenses The balances of unpaid losses and loss adjustment expenses are based upon estimates of the ultimate claim costs associated with property and casualty claim occurrences as of the balance sheet dates including estimates for incurred but not reported ("IBNR") claims... -

Page 40

... used to repay debt maturing subsequent to December 31, 2007, to finance planned capital expenditures or for general corporate purposes. Berkshire has made a commitment until February 28, 2011 that allows MidAmerican to request up to $3.5 billion of capital to pay its debt obligations or to provide... -

Page 41

... to Consolidated Financial Statements (Continued) (12) Notes payable and other borrowings (Continued) 2007 Finance and financial products: Issued by Berkshire Hathaway Finance Corporation ("BHFC") and guaranteed by Berkshire: Notes due 2007 ...Notes due 2008 ...Notes due 2010 ...Notes due 2012-2015... -

Page 42

... is highly certain but the timing of recognition is uncertain and for tax benefits related to acquired businesses that if recognized would not be reflected in income tax expense. (14) Dividend restrictions - Insurance subsidiaries Payments of dividends by insurance subsidiaries are restricted by... -

Page 43

...deferred policy acquisition costs, unrealized gains and losses on investments in fixed maturity securities and related deferred income taxes are recognized under GAAP but not for statutory reporting purposes. In addition, statutory accounting for goodwill of acquired businesses requires amortization... -

Page 44

... return on plan assets...(444) (393) (186) 67 9 Net gain/loss amortization, other...65 $ 263 $ 126 Net pension expense...$ 262 The accumulated benefit obligation is the actuarial present value of benefits earned based on service and compensation prior to the valuation date. As of December 31, 2007... -

Page 45

... projected benefit obligations were as follows. These rates are substantially the same as the weighted average rates used in determining the net periodic pension expense. 2006 2007 Discount rate ...6.1 5.7 Expected long-term rate of return on plan assets...6.9 6.9 Rate of compensation increase... -

Page 46

..., Business Wire, FlightSafety, International Dairy Queen, Pampered Chef, NetJets and TTI Ben Bridge Jeweler, Borsheims, Helzberg Diamond Shops, Jordan' s Furniture, Nebraska Furniture Mart, See' s, Star Furniture and R.C. Willey Service Retailing A disaggregation of Berkshire' s consolidated data... -

Page 47

.... In 2007, consolidated sales and service revenues included $10.5 billion of sales to Wal-Mart Stores, Inc. which were primarily related to McLane' s wholesale distribution business. Premiums written and earned by Berkshire' s property/casualty and life/health insurance businesses are summarized... -

Page 48

... provisions of the federal securities laws in connection with the AIG Transaction. The SEC case is presently stayed. Joseph Brandon, the Chief Executive Officer of General Re, also received a "Wells" notice from the SEC in 2005. Berkshire understands that the government is evaluating the actions... -

Page 49

... of New York, a putative class action asserted on behalf of investors who purchased publicly-traded securities of AIG between October 1999 and March 2005. The complaint, originally filed in April 2005, asserts various claims against AIG and certain of its officers, directors, investment banks... -

Page 50

... condition or results of operations. c) Commitments Berkshire subsidiaries lease certain manufacturing, warehouse, retail and office facilities as well as certain equipment. Rent expense for all leases was $648 million in 2007, $578 million in 2006 and $432 million in 2005. Minimum rental payments... -

Page 51

...causes losses insured by Berkshire' s insurance subsidiaries, changes in insurance laws or regulations, changes in Federal income tax laws, and changes in general economic and market factors that affect the prices of securities or the industries in which Berkshire and its affiliates do business. 50 -

Page 52

.... Berkshire' s corporate office management participates in and is ultimately responsible for significant capital allocation decisions, investment activities and the selection of the Chief Executive to head each of the operating businesses. The business segment data (Note 18 to the Consolidated... -

Page 53

... directly to the company via the Internet, over the telephone or through the mail. This is a significant element in GEICO' s strategy to be a low-cost insurer. In addition, GEICO strives to provide excellent service to customers, with the goal of establishing long-term customer relationships. GEICO... -

Page 54

... respect to life business. Included in the underwriting results for 2007, 2006 and 2005 were $105 million, $31 million and $66 million, respectively, of net losses attributable to reserve increases on certain U.S. health coverages related to workers' compensation and long-term-care business that has... -

Page 55

... of a contract. Other multi-line premiums earned in 2007 reflect significant increases in property business and significant decreases in casualty excess reinsurance. In addition, the management of certain workers' compensation business was transferred to the Berkshire Hathaway Primary Group... -

Page 56

...on market conditions and opportunities. Berkshire Hathaway Primary Group Berkshire' s primary insurance group consists of a wide variety of smaller insurance businesses that principally write liability coverages for commercial accounts. These businesses include: National Indemnity Company' s primary... -

Page 57

... usage in retail markets, as well as increased margins on wholesale electricity sales, partially offset by higher fuel and purchased power costs. Fuel costs increased due to the higher volumes and because of higher average unit costs. Revenues in 2007 from natural gas pipelines increased $116... -

Page 58

..., respectively. McLane Company McLane Company, Inc., ("McLane") is a wholesale distributor of grocery and non-food products to retailers, convenience stores and restaurants. McLane' s business is marked by high sales volume and very low profit margins. McLane' s revenues in 2007 increased $2,386... -

Page 59

... of Forest River (acquired August 2005), IMC and Russell Corporation account for a substantial portion of these increases. Additionally, the building products group of businesses reported increases in revenues and pre-tax earnings in 2006 as compared to the prior year. Other service Berkshire... -

Page 60

... or acquired by subsidiaries of Clayton Homes are financed primarily with proceeds from debt issued by Berkshire Hathaway Finance Corporation ("BHFC"). In September 2007 and January 2008, BHFC issued an aggregate of $2.75 billion par amount of new notes at interest rates that are on average... -

Page 61

.... Financial Condition Berkshire' s balance sheet continues to reflect significant liquidity and a strong capital base. Consolidated shareholders' equity at December 31, 2007 was $120.7 billion. Consolidated cash and invested assets, excluding assets of finance and financial products businesses, was... -

Page 62

.... Except for certain workers' compensation reserves, liabilities for unpaid property and casualty losses (referred to in this section as "gross unpaid losses") are reflected in the Consolidated Balance Sheets without discounting for time value, regardless of the length of the claim-tail. Amounts are... -

Page 63

... frequencies and average severities of claims. Such amounts are analyzed using actuarial techniques on historical claims data and adjusted when appropriate to reflect perceived changes in loss patterns. Data is analyzed by policy coverage, rated state, reporting date and occurrence date, among other... -

Page 64

...individual claim basis. Loss data is provided through periodic reports and may include the amount of ceded losses paid where reimbursement is sought as well as case loss reserve estimates. Ceding companies infrequently provide IBNR estimates to reinsurers. Each of Berkshire' s reinsurance businesses... -

Page 65

...831 (1) (2) (3) Net of discounts of $2,732 million. Includes directors and officers and errors and omissions coverage. Includes medical malpractice and umbrella coverage. General Re' s process of establishing loss reserve estimates is based upon a ground-up approach, beginning with case estimates... -

Page 66

... losses. In response to favorable claim developments and another year of information, estimated remaining World Trade Center losses and estimated losses from the hurricanes in 2005 were reduced by $93 million. In certain reserve cells within excess directors and officers and errors and omissions... -

Page 67

...is determined. Management monitors claim payment activity and reviews ceding company reports or other information concerning the underlying losses. Since the claim-tail is expected to be very long for such contracts, management reassesses expected ultimate losses as significant events related to the... -

Page 68

...' s strategy is to acquire securities that are attractively priced in relation to the perceived credit risk. Management recognizes and accepts that losses may occur. Berkshire strives to maintain high credit ratings so that the cost of debt is minimized. Berkshire utilizes derivative products, such... -

Page 69

.... Berkshire strives to maintain above average levels of shareholder capital to provide a margin of safety against short-term equity price volatility. The carrying values of investments subject to equity price risk are, in almost all instances, based on quoted market prices as of the balance sheet... -

Page 70

...fair value, Berkshire estimates that it could incur a non-cash pre-tax loss of approximately $2.3 billion. Foreign Currency Risk Market risks associated with changes in foreign currency exchange rates are currently concentrated in long duration equity index option contracts on foreign equity indexes... -

Page 71

... Berkshire stock much as Berkshire itself behaves in respect to companies in which it has an investment. As owners of, say, Coca-Cola or American Express shares, we think of Berkshire as being a non-managing partner in two extraordinary businesses, in which we measure our success by the long-term... -

Page 72

...the individual businesses, should generally aid you in making judgments about them. To state things simply, we try to give you in the annual report the numbers and other information that really matter. Charlie and I pay a great deal of attention to how well our businesses are doing, and we also work... -

Page 73

... portfolios through direct purchases in the stock market. Charlie and I are interested only in acquisitions that we believe will raise the per-share intrinsic value of Berkshire' s stock. The size of our paychecks or our offices will never be related to the size of Berkshire' s balance sheet. 9. We... -

Page 74

... the best prospect of attracting long-term investors who seek to profit from the progress of the company rather than from the investment mistakes of their partners. 15. We regularly compare the gain in Berkshire' s per-share book value to the performance of the S&P 500. Over time, we hope to outpace... -

Page 75

... on the date of my death. But I can anticipate what the management structure will be: Essentially my job will be split into two parts. One executive will become CEO and responsible for operations. The responsibility for investments will be given to one or more executives. If the acquisition of new... -

Page 76

... Berkshire' s Class A and Class B Common Stock are listed for trading on the New York Stock Exchange, trading symbol: BRK.A and BRK.B. The following table sets forth the high and low sales prices per share, as reported on the New York Stock Exchange Composite List during the periods indicated: 2007... -

Page 77

...MidAmerican Energy Holdings Company (2) MiTek Inc. Nebraska Furniture Mart NetJets Northern Natural Gas (2) Northern and Yorkshire Electric (2) Northland (1) PacifiCorp (2) Pacific Power (2) The Pampered Chef Precision Steel Warehouse Richline Group Rocky Mountain Power (2) Russell Corporation Other... -

Page 78

... MURPHY, Former Chairman of the Board and CEO of Capital Cities/ABC JO ELLEN RIECK, Director of Taxes RONALD L. OLSON, Partner of the law firm of Munger, Tolles & Olson LLP WALTER SCOTT, JR., Chairman of Level 3 Communications, a successor to certain businesses of Peter Kiewit Sons' Inc. which is...