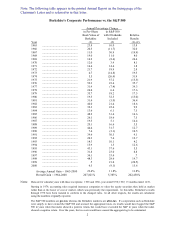

Berkshire Hathaway 2000 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

12

Despite State Farm’s strengths, however, GEICO has much the better business model, one that embodies

significantly lower operating costs. And, when a company is selling a product with commodity-like economic

characteristics, being the low-cost producer is all-important. This enduring competitive advantage of GEICO

one it possessed in 1951 when, as a 20-year-old student, I first became enamored with its stock is the reason that

over time it will inevitably increase its market share significantly while simultaneously achieving excellent profits.

Our growth will be slow, however, if State Farm elects to continue bearing the underwriting losses that it is now

suffering.

Tony Nicely, GEICO’s CEO, remains an owner’s dream. Everything he does makes sense. He never

engages in wishful thinking or otherwise distorts reality, as so many managers do when the unexpected happens. As

2000 unfolded, Tony cut back on advertising that was not cost-effective, and he will continue to do that in 2001 if

cutbacks are called for (though we will always maintain a massive media presence). Tony has also aggressively

filed for price increases where we need them. He looks at the loss reports every day and is never behind the curve.

To steal a line from a competitor, we are in good hands with Tony.

I’ve told you about our profit-sharing arrangement at GEICO that targets only two variables — growth i n

policies and the underwriting results of seasoned business. Despite the headwinds of 2000, we still had a

performance that produced an 8.8% profit-sharing payment, amounting to $40.7 million.

GEICO will be a huge part of Berkshire’s future. Because of its rock-bottom operating costs, it offers a

great many Americans the cheapest way to purchase a high-ticket product that they must buy. The company then

couples this bargain with service that consistently ranks high in independent surveys. That’s a combination

inevitably producing growth and profitability.

In just the last few years, far more drivers have learned to associate the GEICO brand with saving money

on their insurance. We will pound that theme relentlessly until all Americans are aware of the value that we offer.

Investments

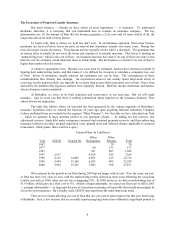

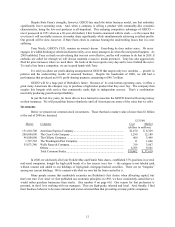

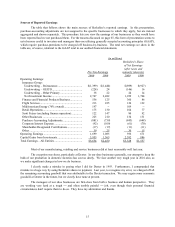

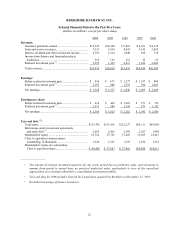

Below we present our common stock investments. Those that had a market value of more than $1 billion

at the end of 2000 are itemized.

12/31/00

Shares Company Cost Market

(dollars in millions)

151,610,700 American Express Company .................................................................. $1,470 $ 8,329

200,000,000 The Coca-Cola Company ....................................................................... 1,299 12,188

96,000,000 The Gillette Company............................................................................ 600 3,468

1,727,765 The Washington Post Company ............................................................. 11 1,066

55,071,380 Wells Fargo & Company........................................................................ 319 3,067

Others.................................................................................................... 6,703 9,501

Total Common Stocks............................................................................ $10,402 $_37,619

In 2000, we sold nearly all of our Freddie Mac and Fannie Mae shares, established 15% positions in several

mid-sized companies, bought the high-yield bonds of a few issuers (very few — the category is not labeled junk

without reason) and added to our holdings of high-grade, mortgage-backed securities. There are no “bargains”

among our current holdings: We’re content with what we own but far from excited by it.

Many people assume that marketable securities are Berkshire’s first choice when allocating capital, but

that’s not true: Ever since we first published our economic principles in 1983, we have consistently stated that we

would rather purchase businesses than stocks. (See number 4 on page 60.) One reason for that preference is

personal, in that I love working with our managers. They are high-grade, talented and loyal. And, frankly, I find

their business behavior to be more rational and owner-oriented than that prevailing at many public companies.