Berkshire Hathaway 2000 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

76

BERKSHIRE HATHAWAY INC.

COMMON STOCK

General

Berkshire has two classes of common stock designated Class A Common Stock and Class B Common Stock.

Each share of Class A Common Stock is convertible, at the option of the holder, into 30 shares of Class B Common

Stock. Shares of Class B Common Stock are not convertible into shares of Class A Common Stock.

Stock Transfer Agent

Fleet National Bank, N.A. c/o EquiServe, P.O. Box 43010, Providence, RI 02940-3010 serves as Transfer Agent

and Registrar for the Company's common stock. Correspondence may be directed to Shareholder Services, Mail Stop

45-02-64. Certificates for re-issue or transfer should be directed to Transfer Operations, Mail Stop 45-01-05. Notices

for conversion and underlying stock certificates should be directed to Corporate Reorganization, Mail Stop 45-01-40.

Phone inquiries should be directed to Investor Relations — (781) 575-3100.

Shareholders of record wishing to convert Class A Common Stock into Class B Common Stock should contact

EquiServe to obtain a "form of conversion notice" and instructions for converting their shares. Shareholders may call

EquiServe between 9:00 a.m. and 6:00 p.m. Eastern Time to request a "form of conversion notice."

Alternatively, shareholders may notify EquiServe in writing. Along with the underlying stock certificate,

shareholders should provide EquiServe with specific written instructions regarding the number of shares to be

converted and the manner in which the Class B shares are to be registered. We recommend that you use certified or

registered mail when delivering the stock certificates and written instructions.

If Class A shares are held in "street name,” shareholders wishing to convert all or a portion of their holding

should contact their broker or bank nominee. It will be necessary for the nominee to make the request for conversion.

Shareholders

Berkshire had approximately 8,800 record holders of its Class A Common Stock and 14,000 record holders of its

Class B Common Stock at March 2, 2001. Record owners included nominees holding at least 410,000 shares of Class

A Common Stock and 5,200,000 shares of Class B Common Stock on behalf of beneficial-but-not-of-record owners.

Price Range of Common Stock

Berkshire’s Class A and Class B Common Stock are listed for trading on the New York Stock Exchange, trading

symbol: BRK.A and BRK.B. The following table sets forth the high and low sales prices per share, as reported on the

New York Stock Exchange Composite List during the periods indicated:

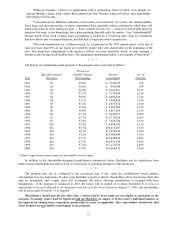

2000 1999

Class A Class B Class A Class B

High Low High Low High Low High Low

First Quarter $58,000 $40,800 $1,888 $1,351 $81,100 $61,900 $2,713 $2,048

Second Quarter 60,800 51,800 1,975 1,660 78,600 68,300 2,540 2,211

Third Quarter 64,400 51,600 2,086 1,706 73,000 54,600 2,333 1,802

Fourth Quarter 71,300 53,500 2,375 1,761 66,900 52,000 2,219 1,700½

Dividends

Berkshire has not declared a cash dividend since 1967.