Berkshire Hathaway 2000 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

The Economics of Property/Casualty Insurance

Our main business — though we have others of great importance — is insurance. To understand

Berkshire, therefore, it is necessary that you understand how to evaluate an insurance company. The key

determinants are: (1) the amount of float that the business generates; (2) its cost; and (3) most critical of all, the

long-term outlook for both of these factors.

To begin with, float is money we hold but don't own. In an insurance operation, float arises because

premiums are received before losses are paid, an interval that sometimes extends over many years. During that

time, the insurer invests the money. This pleasant activity typically carries with it a downside: The premiums that

an insurer takes in usually do not cover the losses and expenses it eventually must pay. That leaves it running an

"underwriting loss," which is the cost of float. An insurance business has value if its cost of float over time is less

than the cost the company would otherwise incur to obtain funds. But the business is a lemon if its cost of float is

higher than market rates for money.

A caution is appropriate here: Because loss costs must be estimated, insurers have enormous latitude in

figuring their underwriting results, and that makes it very difficult for investors to calculate a company's true cost

of float. Errors of estimation, usually innocent but sometimes not, can be huge. The consequences of these

miscalculations flow directly into earnings. An experienced observer can usually detect large-scale errors in

reserving, but the general public can typically do no more than accept what's presented, and at times I have been

amazed by the numbers that big-name auditors have implicitly blessed. Both the income statements and balance

sheets of insurers can be minefields.

At Berkshire, we strive to be both consistent and conservative in our reserving. But we will make

mistakes. And we warn you that there is nothing symmetrical about surprises in the insurance business: They

almost always are unpleasant.

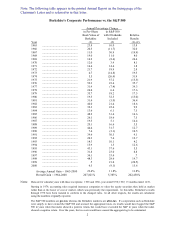

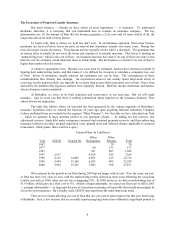

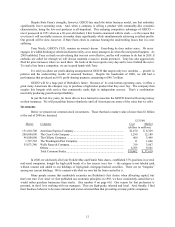

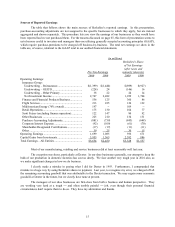

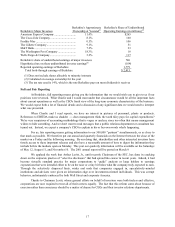

The table that follows shows (at intervals) the float generated by the various segments of Berkshire’s

insurance operations since we entered the business 34 years ago upon acquiring National Indemnity Company

(whose traditional lines are included in the segment “Other Primary”). For the table we have calculated our float

— which we generate in large amounts relative to our premium volume — by adding net loss reserves, loss

adjustment reserves, funds held under reinsurance assumed and unearned premium reserves, and then subtracting

insurance-related receivables, prepaid acquisition costs, prepaid taxes and deferred charges applicable to assumed

reinsurance. (Don’t panic, there won’t be a quiz.)

Yearend Float (in $ millions)

Other Other

Year GEICO General Re Reinsurance Primary Total

1967 20 20

1977 40 131 171

1987 701 807 1,508

1997 2,917 4,014 455 7,386

1998 3,125 14,909 4,305 415 22,754

1999 3,444 15,166 6,285 403 25,298

2000 3,943 15,525 7,805 598 27,871

We’re pleased by the growth in our float during 2000 but not happy with its cost. Over the years, our cost

of float has been very close to zero, with the underwriting profits realized in most years offsetting the occasional

terrible year such as 1984, when our cost was a staggering 19%. In 2000, however, we had an underwriting loss of

$1.6 billion, which gave us a float cost of 6%. Absent a mega-catastrophe, we expect our float cost to fall in 2001

perhaps substantially in large part because of corrections in pricing at General Re that should increasingly be

felt as the year progresses. On a smaller scale, GEICO may experience the same improving trend.

There are two factors affecting our cost of float that are very rare at other insurers but that now loom large

at Berkshire. First, a few insurers that are currently experiencing large losses have offloaded a significant portion of