Berkshire Hathaway 2000 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2000 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.18

One further thought while I’m on my soapbox: Cha rlie and I think it is both deceptive and dangerous for

CEOs to predict growth rates for their companies. They are, of course, frequently egged on to do so by both

analysts and their own investor relations departments. They should resist, however, because too often these

predictions lead to trouble.

It’s fine for a CEO to have his own internal goals and, in our view, it’s even appropriate for the CEO to

publicly express some hopes about the future, if these expectations are accompanied by sensible caveats. But for a

major corporation to predict that its per-share earnings will grow over the long term at, say, 15% annually is to court

trouble.

That’s true because a growth rate of that magnitude can only be maintained by a very small percentage of

large businesses. Here’s a test: Examine the record of, say, the 200 highest earning companies from 1970 or 1980

and tabulate how many have increased per-share earnings by 15% annually since those dates. You will find that

only a handful have. I would wager you a very significant sum that fewer than 10 of the 200 most profitable

companies in 2000 will attain 15% annual growth in earnings-per-share over the next 20 years.

The problem arising from lofty predictions is not just that they spread unwarranted optimism. Even more

troublesome is the fact that they corrode CEO behavior. Over the years, Charlie and I have observed many

instances in which CEOs engaged in uneconomic operating maneuvers so that they could meet earnings targets they

had announced. Worse still, after exhausting all that operating acrobatics would do, they sometimes played a wide

variety of accounting games to “make the numbers.” These accounting shenanigans have a way of snowballing:

Once a company moves earnings from one period to another, operating shortfalls that occur thereafter require it to

engage in further accounting maneuvers that must be even more “heroic.” These can turn fudging into fraud.

(More money, it has been noted, has been stolen with the point of a pen than at the point of a gun.)

Charlie and I tend to be leery of companies run by CEOs who woo investors with fancy predictions. A few

of these managers will prove prophetic — but others will turn out to be congenital optimists, or even charlatans.

Unfortunately, it’s not easy for investors to know in advance which species they are dealing with.

* * * * * * * * * * * *

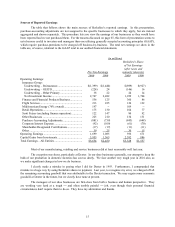

I’ve warned you in the past that you should not believe everything you read or hear about Berkshire

even when it is published or broadcast by a prestigious news organization. Indeed, erroneous reports are

particularly dangerous when they are circulated by highly-respected members of the media, simply because most

readers and listeners know these outlets to be generally credible and therefore believe what they say.

An example is a glaring error about Berkshire’s activities that appeared in the December 29 issue of The

Wall Street Journal, a generally excellent paper that I have for all of my life found useful. On the front page (and

above the fold, as they say) The Journal published a news brief that said, in unequivocal terms, that we were buying

bonds of Conseco and Finova. This item directed the reader to the lead story of the Money and Investing section.

There, in the second paragraph of the story, The Journal reported, again without any qualification, that Berkshire

was buying Conseco and Finova bonds, adding that Berkshire had invested “several hundred million dollars” in

each. Only in the 18th paragraph of the story (which by that point had jumped to an inside page) did the paper hedge

a bit, saying that our Conseco purchases had been disclosed by “people familiar with the matter.”

Well, not that familiar. True, we had purchased bonds and bank debt of Finova though the report was

wildly inaccurate as to the amount. But to this day neither Berkshire nor I have ever bought a share of stock or a

bond of Conseco.

Berkshire is normally covered by a Journal reporter in Chicago who is both accurate and conscientious. In

this case, however, the “scoop” was the product of a New York reporter for the paper. Indeed, the 29th was a busy

day for him: By early afternoon, he had repeated the story on CNBC. Immediately, in lemming-like manner, other

respected news organizations, relying solely on the Journal, began relating the same “facts.” The result: Conseco

stock advanced sharply during the day on exceptional volume that placed it ninth on the NYSE most-active list.

During all of the story’s iterations, I never heard or read the word “rumor.” Appa rently reporters and

editors, who generally pride themselves on their careful use of language, just can’t bring themselves to attach this

word to their accounts. But what description would fit more precisely? Certainly not the usual “sources say” or “it

has been reported.”