Berkshire Hathaway 2000 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

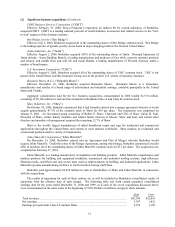

25

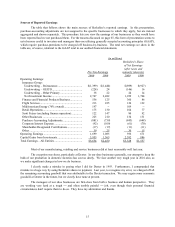

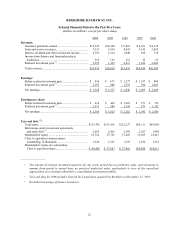

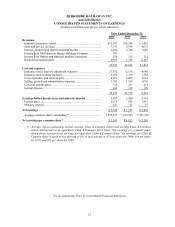

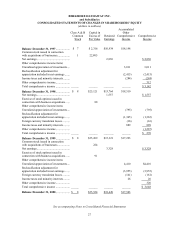

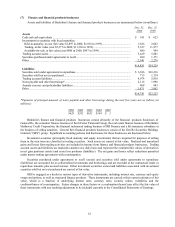

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED STATEMENTS OF EARNINGS

(dollars in millions except per share amounts)

Year Ended December 31,

2000 1999 1998

Revenues:

Insurance premiums earned ........................................................... $19,343 $14,306 $ 5,481

Sales and service revenues............................................................. 7,331 5,918 4,675

Interest, dividend and other investment income.............................. 2,686 2,314 1,049

Income from MidAmerican Energy Holdings Company................. 105 — —

Income from finance and financial products businesses.................. 556 125 212

Realized investment gain............................................................... 3,955 1,365 2,415

33,976 24,028 13,832

Cost and expenses:

Insurance losses and loss adjustment expenses............................... 17,332 12,518 4,040

Insurance underwriting expenses ................................................... 3,602 3,220 1,184

Cost of products and services sold ................................................. 4,893 4,065 3,018

Selling, general and administrative expenses.................................. 1,703 1,164 1,056

Goodwill amortization................................................................... 715 477 111

Interest expense............................................................................. 144 134 109

28,389 21,578 9,518

Earnings before income taxes and minority interest..................... 5,587 2,450 4,314

Income taxes ................................................................................. 2,018 852 1,457

Minority interest ........................................................................... 241 41 27

Net earnings ................................................................................... $ 3,328 $ 1,557 $ 2,830

Average common shares outstanding * .......................................... 1,522,933 1,519,703 1,251,363

Net earnings per common share * ................................................. $ 2,185 $ 1,025 $ 2,262

* Average shares outstanding include average Class A Common shares and average Class B Common

shares determined on an equivalent Class A Common Stock basis. Net earnings per common share

shown above represents net earnings per equivalent Class A Common share. Net earnings per Class B

Common share is equal to one-thirtieth (1/30) of such amount or $73 per share for 2000, $34 per share

for 1999, and $75 per share for 1998.

See accompanying Notes to Consolidated Financial Statements